What Is Shareholder Protection Premium Equalisation?

Shareholder Protection Insurance protects both your business and its shareholders. It ensures there are sufficient funds available on the death or critical illness of a shareholder for the remaining shareholders to buy a deceased or critically ill shareholder’s shares.

Shareholder Protection can also act as insurance for the absent shareholding individual / their family. This is because it allows for easy monetisation of their shares should they be too ill to work or, alternatively, provides funds for their family if the shareholder passes away.

With Multiple Shareholders It Can Start To Get Complicated…

There is no getting around the fact that Shareholder Protection is complicated. This extends to how you pay for it and how HMRC may tax it.

There are different ways to pay for Shareholder Protection, one of which involves each shareholder paying for their own premiums. It’s here the importance of premium equalisation may become apparent.

Premium Equalisation Explained

One option to set up Shareholder Protection is own life under business trust.

There are two options to pay for this:

- Through the business from a company account, with the premiums being a taxable P11D benefit in kind for the shareholders

- Have the shareholders pay for it individually themselves.

In most instances the company will pay for the premiums. However, where the individual pays, each individual shareholder takes out a policy on their own life written into a trust for the benefit of the other shareholders (i.e. the business).

If the shareholder dies or becomes critically ill, the policy pays out into the trust. This gives the remaining shareholders the funds to buy the deceased’s shares from their estate, or from the shareholder themselves if the shareholder is critically ill.

Each individual takes out a policy based on the proportionate value of their equity within the business. So, for example, someone owning 50% of a £1 million company would take out a policy for £500,000.

IMPORTANT NOTICE 🧐

Where individuals pay for the premiums themselves, it’s essential that you equalise premiums to prevent any potential tax implications.

Unequal premiums could be seen as a transfer of value or gift from the shareholder(s) paying the most to those paying the least, which could potentially fall under the remit of inheritance tax on death.

Premium Equalisation Calculator

Imagine a company worth £1 million owned by Jane, Kate and Lucy. They want Shareholder Protection until they’re 65, when they anticipate retiring.

Jane is 50 and the majority shareholder

- She owns 51% of the company – her shares are worth £510,000

- Jane takes out a 15 year policy for £792 per year

- This policy is written into trust for the benefit of Kate and Lucy

Kate is 40 and a minority shareholder

- She owns 30% of the company – her shares are worth £300,000

- Kate takes out a 25 year policy for £275 per year

- This policy is written into trust for the benefit of Jane and Lucy

Lucy is 35 and also a minority shareholder

- She owns 19% of the company – her shares are worth £190,000

- Lucy takes out a 30 year policy for £147 per year

- This policy is written into trust for the benefit of Jane and Kate

Total premiums for the three directors come to £1,214 per year. However, there is a specific formula to equalise these Shareholder Protection premiums laid out below.

What Jane Should Pay | ||

|---|---|---|

Jane’s share in the business (£510,000) multiplied by Kate’s policy payments (£275) Total value of the business (£1 million) minus Kate’s share of the business (£300,000) |

+

| Jane’s share of the business (£510,000) multiplied by Jane’s policy payments (£147) Total value of the business (£1 million) minus Jane’s share of the business (£190,000) | Equalised cost for Jane: £200.36 + £92.56 = £292.91 | What Kate Should Pay |

Kate’s share of the business (£300,000) multiplied by Jane’s policy payments (£792) Total value of the business (£1 million) minus Jane’s share of the business (£510,000) |

+

| Jane’s share of the business (£300,000) multiplied by Lucy’s policy payments (£147) Total value of the business (£1 million) minus Lucy’s share of the business (£190,000) | Equalised cost for Kate: £484.90 + £54.44 = £539.34 | What Lucy Should Pay |

Lucy’s share of the business (£190,000) multiplied by Jane’s policy payments (£792) Total value of the business (£1 million) minus Jane’s share of the business (£510,000) |

+

| Lucy’s share of the business (£190,000) multiplied by Kate’s policy payments (£275) Total value of the business (£1 million) minus Kate’s share of the business (£300,000) | Equalised cost for Lucy: £307.10 + £74.64 = £381.74 |

Premiums for the three shareholders still total £1,214, but now they’ve been equalised to remove any unwanted tax implications unequal premiums might create.

Actual & Equalised Premiums Shareholders Should Pay

In reality you shouldn’t have to worry about the premium equalisation calculations.

Between ourselves and your accountant this should all be taken care of to avoid potential tax issues. The accountant will typically ensure the appropriate amounts are deducted from current, capital or loan accounts or, as an alternative, individual director’s drawings to equalise premiums.

Actual Cost | Equalised Cost | |

|---|---|---|

Jane | £792 | £292.91 |

Kate | £275 | £539.34 |

Lucy | £147 | £381.74 | Total Cost | £1,214 | £1,214 |

Need Help? Get Shareholder Protection Advice

Shareholder Protection is probably the most complicated form of business protection, with premium equalisation being just one of the complications involved.

Why Speak to Us?

You give so much to your business. That’s why you deserve first class service when it comes protecting it. Here’s why you should talk to us:

- No fee for our service

- Award-winning 🏆 independent insurance advisers, working with leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4072 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

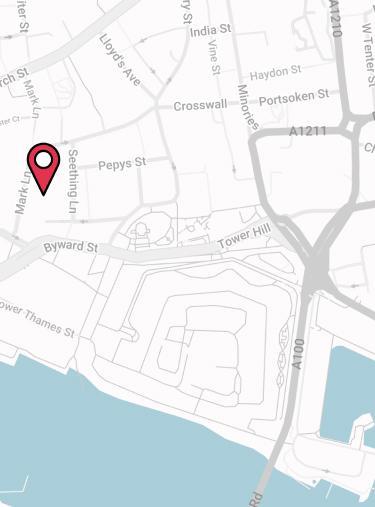

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

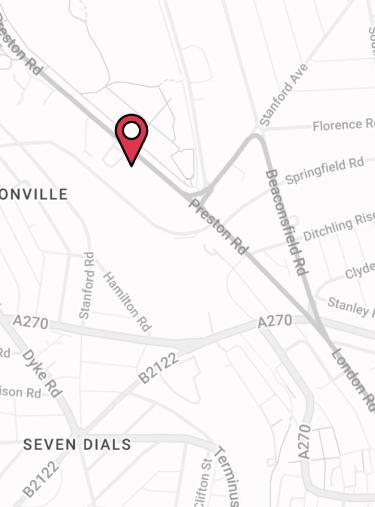

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.