Shareholder Protection: Own Life or Company Share Purchase?

Shareholder Protection Insurance protects a business and its shareholders. It offers cash to buy an absent shareholder’s shares should a shareholder die or become critically ill.

This allows the business to continue trading as normal should the worst happen to a shareholder. It also allows the remaining shareholders to keep control of the business.

Otherwise, the business runs the risk of shares being held by a non-contributing partner or even being sold to a competitor.

Meanwhile, Shareholder Protection also allows the absent shareholder or their family to monetise their shares easily if a shareholder becomes critically ill or dies.

How Should I Set Up Shareholder Protection?

Of the three ways to set up Shareholder Protection, only two are really viable where there are more than two shareholders:

- Own Life Under Business Trust

- Company Share Purchase.

Which one is right for your business will depend on your circumstances. You should only take out Shareholder Protection in consultation with a specialist adviser and your accountant to ensure you’re choosing the best option for your needs.

Shareholder Protection: Own Life Under Business Trust

Here, each individual shareholder takes out an insurance policy on their own life. You then write this into trust for the benefit of the business.

On the death of a shareholder, the policy pays out into a business-owned trust. From there, the shareholders use the funds to buy the deceased or critically ill shareholder’s shares.

Who Pays?

There are two ways to pay for own life under business trust Shareholder Protection: Each shareholder can pay for it personally or the business can pay for it.

How is it Taxed?

HMRC taxes Shareholder Insurance differently depending on how you take it out.

For own life under business trust, the most common route is to have the company pay for it. In this instance, the company is typically able to deduct premiums as a business expense against corporation tax. However, the shareholders would generally have to pay tax on the premiums, as these would be a P11D or benefit in kind.

If each shareholder pays individually, which is much less common, then each shareholder pays premiums from post-tax income. This means there aren’t usually any further tax concerns for the individuals.

Advantages

- There are unlikely to be complications with regards to company law and the company buying back its own shares because this sees shareholders buying out another shareholder.

- You can add new shareholders and remove old ones relatively easily.

Disadvantages

- You may need to equalise premiums, which can be a complex calculation. However, premium equalisation ensures the deal remains ‘commercial’. This means you can usually buy and sell the shares free from inheritance tax concerns, so it’s an important step.

- There may be greater tax efficiencies with the company share purchase option.

Company Share Purchase Shareholder Protection

With company share purchase Shareholder Protection, the company takes out a policy on the life of each individual shareholder.

In the event of death or critical illness of a shareholder, the insurer pays the benefit to the business. This provides the company with the necessary funds to buy out and cancel the absent shareholder’s shares. The result is that the proportionate shareholding of the remaining shareholders effectively increases.

Who Pays?

The company both owns and pays for the policy and is the ultimate beneficiary.

How is it Taxed?

HMRC typically treats the payout as free from corporation tax as a capital receipt, but this depends on your accountant, your local inspectorate of taxes and your legal representatives.

However, premiums will not generally be a deductible expense for corporation tax purposes. There is also typically no need for a trust.

Moreover, as the company owns and pays for the policy and is the ultimate beneficiary, HMRC does not typically class this method as a benefit in kind for the shareholders.

What is a Cross Option Agreement?

The company share purchase route requires the shareholders and the company to enter a cross option agreement. This lays out the terms of the share purchase, such as options to buy and sell the shares and how the shares will be valued.

For tax reasons, at the time you establish the cross option agreement there will be no guarantee that the company will be in a position to purchase the shares.

You’ll typically draft the agreement to accommodate this. For example, the company will have the option to purchase the shares and the shareholder (or their estate) the option to sell the shares. This will generally preserves business property relief for inheritance tax purposes on the shares.

Advantages

- It’s less complicated to set up because trusts and equalisation of premiums are not necessary.

- It’s not usually a P11D or benefit in kind for the shareholders.

- You can add new shareholders to the arrangement simply by taking out a new plan on them and setting up a new cross option agreement.

Disadvantages

- It’s not necessarily suitable for new companies

In order to secure favourable capital gains tax treatment on the proceeds from selling the shares, one stipulation is that the seller needs to have held the shares for at least 5 years (or 3 years if the personal representatives administering the estate are selling). - The company’s articles of association must authorise the company to buy its own shares

Older companies’ articles, especially those set up before 1982, may not permit this. The articles would therefore need amending before a share buyback could happen. - Any changes to the articles as a result of the above may then increase the value of each individual’s shareholding, potentially therefore requiring more cover

- There may also be capital gains tax implications

Should the surviving shareholders eventually dispose of their shareholdings, the value of which has increased thanks to the company share purchase. - There is less flexibility here where a shareholder leaves.

- Any share buyback scheme may be prevented in the future if the company fails to meet the necessary requirements under the Companies Act 2006 in relation to the buyback.

Companies Act 2006

Under the Companies Act 2006, you must meet the following requirements to allow a share buyback to continue:

- The company’s articles of association must permit share buyback or an ordinary resolution requiring more than 50% votes in favour, but excluding the shareholder who is selling the shares. This ordinary resolution must approve the purchase.

- Rather than funding the share purchase from capital, the company must first attempt to use distributable profits instead. Proceeds from Shareholder Protection could be classed in a number of different ways depending on your accountant, legal representatives and financial adviser. For example, tax authorities could potentially class a payout as a receipt in the profit and loss account or perhaps as capital.

- If the company intends to fund the buyback from capital, which may include the payout from Shareholder Protection depending on how HMRC and / or your local inspectorate of taxes classes it, you’ll have to meet additional requirements:

- The directors must make a statement that the purchase will not prejudice creditors. This should be accompanied by an auditor’s report, which you’ll need to deliver to the Registrar of Companies.

- You must place notices to creditors in the Gazette and a national newspaper. If the company has substantial debts, creditors may make a court application to prevent the share purchase going ahead.

IMPORTANT NOTICE 🧐

Shareholder Protection is complicated, and company share purchase is the most complex of all your available options. We recommend seeking not just financial advice but also advice from your accountant and legal representative(s) before taking out such a policy.

Need Help? Getting Shareholder Protection Advice…

Shareholder Protection isn’t simple. It needs carefully-structured advice from a variety of parties to ensure you get it right. It’s therefore best to start your journey by speaking to a specialist adviser.

Why Speak to Us?

You give so much to your business. That’s why you deserve first class service when it comes protecting it. Here’s why you should talk to us:

- No fee for our service

- Award-winning 🏆 independent insurance advisers, working with leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4067 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

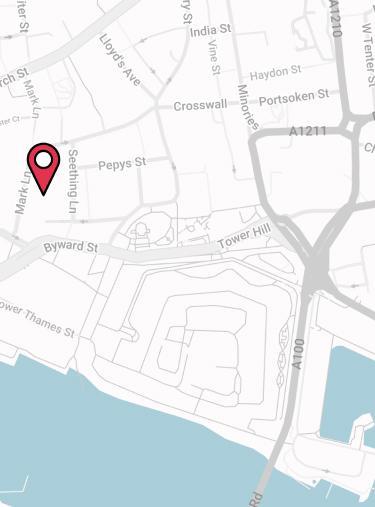

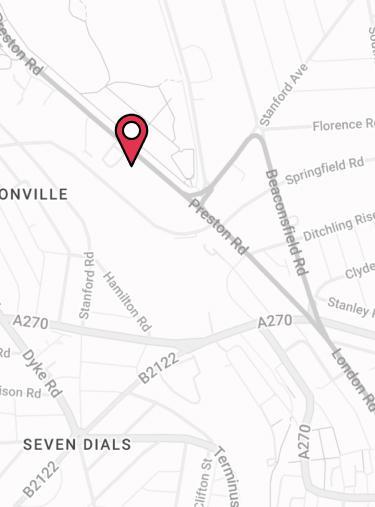

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.