Am I Tied in to Long-Term Income Protection?

I am seriously considering Income Insurance for myself. I understand all the benefits but I’m worried that if my circumstances change in the future I may not need to cover so I want to know if I’m tied into to the policy at all?

No, not at all, insurers understand that your circumstances change over time. For example, you may go from being self-employed to working for a company that provides group income protection. For this reason, it is usually just 30 days notice if you need to cancel your plan.

The most important point with long-term income protection policies (sometimes known as permanent health insurance) is that the insurer is tied into the policy, but you are not. Thus, if the plan runs up until age 65, say, then the insurer is contracted in to provide you that cover up until that age.

Making changes to your income protection

If your circumstances do change it is best to get back in touch with your adviser as it may just be the case that your policy needs altering rather than cancelling.

For example, you may move to a company that doesn’t provide Income Protection (usually only large companies provide this benefit and not normally to all staff) but may provide three months of full sick pay, in which case you may want to alter the policy so the deferred period aligns with this sick pay entitlement.

- Topics

- Income Protection

Frequently Asked Questions

Do I Pay Tax On Income Protection Benefits?

What is accident and sickness insurance?

Can I Take Out Income Protection Up to Age 70?

What is income protection insurance?

Does Income Protection Cover Diving?

Contact Us

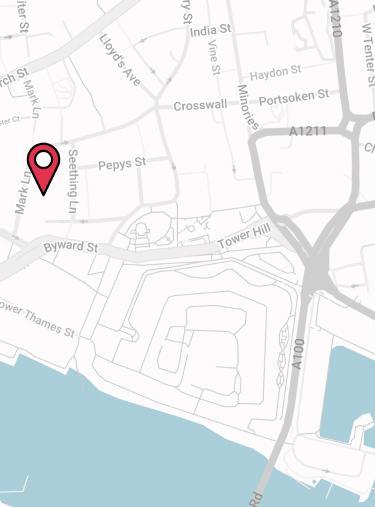

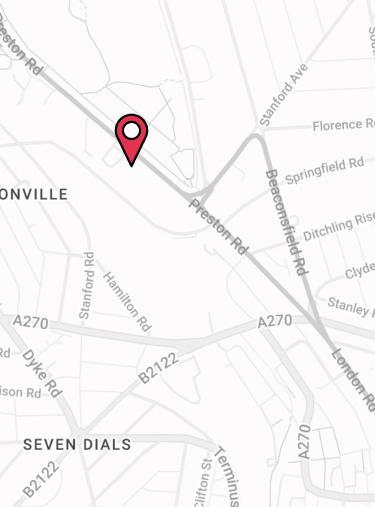

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.