87% of Brits Wanting to Pass Down Assets Haven’t Considered Inheritance Tax

The Treasury’s Inheritance Tax take hit a new record of £4.7bn in the 2016/17 tax year and is projected to rise by a further third by 2022. Despite this, most working Britons haven’t the first idea about their potential inheritance tax liability according to Drewberry Wealth & Protection Survey 2017.

Neil Adams

Head of Financial Planning at Drewberry

- Over 39% of working Britons describe leaving some measure of wealth to their loved ones as a priority – yet only 13% of these people have done anything to assess if they could have an IHT liability

- Meanwhile, 42% say it ‘would be nice’ to leave assets but it’s ‘no priority’ while 16% don’t expect to have anything left to leave!

- Less than 3% of Britons ‘don’t intend’ to leave their loved ones anything

- 39% of Britons have £1,000 or less in cash savings while 42% have over £1,000 in debt.

- Over 1 in 4 Britons (26%) has more than £5,000 in non-mortgage debt.

- 60% of working Britons have no idea which of their assets will attract inheritance tax when they die

- Meanwhile, 87% mistakenly think their pension savings will attract inheritance tax; 12% wrongly believe their house will be IHT-free with around 10% mistakenly believing that cash and ISA savings are both exempt from inheritance tax

- 30% of working Britons expect to inherit £50,000 or more from older relatives during the course of their lives. Despite the UK’s racing property prices, just 3.7% of those surveyed expect to inherit assets in excess of £400,000.

Inheritance Tax and Your Home: Coming to a House Like Yours

Our new Wealth & Protection Survey found that half of Brits are ‘just about managing or worse’ when it comes to their personal finances. In this environment, it’s clear that people are sacrificing savings, pensions and Life Insurance to make ends meet, yet despite this it’s clear that the average Briton is still managing to accumulate significant wealth over their lifetimes.

Tom Conner

Director at Drewberry

How Much Are You Expecting to Inherit from Older Relatives?

In terms of expectations, those in their 40s and 50s currently expect to inherit most with 20% of these cohorts expecting to inherit over £100,000 during their lifetimes. Some 17% of under-30s expect to inherit this much, compared to only 13% of 30-somethings.

“We believe these estimates from British workers to be relatively conservative given our expectations of long-term property appreciation and stock market growth,” says Tom.

“This suggests that the record levels of inheritance now being collected by HMRC are likely to continue for some time, regardless of the new residential allowance that came into force this year.

Inheritance Tax Advice Can Save a Fortune

“The point is,” stresses Tom, “that inheritance tax is no longer just for the ‘Downton Abbey Set’. The 2016/17-tax year saw 45,000 UK households hit with IHT bills and this number is set to rise even with the introduction of a new residential nil-rate band. Inevitably, many families will find it’s well worth paying out for good financial advice.”

There are a host of simple planning measures that can save a fortune in inheritance tax such as getting your Will in order, keeping funds IHT safe in your pension, moving your ISAs to IHT-free options or just giving away your excess assets while you’ve still got at least seven more years on the clock.

All can help with a potential IHT liability, so it’s worth looking into all your options.

“Essentially, anyone who keeps their head in the sand from here may as well include a cheque to the taxman when they come to write their will,” says Drewberry Director Tom Conner.

What Are Your Opinions on Leaving Assets to Your Children?

Inheritance tax is a deeply nuanced area, so to help working Britons get to grips with their potential IHT bills, Drewberry created its Inheritance Tax Calculator. This does all the heavy lifting for you and was the first online tool to include the new main residence nil-rate band introduced in 2017. Alternatively you could just get in touch – feel free to pop us a call any time on 02084327333.

Jonathan Cooper

Senior Paraplanner at Drewberry

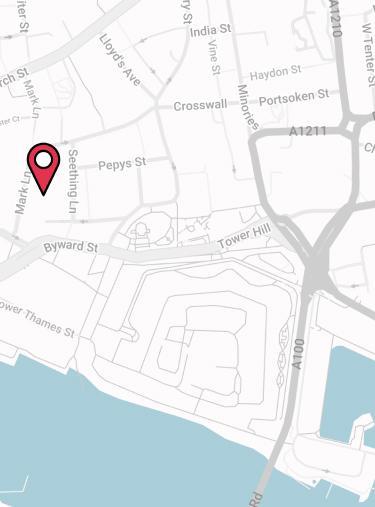

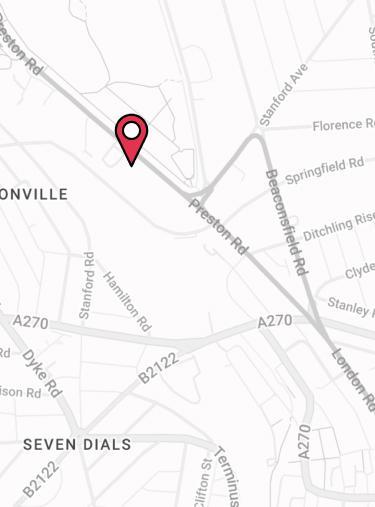

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.