Income Protection pays you a monthly income worth a percentage of your pre-tax earnings if you suffer an accident or sickness that stops you working.

Insurers cover between 50% and 70% of your income. You use the benefit to maintain your essential outgoings while you’re unable to work, such as your mortgage / rent, bills and other commitments.

The best Income Protection provides long-term cover. This means the insurer pays your chosen benefit each month right up until you retire if you become so ill or injured you can’t ever return to your job.

However, before the insurer pays the benefit, you go through the claims process. This page offers a general idea of how to make an Income Protection claim, with a step-by-step guide, an example of one of our clients who made a successful illness claim and questions we’re frequently asked in this area.

How Do I Claim On My Income Protection Policy?

Once you have Income Protection, if you become ill or injured these steps offer a basic outline of how to claim:

- An illness / injury stops you working and you take time off to recover.

- Contact your insurer’s claims team as soon as you stop working.

- Complete a claims form — most insurers let you do this online. Have to hand evidence of your medical condition, for example a doctor’s note, and proof of your earnings in the run up to your claim.

- If your claim is approved, wait out your policy’s deferred period. You choose this when you take out cover. It’s how long you wait between falling ill and the insurer paying out. You usually align it with your sick pay or how long you could last on savings.

- After the end of your deferred period, if you still can’t work your insurer starts paying a monthly benefit to replace your lost income.

- You can claim until you recover, your payment period ends (for short-term cover, typically 1 or 2 years) or until your chosen retirement age if you can never go back to work.

Neil’s Cancer Claim With British Friendly

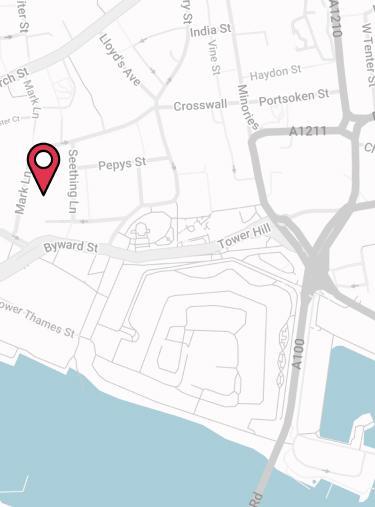

Bathroom salesman Neil came to Drewberry looking for Income Protection to cover his earnings in case he couldn’t work.

We advised him on a British Friendly policy and Neil took it out. Just 4 years later he was grateful for that decision — he needed to make a claim.

It started with a bout of stomach pains. After visiting his GP and having some tests, consultants diagnosed Neil with stage 2 bowel cancer. He needed immediate surgery.

While the surgery was a success, afterwards Neil developed severe sepsis requiring intensive care. He was completely unable to work during this period and his subsequent recovery at home.

Fortunately, he had his British Friendly policy and made a successful claim. Without it, he doesn’t know how he would have coped — here’s the difference it made to his life.

🤕 Read More About Neil’s Experience

Will My Insurer Pay a Claim When I Need It?

Most people understandably want to choose the insurer that pays the most claims.

However, it’s actually fairly hard to distinguish providers from each other in this area. Payout rates across the industry are not only higher than many people assume but are also fairly uniform.

For example, as shown in the table below, most providers pay more than 90% of all Income Protection Insurance claims they get. The top providers pay practically every single claim.

Need Help With Your Claim?

At Drewberry, we do have a claims management service that can help if you get stuck trying to make a claim.

For help in this area, you can call your adviser. Alternatively, we’re available on 02084327333 or you can email help@drewberry.co.uk.