Drewberry is a thriving London-based financial advice business dedicated to guiding its clients through every stage of their financial lives.

![Pensions Advice in London]()

We have teams of advisors providing financial advice in our London and Brighton offices, all of whom are passionate about making a difference for our clients.

Learn more about Drewberry here →

How Financial Advice Should Be…

Since launching in 2009, the Drewberry philosophy has been to cut jargon, invest in technology that empowers our clients and deliver ‘better than best’ levels of customer service when acting as their financial planners.

We’ve built technology into our financial advice process from the outset rather than trying to retrofit a creaking legacy system with the latest bells and whistles.

By coupling market leading technology with specialist advisers we are able to provide a 5 star service to our clients and ensure individuals and business throughout the UK are getting the quality of financial advice they deserve.

At Drewberry we’re all about handing you the reins to your own finances, whether that’s working with you to protect what you’ve already got or helping you start building your nest egg for the future.

Our advisers offer a range of services from our London based office, including:

Meet Our Team →

Speak To Our Specialist Advisers

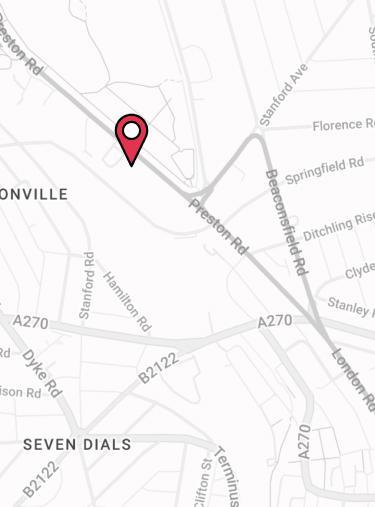

Financial Advice in London, Brighton and Beyond…

Drewberry’s ethos is that every client deserves the best financial advice we can give them. We may be a London financial adviser in terms of our address, but we use our Brighton and London offices as hubs with a far wider reach.

Through our specialist advice we aim to put clients across the UK in charge of their finances, making sure they’re always in the driving seat.

Financial Advice wherever you are in the UK

Thanks to the technology our Brighton and London financial advisers have at their fingertips, they can offer our customers access to the best advice no matter where they are in the country.

Meet Some of Our Clients

Whether it is helping someone set-up a life insurance policy for their mortgage or consolidating half a dozen pension schemes and putting in place actionable retirement goals we are here to improve our clients financial wellbeing.

Find out why dentist Rajpreet turned to Income Protection Insurance to safeguard his financial future…

Self-employed legal counsel explains how he put his pensions in order. Find out how Drewberry got Steve’s lost pensions working for him and his family…

Read the story of Alison Bradley and her successful family-run engineering distribution firm, Ytron-Quadro….

Former IT project manager Paul had three main pension assets when he came to Drewberry. This is the story of how we got them all working for him…

A case study detailing the success of cycle insurance company Bikmo and why they felt Keyman Insurance was important…

Former banker Duncan had a final salary scheme from his previous job, but despite the benefits it just wasn’t suitable for his retirement needs…

Our Recipe for Offering the Best Financial Advice

At Drewberry, we don’t do generic advice. Our focus has always been on treating you as an individual from the outset, finding out what your needs are and aiming to provide a solution and financial advice that works for you as a person, not a customer reference number.

It doesn’t matter who you are or what you need. Our financial advisers are here to help clients from all walks of life.

![pension advice increases retirement income]()

In 2015 alone, Drewberry placed over £1 billion worth of risk with UK insurers and we went on to place still more in 2016.

Today, we have enough satisfied customers to fill the Royal Albert Hall more than twice over. What’s more, we’re proud to say that our dedication to customer service has result in Drewberry’s five-star reviews outnumbering those of any other financial adviser of similar size.

Read our client reviews here.

Our Financial Services in London

At Drewberry, we offer professional, fee-based financial planning services from specialist financial advisers in London. We offer financial advice, financial planning and money management services to individual clients on all aspects of pensions, tax-efficient investments, protection and estate planning.

We also work closely with large numbers of smaller companies in London and beyond, offering our professional financial advice services in the areas of business protection, SME tax planning advice, and advice on pension administration and management.

If you’re looking for financial advice as a first-time buyer, if you’re planning for school or university fees, need financial guidance on building up your pension, or you need advice on legacy planning to ensure the smooth inheritance of your hard-earned assets, we can help you find the best solution that meets your needs.

Pension Advice

The main question we ask our clients is this: What are your retirement goals? Whether you’re already saving for retirement, looking for pension transfer advice, managing a mature pension portfolio, or need one of our London financial advisers to help get you started on saving for the future, our pensions advice services aim to let you retire in style.

Insurance Advice

There are many financial risks in our lives that can get in the way of us achieving our financial ambitions. Severe risks, such as losing our income due to death or poor health, can place harsh limitations on what we can do with our money.

That’s why every review we conduct will include specialist advice on how you can combat these risks and our professional insurance advisers in London can help you find a product that’s right for you.

Investment Advice

Whatever your financial ambitions, we will offer you investment advice to help you frame the best strategy for your needs. We also offer access a huge variety of funds and specialist investments and will monitor the performance, charges and tax efficiency of all your investments, meaning we can make a real difference to your wealth over time.

Tax Advice

Don’t let yourself fall victim to unnecessary tax. We’re specialists in offering all forms of tax-efficient investment advice – whether you want to make the most of your household’s tax allowances, recapture lost tax, or need some inheritance planning advice to help you find the most efficient way to pass on your assets.

Is Financial Advice Worth It?

Whether or not financial advice is worth it for you will depend on your circumstances, although many people find themselves better off having seen an adviser.

For instance…

How do I find a UK Financial Adviser?

There are many resources out there to help you in your search for a financial adviser, but one thing you must always do no matter which adviser you choose is check their position on the FCA register.

This ensures you’re dealing with a regulated, registered firm which is employing the appropriate professionals to manage your money.

You can check out Drewberry’s entry on the FCA register here.

How much does Financial Advice cost?

How much financial advice will cost depends on your circumstances and the type of advice you’re looking for.

A complicated financial process such as a final salary pension transfer will naturally cost more than the relatively simple process of setting up a new pension.

The fees we charge for financial advice at Drewberry are tailored to your needs precisely, so you know you’re not paying a generic fee and potentially handing over cash for services you might not use from us.

To find out more about the cost of financial advice, book a demo with us today.

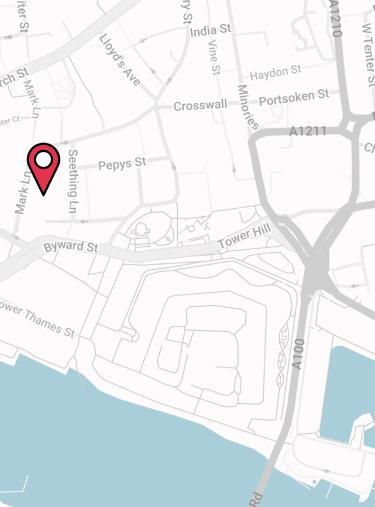

Need Financial Advice in London?

If you are based in or around London and wondering whether financial planning or pension and investment advice is worth it for you, why not contact our London Office on 02084327333 to find out how we can help you. You can talk to one of our advisers free of charge and with no strings attached.

Our London Office

Drewberry

Millennium Bridge House

2 Lambeth Hill

London

EC4V 4GG

Drewberry is a regulated financial adviser that helps its clients through every aspect of their financial lives. Find out how we can help you today.

Why Speak to Us?

We started Drewberry because we were tired of being treated like a number. We want to give you as our client the service you deserve when discussing matters as important as planning your financial future.

Below are just a few reasons why it makes sense to let us help:

- See your financial future

Our sophisticated financial modelling technology visually maps out your financial future. Get a living financial plan that clearly shows what you can achieve depending on the decisions you make — read more here.

- Achieve the retirement you deserve

Can you afford that dream round-the-world trip? Can you help your children onto the property ladder? We’ll model your goals and build your financial plan to help you achieve them.

- Our knowledge saves you time and provides peace of mind

We take care of it all, from organising your pensions, investing your assets, managing risk and making the most of your tax allowances.

- We’ve got bargaining power on our side

This allows us to negotiate better rates for you than dealing with providers yourself.

- You’ll speak to a dedicated specialist from start to finish

You’ll speak to a named specialist with a direct phone line and email. No more call centres and machines asking you to press this and that — you’ll speak to someone who knows you.

- Benefit from our 5-star service

We pride ourselves on providing 5-star service, as seen in our 4071 and growing independent client reviews rating us at 4.92 / 5.

- Gain the protection of regulated advice

Our regulated advice service means you are protected. We’re responsible for the decisions we help you make. Doing it yourself or going direct to a provider doesn’t offer this protection, so you won’t benefit from these securities.

Speak To Our Specialist Advisers