What Is Meant by the Excess Period for Income Protection?

I’m looking to take out Income Protection but I don’t understand what is meant by the excess period?

Income Protection Excess Period Explained

The excess period for Income Protection Insurance is sometimes known as the waiting period or the deferred period.

This is the time you would have to be off work before the policy would start to pay out. As a general rule, the longer the excess period the cheaper the premiums.

Shortest and longest available excess periods

The shortest excess or deferred period is 7 days and the longest is 2 years. When choosing an excess period the question to ask yourself is: “How long could I survive without an income?”

Your sick pay might make a difference

It may be that your employer has an occupational sick pay scheme which will pay you full salary for 3 months or 6 months. If this was the case you could set your deferred period to coincide with when your occupational sick pay runs out.

At the other end of the scale some employers do not pay sick pay at all so you would be dependent on government statutory sick pay and savings from day one. Statutory sick pay is only £118.75 per week so most of us would struggle to meet our monthly outgoings on this income.

If this is the case then you would need to consider what savings you have available to live off in an emergency and how long they would last. For example, you might have enough saved for one month’s expenses in which case you could have an excess period of 4 weeks.

Speak to a specialist

If you would like to know more about the excess period for Income Protection or have any other queries don’t hesitate to get in contact on 02084327333 or help@drewberry.co.uk

- Topics

- Income Protection

Frequently Asked Questions

Does Income Protection Cover Motorbike Riding?

How Long Should I Set My Income Insurance Deferred Period?

Can I Claim Employment and Support Allowance As Well As Income Protection?

Can I Get Insurance for Accidents and Sickness?

What's The Maximum Age For Income Protection Insurance?

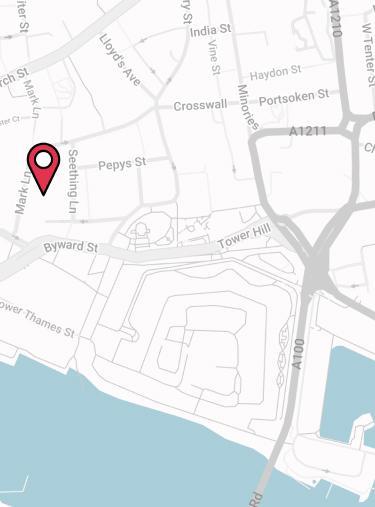

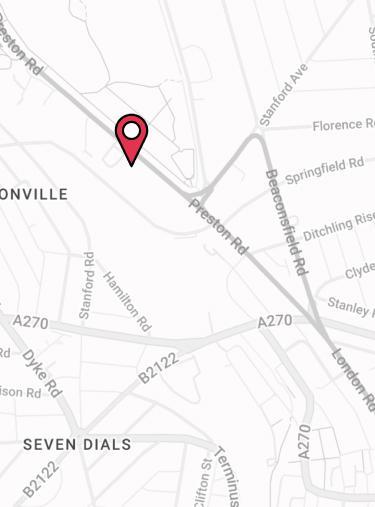

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.