Can My Limited Company Pay My Income Protection Premiums?

Is it possible for me to take out an Income Protection Insurance policy and pay the premiums through my limited company?

Buying Accident & Sickness Insurance Through Your Limited Company

If you are a director of a UK Limited Company, you have a few options when it comes to setting up an Income Protection policy.

You can either pay for the cover yourself out of post-tax income, or your company can pay for it. Which method is more cost-effective comes down to the policy choice (either a personal or executive plan) and the respective tax implications.

Personal Income Protection

With personal Income Protection, you would take the cover out and own the policy. As a result you would pay the premiums from your personal bank account, out of your net income. If you were to make a claim, the monthly benefit would be paid to you, free from income tax. This is because you would have already paid tax on the money used to pay for the premiums.

It may also be possible to take out a personal plan and pay the premiums through a limited company. Whether the premiums can be classified as a business expense would come down to the opinion of the local inspector of taxes and your accountant. Because of this it’s important to have this discussion with them.

Executive Income Protection

Executive Income Protection is often taken out by company directors, who are looking to protect themselves. Or, a business who wants to offer a policy to a small number of employees rather than providing a Group Income Protection Scheme to all staff.

With this type of policy, rather than you owning and paying for the premiums, your company does. If a claim is made, the benefit amount would be paid back to the company rather than to you individually. Your company would then distribute this as needed.

It’s important to note that the payout from the policy would be treated as a trading tax receipt and would be taxed accordingly. Due to this, when taking out cover you would need to ‘gross-up’ the benefit amount so an appropriate amount of income is left after tax.

Getting Specialist Help

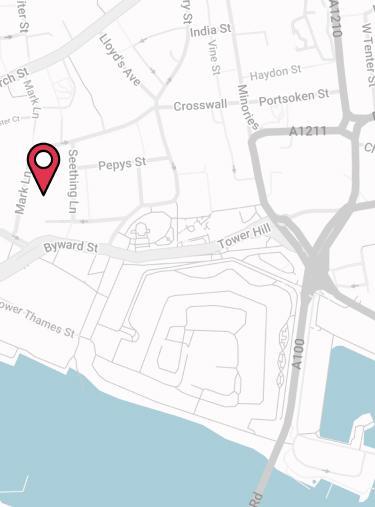

When taking out cover through a limited company most providers require the policy to be set-up by a specialist adviser. If you need any help please do not hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk.

- Topics

- Income Protection

Frequently Asked Questions

What's The Maximum Age For Income Protection Insurance?

Can I get Income Protection as an Airline Pilot?

Do I Pay Tax On Income Protection Benefits?

How does income protection insurance work?

Does Income Protection Have An Initial Exclusion Period?

Contact Us

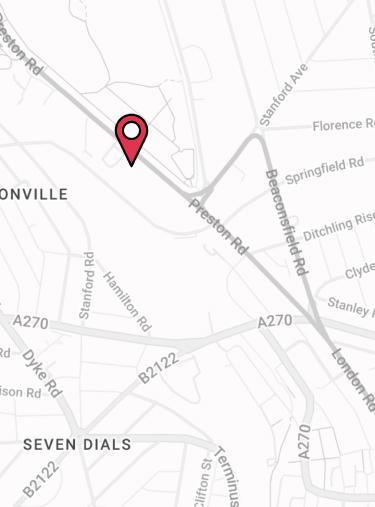

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.