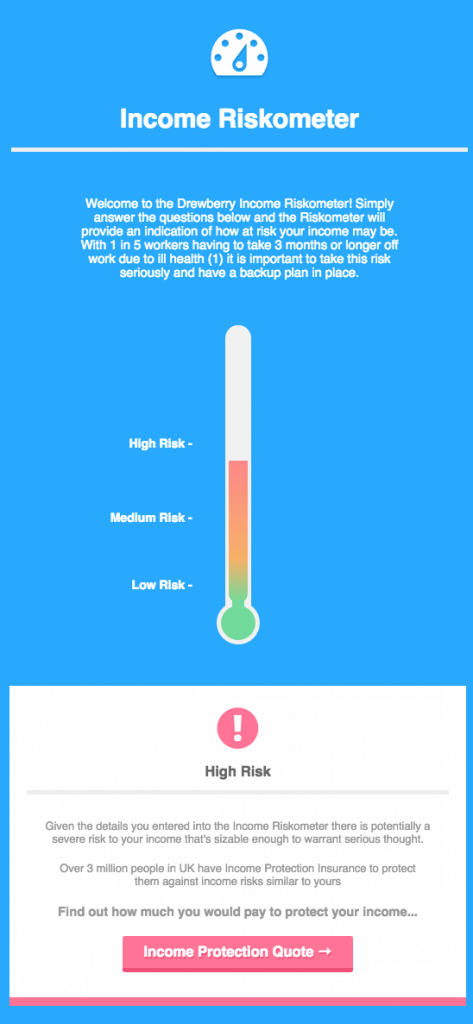

Drewberry releases Income Riskometer consumer tool

How the Riskometer works?

The Riskometer works by answering 5 key questions are based around the persons individual circumstances. We ask how long you would receive employee sick pay, if you have access to any savings to fall back on, your capacity to financially survive on state benefits, any employee benefits which might be considered as well as potential financial support from family or friends should you need it.

Depending on your answers, our clever tool will show you the kind of risk level you might find yourself in ranging from low to high. As well as this, we explain in more detail how we come to collate your score on the Riskometer by looking at some other external factors such as:-

- How common it is for workers to be off work for 6 months or longer

- How much you would be entitled to on State Benefit and for how long you can claim this

- The average claims length on an Income Protection policy

Income Riskometer

You can access the tool here →

The aim of the tool is to highlight the risk of not having Income Protection in place should the worst happen and you’re unable to work and fulfil your monthly outgoings. Even if you find yourself in a ‘low risk class’ it might still be worth discussing your specific situation as everyone’s circumstances are different.

Tom Conner, Director at Drewberry, said “We are very excited about our latest tool The Riskometer. Providing as much information as we can to the consumer so they are better informed is high on our agenda, we want to arm people with as much knowledge on the risks of being unable to work due to illness or accident as possible and we find that these interactive tools are a great way to achieve this.“

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.