What Should I Do If I’ve Been Declined Critical Illness Cover?

I’ve recently been refused Critical Illness Insurance by an insurance company I have dealt with before. I’m after cover as we’ve just taken out a bigger mortgage. Is there anything I can do – should I contact another provider?

Declined Critical Illness Insurance: Watch Our Quick Specialist Video

So, what are your options if you’ve been declined for a Critical Illness Policy? Drewberry’s Independent Protection Specialist, Alex Weir is here to help. Learn more about your options 👇

What To Do If You’ve Been Declined Critical Illness Cover?

Being refused Critical Illness Cover can be worrying, especially if it’s protection you’d really like to have in place. However, just because you have been declined from one insurer doesn’t mean you should just stop looking for cover.

Each provider is different, so just because one has declined you doesn’t mean that others will. Firstly, you should find out as much information as possible as to why you’ve been declined. It’s important to understand what medical and lifestyle reasons have led to you not being able to get cover.

SPECIALIST TIP 🤓

If the insurer has asked for a report from your GP, getting hold of this could help your chances of getting cover. It’s best to compile any supporting information and give it to your independent adviser.

Speak With A Financial Adviser

Once you have this information you should give it to an independent protection adviser. Being specialists in the market, they work with providers day in and day out. As a result, they have a good understanding of which insurers are more likely to provide cover.

This can save a lot of time and effort in applying with insurers who will potentially decline, offer special terms or increase your premiums.

An adviser can take your information and speak with the relevant insurers on your behalf. They can also discuss any pre-sales medical underwriting before submitting an application. This will allow an adviser to apply with the insurer that will offer the best terms and for the best premium.

Need Friendly Specialist Help?

If you’ve already been declined Critical Illness, trying to find a provider that will insure you can feel overwhelming. Working with a specialist adviser can help take this stress away, as they can do all the heavy lifting for you.

If you do need help, Drewberry’s friendly specialist advisers are on hand to help. Call us on 02084327333 or email help@drewberry.co.uk to find out your options.

- Topics

- Critical Illness Cover

Frequently Asked Questions

Does Critical Illness Insurance Cover Skiing?

Can I Get Critical Illness Cover With a Family History of Cancer?

What is Total Permanent Disability on Critical Illness Cover?

Can I get critical illness cover with asthma?

Can I Get Critical Illness Cover If I've Had A Heart Attack?

Contact Us

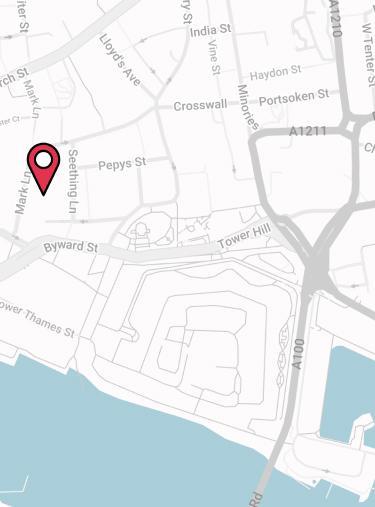

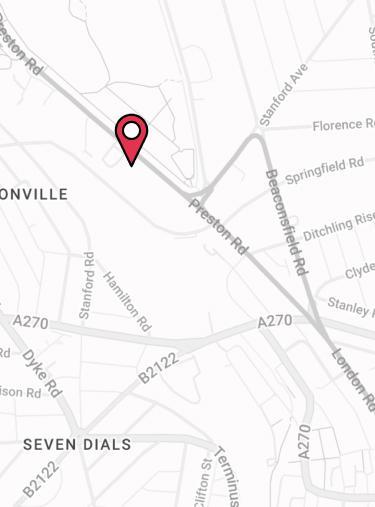

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.