Risk Reality Calculator 🤒

Calculate Your Risk Of Experiencing A Major Life-Changing Event

The new Drewberry Risk Reality Calculator, in conjunction with Liverpool Victoria (LV), highlights the importance of protecting your most valuable asset — yourself!

With just a few personal details, you can work out the risk of a variety of major, life-altering events. For example, the risk of:

- Being unable to work for 2 months+ due to accident or sickness

- Suffering a serious (critical) illness

- Dying

- Any of these events happening before your retirement age.

While no one wants to think about these unpleasant risks, the fact is that we must. How else can we suitably protect ourselves and our families should the worst happen?

Could you survive for 2 months or more if out of work due to illness or injury? Or how would your family cope if you were to pass away, leaving behind a mortgage and other financial responsibilities?

The Calculator highlights just how high the risk of these events can be. Often, it’s much higher than we think.

How Does It Work?

All you need to do is enter your:

- Name

- Age

- Sex

- Smoker status

- Retirement age.

You can also include your partner’s details if you’re a couple and want to find out the joint risk of any of the above events happening to one or both of you.

It’s that simple! You’ll then receive a personalised report highlighting just how vulnerable you are to the above risks happening before you retire.

How Do I Protect Myself Against These Risks?

As you may have noticed from the Calculator, the risk of illness, injury and even death are higher than many of us assume.

However, despite this, the nation is worryingly under-protected.

- Less than half of UK adults have Life Insurance should they pass away.

- Only 11.8% of adults have Critical Illness Insurance to pay out a cash lump sum should they become critically unwell with an illness such as cancer, heart attack or stroke.

- Meanwhile, just 1 in 10 have Income Protection to pay out a proportion of their wages if they become too ill or injured to work.

The Facts & Figures Behind The Calculator

The Risk Reality Calculator is designed as a guide to an event that may happen to someone up to a certain age. It’s generally accepted the older you become, the higher the chance of something happening which would prevent you from working.

The statistics behind the Calculator are based on a large number of people. They therefore give a reasonable guide to the average likelihood of one of the described events happening.

However, everyone is unique. The results should therefore be used as a rough guide and preferably talked through with a qualified financial adviser. One of the team at Drewberry would be happy to assist with this.

The results give the probability of any one of the three described events happening between your current age and your planned retirement age. The later you retire, the higher the chance of something happening. This will be reflected in the Calculator results.

The Calculator provides the results separately for each person, as well as in combination if two people are included.

For the combined results for two people, the probabilities for each person are based on different periods of time, depending on their current age and the retirement age they’ve selected . It’s assumed that the chances of something happening to each life are not linked (the lives are independent).

Risk Of Being Unable To Work For 2 Months+

The calculator works this out using an interpretation of industry data combined with LV’s experience Income Protection Insurance policies it has previously sold.

Risk Of Suffering A Serious Illness

These probabilities are based on the rates of a critical illness occurring. The Calculator draws on data from the Institute and Faculty of Actuaries’ Continuous Mortality Investigation.

These rates were adjusted to be applicable for standalone critical illness based on a comparison of market experience and published morbidity tables. Using these standard rates and based on our own experience, we have also adjusted them to be applicable to the general population, which also includes people who do not have insurance policies.

Risk Of Death

These probabilities are based on mortality tables published by the Institute and Faculty of Actuaries’ Continuous Mortality Investigation. The industry rates are projected to apply to a population of insured individuals — those people who have life insurance policies.

Combined Results

These results look at the probability of any one of the three above events happening before the chosen retirement age. The results can be viewed separately for each person, or as a combination for a couple.

- Topics

- Income Protection

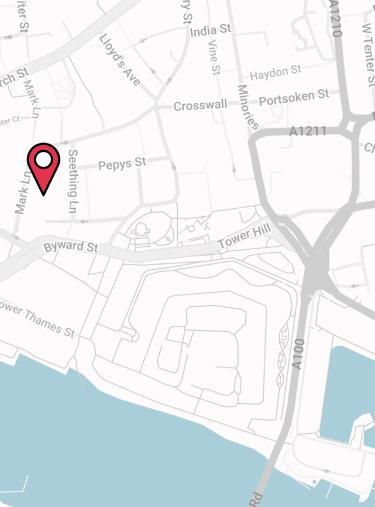

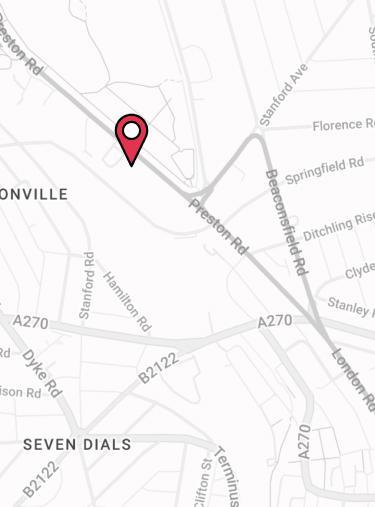

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.