What’s the Difference Between Health Insurance and Income Protection?

I want some kind of health cover in case I am ill. I’ve come across Health Insurance, Income Protection and Permanent Health Insurance – what is the difference?

This is a very common question. Firstly Income Protection (IP) and Permanent Health Insurance (PHI) are exactly the same plan; Income Protection is just the new name for PHI.

However, Income Protection and Health Insurance (sometimes known as Private Medical Insurance) are very different plans with completely different purposes.

Income Protection Insurance

Income Protection is designed to pay a monthly benefit if you are unable to work due to illness or injury, which can be used to keep up to date with your rent / mortgage and other monthly costs.

Private Health Insurance

On the other hand, Medical Insurance is designed to pay for healthcare treatment in private hospitals and these days most insurers will settle the medical bill directly with the hospital or consultant.

Please see our Private Health Insurance guide for more information.

Income Protection or Health Insurance?

Firstly, these two policies are complementary rather than substitutes. When taken out together it means that you would receive prompt and quality healthcare from the Medical Insurance policy as well as an income whilst receiving treatment and making a recovery from the Income Protection policy.

However, given the very low level of state incapacity benefit, the first port of call is usually Income Protection so at least all your essential bills are paid for each month. After all, we’re fortunate in the UK to have the NHS which provides healthcare free at the point of use and so there’s generally less need for Private Medical Insurance than for Income Protection.

- Topics

- Income Protection

Frequently Asked Questions

Do Income Protection Premiums Rise if I Make a Claim?

How Soon Can I Make a Claim on My Income Protection?

Does Income Protection Insurance Cover Stress?

Am I Tied in to Long-Term Income Protection?

Can Self Employed People Get Income Protection?

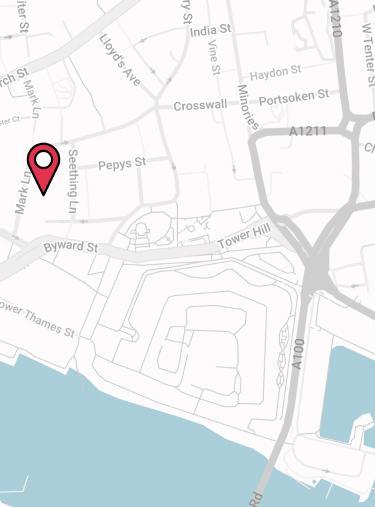

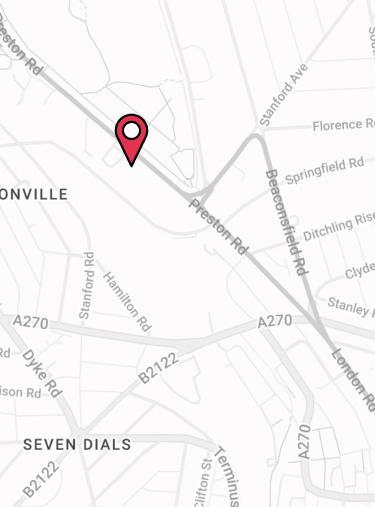

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.