Income Protection Glossary

Level of Cover

With most insurers the maximum you are eligible to cover is between 50% and 70% of your gross or pre-tax earnings. The greater the level of cover in monetary terms the higher the income protection quotes will be as the provider is insuring a greater risk.

To get a good approximation of the protection you require it is best to start with your net pay and deduct any sick pay and savings you would received and be willing to use if you were unable to work.

Length of Cover

The maximum length of time the policy would pay a continuous claim, short term policies tend to pay our for a maximum of 24 months where as a long term product could continue paying out right up until you reach retirement.

As you increase the length of cover so you increase the period over which the insurer must protect your income and thus increase their risk, especially as the longer the term of the policy the older you are requiring cover.

Deferred Period

In addition to the level and length of cover the next most important factor is the deferred periods. In it’s simplest form this is the time period you need to be unable to work for the policy to start paying out.

Often the deferred period is aligned with one’s sick pay provided from their employer, the deferred period can be as short as 4 weeks to as long as a year. The longer the deferred period the less likely a claim will arise and thus the cheaper the premiums.

Incapacity Definition

The definition of incapacity is the definition by which income protection or payment protection insurers will assess a claim for accident or sickness. The most comprehensive definition is ‘own occupation’ cover where the insurers will payout a claim if you cannot perform the main duties of your specific job role. With lesser definitions a claim may still be declined even if you cannot do your current job due to illness or injury.

Own Occupation

The own occupation definition of incapacity provides the most comprehensive form of accident and sickness cover as the policy would payout if the policyholder is unable to perform the main duties of their specific job role.

It is important to be aware that with other definitions of incapacity it is entirely possible that the policyholder could be unable to do their specific job due to illness or injury but the definition used would still not evoke a payout.

Suited Occupation

The suited occupation definition of incapacity means that an accident and sickness policy would only payout if the policyholder is unable to perform any occupation given their skills, experience or education.

For example, insurer may deem that there is a less strenuous job that could be done based on the policyholders skill-set and decline a claim, even if the policyholder was unable to do their current job. For the plan to payout based upon the policyholders actual job they would need to hold a policy using the own occupation incapacity definition.

Work Tasks /

Activities of Daily Living

When the activities of daily living definition of incapacity is used on an accident and sickness insurance policy the plan would only payout if the policyholder is unable to perform a set number of ‘tasks’ based on a defined list.

These basic tasks may include activities such as walking up stairs and getting dressed. For protection against the risk of not being able to undertake a current job role a policy should be taken that uses the ‘own occupation’ definition of incapacity.

Indexation

Inflation indexation is an option that can be selected with income protection, life insurance and critical illness cover policies whereby the level of cover will rise each year in line with inflation. The most common inflation measure used is based on changes in the Retail Price Index (RPI). It is important to note that each year both the level of cover and the monthly premiums will rise.

Premium Type

Guaranteed Premiums

With income protection, life insurance and critical illness cover it is possible to have guaranteed premiums. With this option the insurer does not have the right to alter the premiums charged over the life of the policy. In other words, the premiums are fixed for the entire policy term. This differs to plans with reviewable premiums where the insurer does have the right to change the premium amount over time.

Reviewable Premiums

When a policy has reviewable premiums it means that the insurer is free to alter the premiums charged periodically over the life of the plan. Many general insurance plans, such as payment protection insurance, are often reviewed annually. Protection plans, such as critical illness cover or income protection, often have an initial period where the premiums are fixed (commonly for 5 years) but after which changes can be made at the insurer’s discretion. The alternative is guaranteed premiums where the premiums are fixed over the life of the plan.

Age Banded Premiums

With age banded premiums the monthly premiums charged by the insurer increase each year as the policyholder grows older. Is it common for premiums to be adjusted on a fixed data each year rather than on the policyholder’s birthday. Some plans have ‘guaranteed’ age banded premiums where the rate table used to determine the price rise is fixed over time but is more common for this rate table to be ‘reviewable’ at the insurers discretion. Age banded premiums can rise significantly as the policyholder reaches the latter stages of their working life.

Other Terminology

Permanent Health Insurance

Permanent Health Insurance is the name that used to be used for what is now called Income Protection Insurance. The policy pays out a monthly benefit to replace a proportion of lost earnings should the policyholder have to cease working due to illness or injury (incapacity). The plan pays out after a ‘deferred period’ (which can range from 7 days to 12 months) and can payout for 12 or 24 months (short-term cover) or until retirement (long-term cover).

Payment Protection

Payment Protection is a type of insurance traditionally used to cover monthly loan repayments against the policyholder having to take time off work due to accident, sickness or unemployment. The most common example is Mortgage Payment Protection Insurance (MPPI). However, many plans are now available that cover general income and these policies are often confused with income protection cover.

Excess Period

An excess period (more commonly known as a deferred period) is the length of time a policyholder would need to wait before an income protection or payment protection policy starts paying out after ceasing work due to accident, sickness or unemployment.

Initial Exclusion Period

The initial unemployment exclusion period is the length of time after taking out a payment protection policy before a valid unemployment / redundancy claim can be made. For a valid claim to be made the policyholder must not have been informed of their potential redundancy during this period. All unemployment plans have an initial exclusion period but they vary from 90 days to 180 days depending on the insurer and many providers are willing to waiver the exclusion for those switching from another provider.

Waiver of Premium

When a policy includes waiver of premium it means that the insurer will ‘waiver’ the premium should the policyholder have to cease working due to accident or sickness. The policyholder would need to see out a deferred period (which can range from 4 weeks to 52 weeks) before the waiver kicks-in. Given the nature of the plan, most income protection plans automatically include waiver of premium but it is an added option with life insurance and critical illness policies.

- Topics

- Income Protection

Contact Us

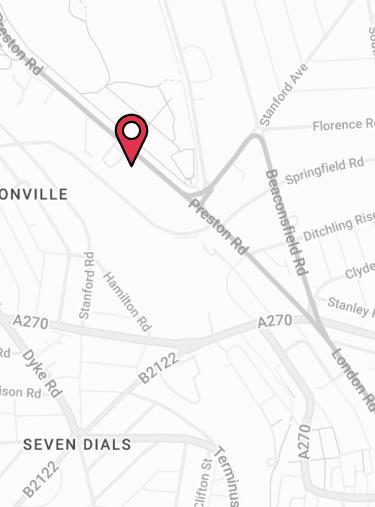

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.