6 Reasons That Might Stop You Taking Out Income Protection

Income Protection Insurance is one of the most valuable protection products to purchase if you’re worried about how you would cope if you couldn’t work due to accident or sickness. For instance…

- People are 4 times as likely to buy pet insurance than income protection insurance.

- Only 1% of self-employed UK workers have Sick Pay Insurance, despite having no sick pay

- More than 1 out of 10 people has described their finances as hanging by a thread.

There are a lot of reasons people give for avoiding taking out Accident & Sickness Insurance. In the hopes that we may convince you to invest in this valuable protection product, we’ve busted some myths around the top 6 excuses that people use to avoid taking out Income Protection Insurance.

I Don’t Need Accident & Sickness Insurance

Many of us tend to have an optimistic outlook when it comes to our wellbeing, living by the mantra ‘it won’t happen to me’. However, most of the people out of work due to illness or injury probably thought the same.

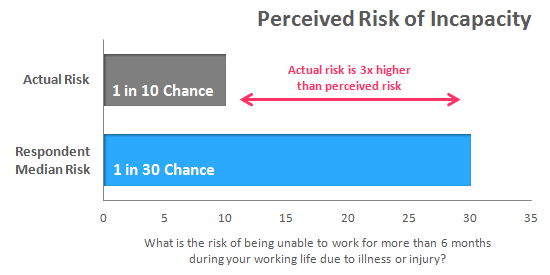

Our Protection Survey asked the public to estimate the chances of someone needing to be off work for more than 6 months due to ill health. The median result of our participants was that there is a 1 in 30 chance of needing more than 6 months off.

The real answer to this question, however, is that 1 out of every 10 people will need to take more than 6 months off during their working life to recover from an illness or injury. This means that the risk of being seriously ill or injured is 3 times higher than we perceive it to be.

There is a 1 in 10 chance that you will become severely injured or ill during your working life and require more than six months off of work. What you would do if the worst did happen and you were out of work for six months?

The Cost Of Income Protection Insurance Is Too Expensive

Following on from the points above, is it any wonder why Income Protection Insurance can be perceived as expensive if we all tend to underestimate the chances of needing to claim?

A suspicious mind might think that premiums are ‘expensive’ because insurers are making huge profits, but this generally isn’t the case given how competitive it is in the UK insurance market.

It’s important to remember that when setting the cost of your Income Protection premiums that there are a lot of factors you can do to keep a lid on costs. The cost of a policy won’t be the same for everyone and with a bit of research you will find that a lot of available Sick Pay Insurance options are more than affordable.

If you’re worried about the cost of Income Protection, there are some aspects of your policy that can be adjusted to reduce the cost of Income Protection:

- Your deferred period – the longer you can wait before receiving your benefit, the lower your premiums will be

- Your policy’s cease age – a higher cease age means costlier premiums because of the higher risk of your claiming as you age

- Your level of cover – do you need the maximum cover you’re entitled to? Consider your outgoings and see if you could pare them back in the event of a claim.

- Your premium type – guaranteed premiums will stay fixed over time, whereas age-banded premiums will increase each year in line with your age.

The cost of your policy will also be affected by your own personal circumstances, such as your age, occupation, and your smoker status.

I Don’t Think Claims Are Paid

A common misconception that some people share is that insurers deny people’s claims quite frequently.

The truth is that insurers rarely reject Income Protection claims and, when they do, it’s often because of an issue that wasn’t disclosed at the application stage, or due to outright fraud.

In our survey, we asked 2,000 UK workers what proportion of insurance claims they thought were paid by the top five insurers. We were surprised when results showed that people think that only 50% of these insurer’s claims are paid when the reality is very different.

Insurer | 2022 | 2023 | 2024 |

|---|---|---|---|

Zurich | 85% | N/A | 95.8% |

Vitality | 96.5% | 95.4% | 91.9% |

Cirencester Friendly | 95.4% | 95.8% | 95.8% |

Holloway Friendly | 93.4% | 86% | 88.3% |

British Friendly | 90% | 89% | 86% |

Liverpool Victoria | 92% | 92% | 90% |

The Exeter | 92% | 96% | 93% |

Aviva | 92.5% | 90.1% | 92% |

Legal & General | 82.2% | 80% | 84% |

Income Protection claim payout rates have been consistently high among the top insurers. The top five insurers by claims payout rate all paid in excess of 94% of claims.

The amount of successful claims is considerably higher than what our survey participants expected them to be, which shows that there is very little cause to worry that your claim will be declined.

One of the top reasons for these rare occurrences of claims being rejected is people misunderstanding what is covered by their policy or not providing the correct information when they apply.

An adviser can help you avoid this by assisting with your application and explaining your policy to you clearly.

Samantha Haffenden-Angear

Independent Protection Specialist at Drewberry

Do I Really Need Income Protection If I Can Claim Benefits?

Employment & Support Allowance (ESA) is one potential source of income if you’re unable to work, but it’s very unlikely that you would live comfortably on benefits alone.

Depending on your circumstances, ESA will pay out an average of £92.05 per week. This can seem like an absurd amount to live on when you consider that the average UK household expenditure per week in 2016 was more than £500.

As you can see, for many people benefit payments could barely make a dent in their monthly expenditure, which is why Sick Pay Insurance is seen as a vital protection product for anyone that wants to protect their savings and income.

In 2016, the average length of Sick Pay Insurance claims for LV= was 7 years and 7 months and the average benefit payout was £14,695.

Why Do I Need Income Protection If I Get Sick Pay?

When deciding if you need Accident & Sickness Insurance, it is important to find out what your employer would provide you with if you needed to take time off of work due to illness or injury.

However, even where sick pay is offered by their employers, many people may find that their entitled sick pay is not sufficient to support them while they are out of work.

Statutory Sick Pay – the minimum an employer has to pay you – stands at a weekly rate of £118.75 for up to 28 weeks. Some employers won’t pay you anymore than this, and it’s clearly a very small amount.

Some employers will choose to go beyond this and provide a level of full sick pay for a period of time. However, our Protection Survey showed that 24% of people did not receive any additional sick pay from their employer and received only the national minimum.

As mentioned, if you do receive more sick pay than this, you can always increase your deferred period to lower the cost of cover.

Why Have Income Protection Insurance When I Have Savings?

Some people believe that the money you save by not buying Income Protection Insurance can be put in the bank instead and used when you’re low on income.

While it is always worthwhile to save money, there is a good chance that your savings won’t be enough to support you if you are incapacitated. If you fall ill after only one month of saved premiums, for example, you would struggle to get by.

- In our Protection Survey, we asked participants how much they had in cash savings and 2 out of 5 adults had less than £1,000.

- In addition, more than 44% of people had less than £200 left at the end of the month after covering their necessary expenses.

Considering that average weekly expenditure for UK households exceeds £500, these statistics mean that…

2 out of 5 adults wouldn’t last any longer than two weeks if they tried to live on their cash savings without any other source of income.

On the other hand, by paying premiums of, for example, £50 per month, you could have almost immediate access to monthly payments of 50% to 70% of your regular income. That will leave you the option to secure the rest of your monthly savings for your retirement.

Get Specialist Income Protection Advice

If you have been putting off purchasing Accident & Sickness Insurance for any of these reasons, then it may be time for you to reevaluate your situation.

Is Income Protection worth it? For most working adults it is one of the most valuable forms of protection ensuring you are well prepared if you ever faced misfortune of being unable to work and earn an income in the future.

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4074 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

If you would like to learn more or compare income protection quotes from the UK’s leading providers then please don’t hesitate to get in touch.

Pop us a call on 02084327333 or email help@drewberry.co.uk.

Tom Conner

Director at Drewberry

- Topics

- Income Protection

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.