Do I Need Mortgage Insurance?

Mortgage Life Insurance

Quote

Receive an upfront cash lump sum for your loved ones to pay off the mortgage in full should you pass away during the term of your mortgage

Get My Instant Quotes

Mortgage Payment Protection

Quote

Receive an income to cover your monthly mortgage repayments should you be unable to work due toaccident, sickness or unemployment

Get My Instant QuotesMortgage Insurance is split into two distinct products. Each type of policy covers very real – yet very different – risks.

- Mortgage Life Insurance

Pays a lump sum to your family on your death to cover the outstanding mortgage balance - Mortgage Payment Protection Insurance (MPPI)

Temporarily covers your mortgage payments if you’re put out of work due to accident, sickness or (potentially) unemployment

How do you know which type of cover is right for you? And how can you tell whether you need Mortgage Insurance or whether you’ll be able to cope without it?

Mortgage Insurance is designed to cover:

- Accident & Sickness

If you are ill or injured and not able to work, Mortgage Payment Protection can pay out a monthly benefit that covers the cost of your mortgage payments until you are well enough to return to work. - Unemployment

If you are made redundant, some policies will help you keep up with your monthly mortgage payments until you return to work. - Death

If you pass away, Mortgage Life Insurance can kick in and pay out a lump-sum to your family. This payout will cover your remaining mortgage debt so your loved ones can pay off the loan all at once.

Essentially, anyone with a mortgage needs to ask themselves if they could afford repayments if they couldn’t work due to accident, sickness, illness or injury.

If you’re considering Mortgage Life Insurance, ask yourself what’s protecting your family and their home in the event that you pass away.

Is Mortgage Insurance Compulsory?

It may feel like Mortgage Insurance is mandatory for a mortgage to be approved but that’s not the case. However, it does have a lot of benefits that make it a worthwhile protection product to consider.

- In 2017/18 555,000 British workers sustained injuries at work, with over 135,000 leading to an absence of more than 7 days.

- Every year, almost 357,000 people in the UK are diagnosed with cancer, while an estimated 2.5 million are currently living with cancer.

If you’re injured or diagnosed with a serious illness such as cancer, you may need to leave work to receive treatment, potentially depriving your household of a primary earner.

As well as the risk of not being able to work due to accident or sickness, consider what would happen if you passed away. According to the Office for National Statistics, 11.2% of people who died in the UK in 2016 were aged between 20 and 60.

Do I Need To Protect My Mortgage?

According to Drewberry’s Wealth & Protection Survey, 2 out of 5 people in the UK have no more than £1,000 in cash savings. Meanwhile, 44.9% of Brits have a mortgage and, of these, 1 in 4 still has at least £100,000 left to repay.

This would be an impossible debt for many families to repay in the event of the death of a loved one whose income contributed most to the mortgage repayments. It is why getting the right mortgage protection is such an important piece of financial planning.

While it might not be right for everyone, having some form of protection against illness or death should be a priority for homeowners – especially those with families. The right kind of protection insurance could defend against the worst, but the difficulty for most people is knowing exactly what cover meets their needs.

Do I Need Mortgage Life Insurance?

Mortgage Life Insurance is designed to pay out a lump sum to your beneficiaries to pay off the mortgage in full in the event of death or the diagnosis of a terminal illness. This usually means that your loved ones are able to stay in the home without worrying about keeping up with mortgage payments.

Do I Need Level Term or Decreasing Mortgage Life Insurance?

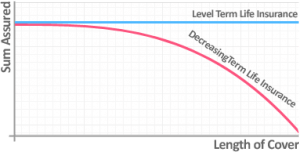

There are two types of Mortgage Life Insurance that you need to be aware of in order to find the right one for you:

- Decreasing Term Mortgage Life Insurance is a type of Life Insurance where the cover falls over time to match the decreasing value of your repayment mortgage.

- Level Mortgage Life Insurance provides level coverage throughout the entirety of your policy. It’s therefore particularly suited to interest-only mortgages, where the amount of cover you need remains fixed over time along with your outstanding mortgage balance.

They offer considerably different levels of cover, which is why it is so important that you know the difference between decreasing and level life insurance before you start shopping for policies.

Do I Need Single or Joint Mortgage Life Insurance?

If you’re living with a partner, you may also want to think about a Joint Mortgage Life Insurance policy (which is also known as Shared Mortgage Life Insurance). With this type of mortgage protection, your mortgage would be paid off in full should either of you die.

With a joint policy, if either you or your partner were to die while you have this policy, the insurer would pay out to the surviving person who would then use the payout to clear the mortgage.

Do I Need to Write My Life Insurance in Trust?

It’s not always necessary to write Life Insurance into trust as the sum is destined for the mortgage lender, so the outstanding mortgage balance on the estate negates the lump sum received from the Life Insurance.

In other instances, it may simply offer more control to write the policy into trust – the process is free and Drewberry’s specialists can facilitate it, so it might be something you want to consider regardless.

Do I Need Critical Illness Insurance for My Mortgage?

While Life Insurance plans pay out upon death or diagnosis of a terminal illness, Critical Illness Cover (CIC) will pay out if you develop a critical illness or injury.

If you have Mortgage Life Insurance with Critical Illness Cover, your plan will pay out for either death or a serious illness.

Critical Illness cover will pay out a tax-free lump sum if you are diagnosed with an illness that your insurer has specified. The three most common reasons for claiming on these policies are

- Cancer

- Heart attacks

- Strokes

Do I Need Mortgage Payment Protection?

According to our Wealth and Protection Survey, 43.8% of people said they’d rely on savings if they needed to take six months or more off work due to illness or injury. However, our survey has also found that 2 out of 5 people in the UK have no more than £1,000 in cash savings.

44.9% of British people have a mortgage and 1 out of 4 Brits still has at least £100,000 left on their mortgage.

Who Might Benefit from Mortgage Payment Protection?

If you only needed to cover your mortgage payments for a short time, Mortgage Payment Protection Insurance might be a good option. Given that it’s short-term, it tends to be among the cheaper methods of protecting your mortgage because claims are often capped to a maximum of 12-24 months.

Given the short payout length, it may not be enough to support you if you were to have a serious illness or injury that took you out of work for several years.

Income Protection Might Be A Better Option…

While Mortgage Payment Protection Insurance can kick in to keep up with your mortgage repayments if you can’t work due to accident, sickness or unemployment, it’s a short-term product. This could be problematic if you fell ill with a long-term condition.

For this reason, we generally recommend standard Accident & Sickness Insurance, also known as Income Protection Insurance, potentially alongside a standalone Unemployment policy if redundancy cover is required, as this could provide a more comprehensive protection for your circumstances.

- MPPI is usually cheaper than Income Protection

As MPPI offers short-term and generally more limited cover compared to Income Protection, it’s usually tends to be the cheaper option of the two - Mortgage Payment Protection Insurance offers short-term cover

MPPI usually pays out for a maximum of either 12 or 24 months - Income Protection can provide long-term cover

The best plans let you pre-define when you want the policy to end, often aligned with your retirement age - MPPI ends when your mortgage does

Given it’s linked to your mortgage, it ends when you’ve paid off your mortgage, whereas the best Income Protection policies will cover you up until retirement - Mortgage payment protection only covers your mortgage

While some plans will cover up to 125% of your monthly mortgage repayments, this only provides cover for your mortgage and very limited other expenses, whereas Income Protection is linked to a percentage of your income - Mortgage Payment Protection often has reviewable premiums

With reviewable premiums, insurers are entitled to review your premiums annually, which may lead to significant increases - Income Protection offers guaranteed premiums as an option

For those eligible, opting for guaranteed premiums fixes the monthly cost of your cover for the life of the policy. - Better Income Protection policies have superior incapacity definitions

We generally only recommends own occupation Income Protection so the policy will pay out if you can’t do your specific job, it is important to watch out for inferior definitions such as ‘suited occupation’.

Specialist Advice Comparing Mortgage Insurance Quotes

When looking for the right Mortgage Insurance policy, there are a few things that you can look out for:

- Insurer claims data for Life Insurance and Critical Illness Cover (if the latter is applicable)

- If your policy has any exclusions

- ABI-approved definitions for CIC

- How easy your policy is to understand

- The notification period for claims

- Any added extras and benefits.

Why not use our Mortgage Insurance Calculator to compare the best UK insurers.

Once you’ve run your Mortgage Insurance quotes, you’ll have our specialist advisers on hand to help you along the way, including advising you on the right policy, the right amount of cover, and how to tailor your policy to give maximum protection for minimal cost.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4077 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

At Drewberry, we help our clients secure and protect potentially the most important investment in their life – their homes.

If you’re in need of advice just pop us a call on 01273646484 or email help@drewberry.co.uk.

- Topics

- Mortgage Insurance

Contact Us

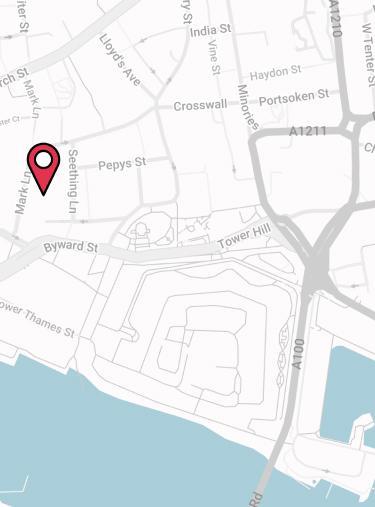

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.