The Exeter Income One Plus

Income One Plus

Founded

1888

Company Type

Friendly Society

Company Overview

With links going back as far as 1888, The Exeter as it is today was founded in 2008 when two friendly societies joined forces: The Exeter Friendly Society and Pioneer Friendly Society.

As a mutual friendly society, they operate for the benefit of its members. It offers a range of protection products, including two different types of Income Protection policies, one of which is Income One Plus.

The Exeter has won several awards for its policies and service over the years, including being awarded 5 stars for the Financial Adviser Service awards for 4 years in a row.

Documentation

Income One Plus Overview

The Exeter’s Income One Plus is a traditional Income Protection product designed and priced specifically for low risk occupations. For that reason, this policy is very popular with young professionals.

- Income One Plus offers Level Guaranteed Premiums which will not change in price throughout the duration of your policy.

- The Exeter offer Own Occupation cover for all policyholders.

- Income One Plus policies have the option to fix 75% of your benefit to avoid losing your cover if your salary tends to fluctuate.

- Get a range of guaranteed options that allow you to adjust your cover to your changing circumstances, making Income One Plus a flexible, long-term policy.

- Income One Plus is designed to cover specific low-risk occupations. You may not be able to take out an Income One Plus policy if you are in an ineligible occupation.

The Exeter Income One Plus Policy Conditions

Overview of Key Policy Details

| |

|---|---|

Policy Type | Income Protection |

Premium Type |

|

Maximum Claim Duration | Unlimited |

Incapacity Definition | Own Occupation |

Deferred Period | Day 1 / 1 week / 4 weeks / 8 weeks / 13 weeks / 26 weeks / 52 weeks |

Indexation | Optional |

Waiver of Premium | Automatically Included |

Maximum Cover | 60% of the first £100,000 of your taxable income and 40% of your income above £100,000. |

Minimum Entry Age | 18 years old |

Maximum Entry Age | 59 years old |

Minimum Policy Term | 5 years |

Maximum Cease Age | 70 years old |

Guaranteed Insurability |

Increase your benefit for a maximum of 20% or £500 per month. Available up to your 55th birthday and subject to terms. |

Policy Exclusions | No Standard Exclusions |

We have taken care to ensure that the information on this Drewberry owned website is accurate. However we can give no guarantee as to the accuracy of the content of the site. We accept no liability for any losses whether direct or indirect arising from errors on our part.

Drewberry’s Exeter Income One Plus Review

One of the major differences between Income One Plus and The Exeter’s other Income Protection policies is the availability of Level Guaranteed Premiums.

Key Comparison Points

- Level guaranteed premiums are the best kinds of premiums you can find with an Income Protection policy. Provided you don’t choose to have your policy index-linked or voluntarily increase your cover, level guaranteed premiums will stay the same until the end of your policy.

- All policyholders receive Own Occupation cover and will be able to claim on their policy as long as they are unable to work in their own occupation.

- While some providers only offer cover if you are in the UK at the time you want to claim, The Exeter allow you to claim on your policy in certain countries outside of the UK, including any country within the European Union.

Additional Benefits

The majority of The Exeter’s additional benefits are found within its HealthWise program, which is accessed via smartphone app. This offers:

- GP on demand and prescription service (up to 4 consultations each year)

Book phone or video services with UK GPs without leaving your home for guidance, recommendations for further treatment and potentially prescriptions if required. - Second medical opinion service (up to 2 consultations each year)

Provides access to a second medical opinion where your diagnosis can be assessed and analysed by a second specialist pair of eyes. It could provide a different treatment plan, or just valuable reassurance. - Physiotherapy (up to 6 consultations each year)

Offers assessment, diagnosis and treatment of musculoskeletal conditions through a network of physiotherapists. You can get the help you need via video consultation. - Mental health support (up to 6 consultations each year)

Gives you access to fully trained specialists who can assess and treat a range of mental health conditions including anxiety, depression and substance abuse, as well as offering emotional and behavioural support. The service is provided by video consultation with therapists via the app.

Another benefit is Proportionate Benefit, which will pay a reduced benefit if you aren’t able to return to your own occupation but instead take up a different occupation with a lower income. You can continue claiming this reduced benefit while working until:

- Your claim period ends (if you selected a limited claim period)

- Your income from your new occupation is equal to or more than your income before you were incapacitated

- You are medically able to return to your old occupation

- Your policy is terminated.

Financial strength

In 2016, The Exeter had gross assets of £195 million and reserves of £119 million. Both of these numbers saw an increase during 2015 with gross assets growing by as much as £21 million. The Society’s capital reserves represent 249% of its solvency capital requirement under the new Solvency II rules.

The Exeter Income One Plus: FAQs

We aim to know the policies we advise on inside out and back to front. Below, we have answered a couple of commonly asked questions with regards to the policy coverage of The Exeter’s Income One Plus.

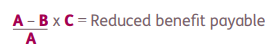

Q. How much of my original benefits do I receive if I claim for Rehabilitation or Proportionate Benefits.

A. The amount that you receive from these benefits is dependent on your current, reduced level of income and the amount you were earning before you began claiming for incapacity.

A is your income before you began claiming for incapacity.

B is your current, reduced income.

C the benefit you were claiming while incapacitated.

Please note, however, that you will not be able to claim these reduced benefits if you chose to guarantee a minimum benefit.

Q. Do I need to provide my medical information if I want to increase my Income Protection benefit?

A. Whether or not you need to resubmit your medical information upon increasing your benefit will depend on the circumstances.

You will not need to submit any new information if you you are increasing your cover because your marital status has changed; you or your partner has had a baby or you have adopted; you have take out a new mortgage or your mortgage has increased; or it is the third anniversary of your policy.

Otherwise, you may have to submit medical information in order to increase your benefit.

Need Specialist Income Protection Advice?

As you can see, there are a lot of points to consider when comparing insurers. With so many factors in play, it can be time-consuming to pull up key information across every single insurer in the market, so why not ask an adviser for help?

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to talk to us.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4084 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

If it is all getting a little confusing and you want to talk you through your options to make sure you find the most suitable cover please don’t hesitate to get in touch.

Pop us a call on 02084327333 or email help@drewberry.co.uk.

Tom Conner

Director

- Topics

- Income Protection

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.