Getting Critical Illness Cover With Diabetes

Whether you can get Critical Illness Cover with diabetes will depend on a number of factors. One of these being the type of diabetes you have.

- Type 1 Diabetes – typically diagnosed at childhood when the pancreas does not produce enough insulin

- Type 2 Diabetes – is diagnosed as a middle aged adult usually with high blood pressure and cholesterol.

Unfortunately if you have Type 1 Diabetes the likelihood is that you won’t be able to get cover. However if you have well controlled Type 2 Diabetes with no complications you do have more options.

The cover you get will depend on the insurer you go to. This is because they will all take a different stance on Diabetes. Some will increase your premiums due to you being higher risk. Others may just exclude Diabetes and related conditions all together.

What Does Critical Illness Insurance Cover?

Critical Illness Cover will pay you a lump sum if you suffer a severe illness such as cancer, heart attack, stroke or motor-neurone disease. It is designed to pay off your mortgage or provide a lump sum to you or your family to spend how you please.

Need Specialist Help?

Each individuals case will be different when it comes to taking out cover. Because of this it’s always a good idea to get specialist advice.

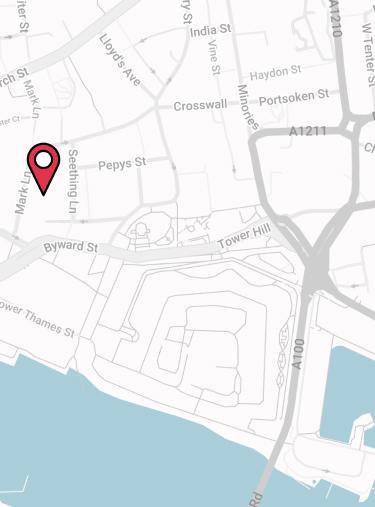

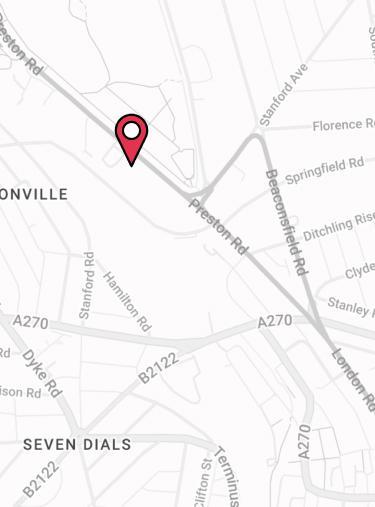

The team at Drewberry has a wealth of experience when it comes to dealing with various different medical disclosures. This experience can really help you refine which insurers to look at, to make sure you go with one that will look after you and your particular needs.

Don’t hesitate to get in touch, give us a call on 02084327333 or email us on help@drewberry.co.uk.

Watch Our FAQ Video

Wondering whether you can get Critical Illness Cover if you have diabetes? We’ve got Drewberry’s Independent Protection Specialist, Alex Weir, to give you a quick, clear answer 👇

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.