Women Still Lacking Life Insurance Cover

The contribution to household income provided by women has been increasing rapidly over the last decade or so, yet women are still failing to protect their families by taking out life insurance in sufficient numbers.

The Research

In a new report, put together by the insurer Bright Grey, it was found that nearly half of women declare themselves as the main household earner.

At Drewberry we continuously see couples looking for joint mortgage protection where the woman earns significantly more than the man, and this is becoming an increasingly common trait.

Although the wage distribution between men and women is changing, women are still significantly lacking financial protection relative to men. This lack of protection not only relates to life insurance but also in terms of salary insurance, even though the loss of earnings from the female partner would have a very negative impact on family income.

The Statistics

The Bright Grey research showed that over half of the women surveyed stated that they didn’t have any life insurance in place whatsoever, not even to protect their mortgage and/or family should they die.

In terms of other forms of personal financial protection, around 80 per cent of employed women did not hold salary insurance and over 75 per cent did not hold either critical illness cover or private medical insurance (which is designed to pay for the diagnosis and treatment in private hospitals, thus avoiding potentially long NHS waiting lists).

Common Protection Plans

In an ideal world individuals would protect their mortgage loans with life insurance and critical illness cover so the loan could be repaid should they pass away or suffer a critical illness condition. Additional life insurance should also be considered for family protection purposes.

An income protection plan (also know as salary insurance) should be considered in order to meet other monthly outgoings and to protect their lifestyle should they suffer illness or injury and are therefore unable to work.

Given the increased scope of cover provided salary protection it is also wise to consider covering monthly mortgage loan repayments instead of taking out critical illness cover.

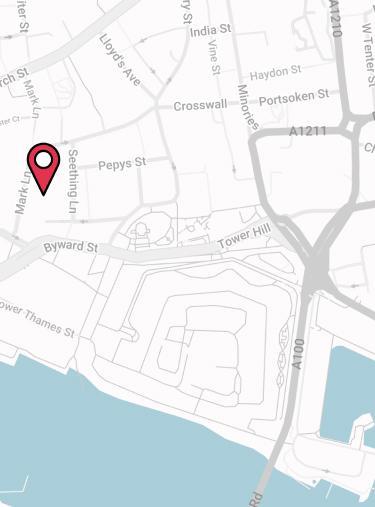

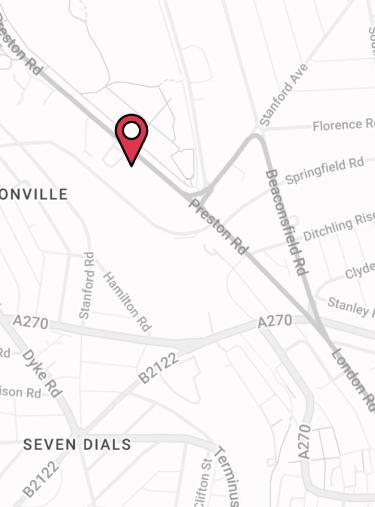

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=4115)