The Struggle to Insure the Gig Economy

Getting Income Protection in the Hands of Gig Workers

When we hear of someone working in the Gig Economy, we tend to automatically think of couriers, drivers, and labourers. However, the general consensus is that the Gig Economy is defined by a substantial uptake of short-term contracts and self-employment.

Why the Gig Economy is Difficult to Insure

There are two polar opinions about the Gig Economy: it’s either praised as a revolutionary surge of flexible working or it is criticised as evidence of employers abandoning safeguards put in place to protect the welfare of the people they hire.

There are a range of difficulties that gig workers face that can also reduce the Personal Protection Insurance options available to them and the cover they can apply for.

Zero Hour Contracts

A lack of set hours means that the amount of hours they work per week can be uncertain and change without notice. To apply for Income Protection Insurance you need to work for a minimum of 16 hours per week, which might not always be met if the amount of hours you work changes on a whim.

No Sick Pay

A lack of sick pay means that many people in the gig economy would not be able to last for very long without an income given that household savings are very low. As such, Income Protection policies can cost more for those taking on gig work because of the necessity of a shorter deferred period, which is the period between you being off work and the start of the benefit payment.

Lack of Consistent Income

Workers in the Gig Economy often move from gig to gig at a continuous rate and their income will usually depend on what’s available. This makes it difficult to gauge their typical earnings and, as a result, how much Income Protection they should apply for.

In the event of a claim, an insurer will look at your income over a set period to determine your eligibility for the benefit you’ve insured. If you’ve earned less than the benefit you’ve paid for then you won’t be entitled to the full benefit you’ve purchased, only a proportion of what you’ve actually been paid.

How Can Providers Help?

The main issue with insuring gig workers is that the insurance industry isn’t quite keeping up with how quickly UK employment is changing. There are some measures that have been put in place to help freelancers and workers in the Gig Economy – such as a minimum benefit guarantee – but there is still more that can be done to help Income Protection adapt to a modern labour market.

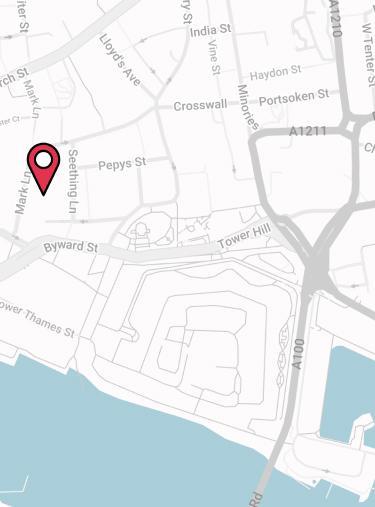

Robert Harvey

Independent Protection Specialist at Drewberry

Make the Most of Tech

A prominent feature of the Gig Economy is the use of technology. Many workers find employment and receive their payments predominantly through apps and websites. This allows for the fast-paced nature of the labour market as it is today and may be the key to making insurance products more efficient and manageable.

More Reduced Benefit Options

Getting back to work after being ill or injured is often a top priority. One of the great benefits of some Income Protection policies is the option to receive reduced benefits if you can only return to work on a part-time basis after a claim or if you are forced to change occupation. These smaller benefits are designed to top up your income and bring it closer to your original earnings prior to being incapacitated. However, not all providers are willing to offer this.

More Additional Benefit Options

Some of the top UK Income Protection providers offer additional benefits that you can claim in addition to your standard benefits in certain circumstances.

These benefits can give your income a boost to help you afford the things you and your family need in an emergency. For example, one of the most common you will find is a Death Benefit, which will pay your family a lump sum if you pass away while covered by your policy. This can be used to afford a funeral or top up their savings.

The top insurers provide the following benefits to give you additional support while covered by Income Protection:

- Cirencester Friendly: Fracture Benefit / Hospitalisation Benefit / Immediate Death Benefit

- Holloway Friendly: Medical Expenses Benefit / Terminal Illness Benefit

- Legal & General: Hospitalisation Benefit / Death Benefit

- Liverpool Victoria: Fracture Benefit

- Royal London: Fracture Benefit/ Hospitalisation Benefit / Terminal Illness and Death Benefit

- Unum: Disability Benefit / Death Benefit

- Vitality: Death Benefit / Terminal Illness Benefit

While these benefits are highly valuable, they aren’t always available. Providers that choose to offer these benefits or expand the range of additional benefits they offer could provide gig workers with valuable support. With low and uncertain incomes, these benefits can help support them and their families over and above their Income Protection benefit in the worst of circumstances.

Additional Services

The additional support services and helplines that complement Income Protection can be a great help when it comes to getting back to work and avoiding long-term absence.

Providing these services, or providing a broader variety of services, to individual policyholders could be a saving grace for many workers in the Gig Economy. Services such as counselling could reduce the need to take time off due to stress or poor mental health, and medical advice services could instruct policyholders on how they can adjust their lifestyle around their health needs without giving up work.

What Needs to Happen?

Policy providers need to start making their cover more flexible if they want their products to keep up with the demands of their clients. The best insurance policies and providers are those that are able to adapt to a changing economic landscape and labour market. This is where some of the policies today fall short of protecting the people that need a safety net more than anyone else.

Samantha Haffenden-Angear

Independent Protection Specialist at Drewberry

- Topics

- Income Protection

Contact Us

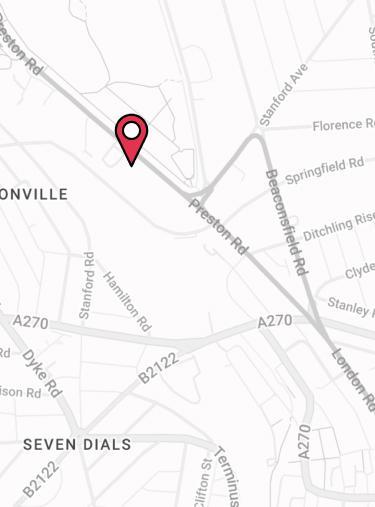

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.