What Does Critical Illness Insurance Cover?

Critical Illness Cover works by paying out a cash lump sum should you be diagnosed with a serious illness.

Cover can be linked to an outstanding mortgage debt or simply provide a cash lump sum to maintain your standard of living during such difficult times. It is usually purchased as a combined policy with Life Insurance to provide coverage against the risk of death as well as disease.

Critical Illness Insurance typically covers around 40 serious illnesses. However, there are plans which cover more than 100 and others which protect against fewer than 10, so check carefully before buying or ask a specialist adviser.

The critical illnesses which are covered will be defined in the policy wording. The most common claims which account for around 80% of all claims on these policies are for:

- Cancers

- Heart attacks

- Strokes.

Other serious illnesses usually covered include:

- Permanent blindness / deafness

- Loss / paralysis of limbs

- Multiple sclerosis

- Parkinson’s

- Organ failure / transplant

- Motor neurone disease

- Cardiomyopathy.

Comparing Critical Illness Policies

Critical Illness Insurance is one of the more complicated types of protection insurance. This is because each insurer sets their own list of the serious illnesses they will cover as well as the definitions they use for these conditions.

As mentioned, the typical policy will protect against around 40 conditions, but you need to carefully examine the definitions of these conditions in the policy wording to ensure you are comparing apples with apples.

When cancers, heart attacks and strokes account for around 80% of all claims you can see why it is so important to compare the definitions of these conditions to make sure you are getting the most comprehensive policy for your budget.

Some insurers may have excellent cancer definitions that make a successful claim more likely than another insurer with a lesser definition. Other insurers may have better definitions of heart attacks and strokes, so getting the right policy can be a minefield.

To make the process easier, we’d always recommend getting cover through a specialist.

We have access to sophisticated software that allows us to rank policies and their wording against each other to figure out which one is most likely to pay out for the conditions someone like you is most likely to suffer.

Michael Barrow

Independent Protection Specialist at Drewberry

Getting Critical Illness Insurance with Pre-Existing Conditions

When it comes to pre-existing conditions, the way Critical Illness Insurance works will depend on the nature of your condition and your individual circumstances.

If you have a pre-existing condition, you must declare it to the insurer in the application process. Based on your medical history, the insurer may do one of three things:

- Offer the policy on standard terms

- Place an exclusion on the policy relating to the pre-existing condition

- Cover the pre-existing condition but charge a higher premium to reflect the increased risk.

If you have a pre-existing condition, we’d always recommend speaking to an adviser.

We know the market inside out, so we’re aware of which insurers may apply the most favourable terms depending on your condition and circumstances.

Samantha Haffenden-Angear

Independent Protection Specialist at Drewberry

How Medical Underwriting Works on Critical Illness Policies

Critical Illness Insurance works on a medically underwritten basis. This means each application is assessed based on factors such as:

- Your individual medical circumstances

- Lifestyle factors (e.g. height, weight, smoker status)

- Your age.

Further medical evidence may be required beyond the initial application should you declare an existing medical condition or you require a higher level of cover which exceeds the insurers underwriting limits.

For example, a 20-year-old looking for £100,000 worth of cover would be unlikely to require any additional medical reporting, but a 50-year-old wanting £500,000 of cover may need a medical report.

If you’ve had poor health in the past or have pre-existing conditions, that can also trigger the need for a report.

The Three Levels of Medical Underwriting

There are three levels of medical reporting:

- Simple Screening

This is undertaken by a nurse examining your blood pressure, height, weight and whether you’re a smoker. - GP Report

This will usually be necessary if you’ve made a disclosure, in which case the reporting request will usually be targeted to that particular condition / symptom. - Full Medical Examination

This will be much more detailed and will typically require blood and urine samples as part of an in-depth health assessment.

How Critical Illness Insurance Claims Work

The first stage of the Critical Illness Insurance claims process is for the insurer to write to your GP for the medical evidence necessary to consider your claim.

Most Critical Illness Insurance policies have a defined survival period, which is the length of time you must live from your diagnosis before a claim will be paid. This is typically 14 days.

Assuming you’ve outlived the survival period, once the insurer has received your completed claims form and the required medical evidence (e.g. consultants’ reports, medical imaging data, a GP letter etc.), a successful claim will result in the payment of a tax-free lump sum.

The money can be used for anything you want, but it’s typically thought of as a way of helping you through difficult times after the diagnosis of a severe medical condition.

The most common uses for a Critical Illness Insurance payout including repaying a mortgage, covering medical treatment, adapting a home to account for a new disability or simply funding living costs while you recuperate.

Partial Claims

Critical Illness Insurance works not only by providing a list of critical illnesses you can claim for, but also definitions of those illnesses that must be met for a successful claim.

For instance, a so-called ‘mini stroke’, also known as a transient ischaemic attack, may not necessarily trigger a successful claim. This would especially be the case if there are no permanent symptoms resulting from the condition.

Cancer must also typically be of a specified severity to result in a successful claim. For example, stage 1 cancer or non-invasive instances of the disease may not result in a paid claim.

It’s common for insurers to offer partial payouts on Critical Illness Insurance where you don’t meet their full definition of the illness. This might be 25% of the sum assured, for instance, depending on the severity of the condition.

This has the benefit of leaving some money ‘in the pot’ if you need to make a claim later, but does mean you may not always receive the full benefit you’re insured for depending on the severity of your condition.

How Critical Illness Insurance Works With Other Protection Insurance

Critical Illness Cover, Life Insurance and Income Protection are all related but distinct products. Depending on your circumstances and needs you may require none, some or all of them.

You may be fortunate enough to have some cover in place from employee benefits or be able to use your savings to tide you over if you couldn’t work.

However, keep in mind that employee benefits will end if you leave or lose your job. Meanwhile, you’d need very significant savings to replace the sort of sums that can be offered by Critical Illness Insurance.

Income Protection

Income Protection can be seen as similar to Critical Illness Cover, offering funds in unfortunate circumstances, but there are notable differences in the way the products work.

Unlike Critical Illness Cover, Income Protection doesn’t offer a lump sum payout in the event of a successful claim. Instead, it offers you a regular income if you’re unable to work due to an illness or injury.

The payout will be a proportion of your earnings, something that doesn’t apply to Critical Illness Cover, where you choose the sum you want to insure yourself for.

Income Protection also pays out in the event of any medical condition that prevents you from doing your job, rather than on a specified critical illness. Long-term cover will pay you a regular income right until retirement if you can never work again.

Critical Illness Cover can work in conjunction with Income Protection or as a supplement to it.

However, if you have your monthly outgoings covered by a long-term Income Protection policy, you may not need as large a critical illness policy.

Victoria Slade

Independent Protection Specialist at Drewberry

Life Insurance

Life Insurance is intended to give a payout to your estate, or a trust that you’ve set up, after you die.

It can be bought separately from Critical Illness Cover, but if you want both products it’s often easier and more cost-effective to buy combined Life and Critical Illness Cover.

With joint cover, be sure you know whether you’re buying an integrated policy or an independent one. If an integrated policy pays out a full critical illness claim there’ll be no further Life Insurance payout, but independent policies allow for two separate payouts.

Need Help With Your Critical Illness Insurance?

If the options seem a little overwhelming and you’re still wondering how Critical Illness Cover works don’t worry, we have a team of specialists on hand to answer any questions you might have and help ensure you find the most suitable cover.

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4072 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

If it is all getting a little confusing and you want to talk through your options to make sure you find the most suitable cover please don’t hesitate to get in touch.

Pop us a call on 02084327333 or email help@drewberry.co.uk.

Samantha Haffenden-Angear

Independent Protection Specialist at Drewberry

- Topics

- Critical Illness Cover

Contact Us

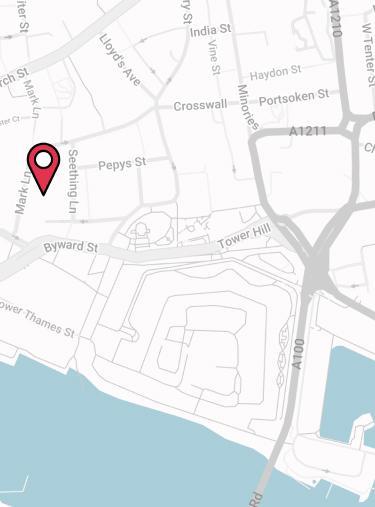

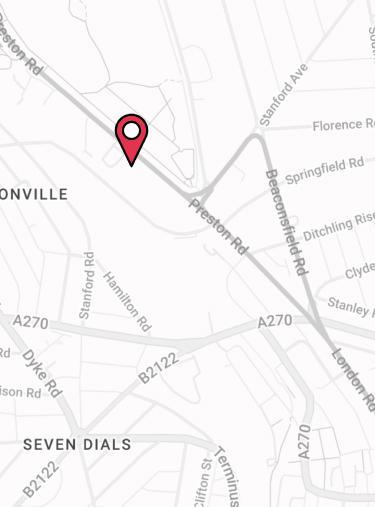

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.