Bright Grey Income Protection

Bright Grey is now part of Royal London. Head to our Royal London Income Protection review.

Income Protection Solutions

Founded

2003

Company Type

Mutual

Company Overview

As part of the Royal London group Bright Grey was formed to be a forward thinking personal and business protection specialist working closely with the intermediary market.

Documentation

Income Protection Overview

A traditional income protection product which also offers both 12 and 24 month limited term benefit options which makes it very appealing for those looking for a more affordable option to to traditional full term payment period.

- Bright Grey use an ‘Own Occupation’ incapacity definition for the vast majority of occupations.

- The Bright Grey product has a core premium which is guaranteed for the full term of your policy.

- It is important to note as is still the case with many insurers Bright Grey do not publish their claims statistics.

- The Bright Grey product has an application which includes full medical underwriting so you know exactly where you stand from the outset.

Bright Grey Policy Conditions

An overview of the key policy details of Bright Grey Income Protection Solutions proposition.

Overview of Key Policy Details

| |

|---|---|

Policy Type | Income Protection |

Underwriting | Mutual |

Premium Type | Guaranteed |

Maximum Claim Duration | Unlimited |

Incapacity Definition | Own Occupation |

Deferred Period | 4 / 8 / 13 / 26 / 52 weeks |

Indexation | Optional |

Waiver of Premium | Included |

Maximum Cover | 50% Gross |

Maximum Cover | £12,500.00 |

Max. Policy Cease Age | 65 years old |

Min. Policy Term | 5 years |

Min. Entry Age | 18 years old |

Max. Entry Age | 59 years old |

Guaranteed Insurability | – Mortgage Increase – Marriage or Civil Partnership – Childbirth or Adoption |

Guaranteed Benefit | Not Available |

Overseas Travel | Cover is available overseas for a maximum of 12 months should the stay be temporary. If you become permanently resident outside of the United Kingdom, Channel Islands or Isle of Man, Bright Grey will cancel the cover and will not pay any claim. |

Policy Exclusions | – Self Inflicted Injuries – Restrictions with regard to living abroad. |

Drewberry reviews Bright Grey Income Protection…

Bright Grey has a very reputable income protection policy (called ‘Bright Grey Income Cover for Sickness’) and overall protection insurance offering. Drewberry do not have any concerns recommending Bright Grey to our clients based on previous customer service levels and claims experience.

Key Comparison Points

- For more risky occupations (possibly with a large amount of manual work involved) Bright Grey will not usually offer own occupation cover so it may therefore be more appropriate to look toward a more specialist insurer, such as Exeter Family Friendly

- When the inflation indexation option is selected, it is important to be aware that Bright Grey will take age into account when calculating premiums due to any rises in cover. This means that the premiums are likely to rise quicker than the benefit over time

- Bright Grey does not engage in providing additional benefits, with the focus being on customer service and affordable pricing.

Policy exclusions

Although it would seem like an obvious and possibly understandable exclusion, unlike many other insurers Bright Grey do exclude self-harm (termed as a ‘self-inflicted injury’) from their policy

Also unlike many other insurers, Bright Grey will not allow the plan to continue (it will be cancelled automatically) for anyone who decides to move overseas permanently.

Financial strength

Although possibly not as well known as other insurers, Bright Grey is part of one of the largest financial services companies in the UK, the Royal London Group, which was formed over 150 years ago and has over 3 million customers.

Being a Mutual Society, Royal London (and therefore also Bright Grey) do not have shareholders to pay and is run for the benefit of their members.

Bright Grey Income Insurance – Questions and Answers

A series of commonly asked questions with regards to the policy coverage of the Bright Grey permanent health insurance product.

Q. I’m looking at taking this policy out until age 65 as that’s when I hope to retire but am I tied into this policy at all? Are there any penalties if I cancel?

A. No, insurers understand that circumstances can change over such a long time so you would only need to provide 30 days notice if you would like cancel the policy.

It is usually best to have a run through with an adviser before making any changes. For example, it may be the case that someone is moving to a company that provides a longer period of sick pay, in which case it may be more appropriate to adjust the deferred period so it aligns with the new sick pay entitlement rather than cancelling the policy and taking out a new plan.

Q. The premium I’ve been quoted seems very affordable now but I’m worried this cost may go up in the future. Is the insurer able to increase the premium at will?

A. Whether the insurer is able to increase your monthly premiums depends on whether you select ‘reviewable’ or ‘guaranteed’ premiums.

Policies with reviewable premiums usually have lower initial rates but the insurer does have the right to change how much they charge you over time (rates are fixed with guaranteed premiums). Usual reasons for insurers making premium adjustments include the following: changes in the number of claims made; increasing insurer costs; inflation; falling investment returns; and tax changes.

Need Specialist Income Protection Advice?

As you can see, there are a lot of points to consider when comparing insurers. With so many factors in play, it can be time-consuming to pull up key information across every single insurer in the market, so why not ask an adviser for help?

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to talk to us.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4100 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

If it is all getting a little confusing and you want to talk you through your options to make sure you find the most suitable cover please don’t hesitate to get in touch.

Pop us a call on 02084327333 or email help@drewberry.co.uk.

Tom Conner

Director

- Topics

- Income Protection

Contact Us

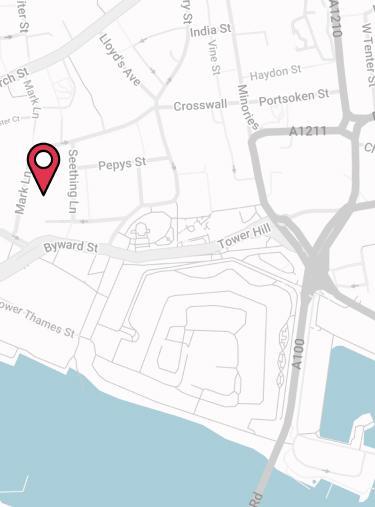

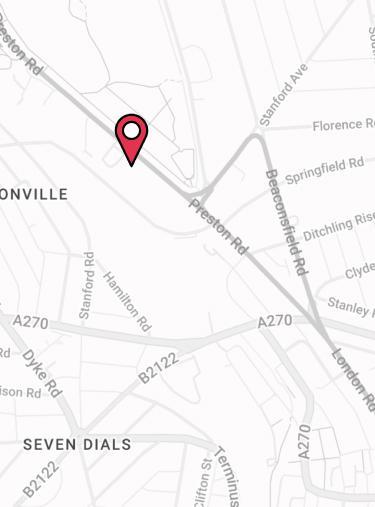

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.