What Does Mortgage Protection Insurance Cover?

Mortgage Life Insurance

Quote

Receive an upfront cash lump sum for your loved ones to pay off the mortgage in full should you pass away during the term of your mortgage

Get My Instant Quotes

Mortgage Payment Protection

Quote

Receive an income to cover your monthly mortgage repayments should you be unable to work due toaccident, sickness or unemployment

Get My Instant QuotesPaying off your mortgage is something that can take a lifetime. Yet over the length of your loan, you could face a number of misfortunes that prevent you from repaying your loan in full.

To protect your mortgage against the various risks life could throw at you, there are two types of Mortgage Insurance:

- Mortgage Payment Protection Insurance (Mortgage PPI)

Mortgage PPI steps in if you find yourself without an income due to accident, sickness or (potentially) unemployment and can’t meet your mortgage payments. - Mortgage Life Insurance

Mortgage Life Insurance covers your family if you die before repaying your mortgage by repaying your entire loan if you pass away, allowing your loved ones to remain in the family home after you’re gone.

Although each product is a branch of Mortgage Insurance, Mortgage Life Insurance and Mortgage Payment Protection Insurance each cover two very different risks.

Mortgage PPI will temporarily step in (usually for a maximum of 24 months) to cover your monthly mortgage payments in case sickness, injury or redundancy prevents you working. Meanwhile, Life Insurance repays your whole loan for you if you pass away.

What Does Mortgage Payment Protection Insurance Cover?

MPPI is a specific Mortgage Insurance plan designed to protect your mortgage against you being out of work due to to three main risks:

- Accidents / injuries

In 2023/24, the Health and Safety Executive (HSE) reported that 127,000 workers received non-fatal injuries on the job that required at least seven days off work to recover - Sickness / illness

Cancer Research UK reports that nearly 1 in 2 people born after 1961 will develop cancer at some point in their life, while the British Heart Foundation reports that someone suffers a heart attack every five minutes in the UK - Unemployment

As of September 2025, the Office for National Statistics put the UK unemployment rate at 4.7% between May and July 2025.

The three different elements of Mortgage PPI are sometimes combined in a single product. In this instance, you may find it referred to as Mortgage Accident, Sickness & Unemployment cover.

If you’re off work due to an accident or injury – or redundancy, depending on your policy and your employment circumstances – it can cover your mortgage payments in the short-term until you can return to work.

This will last until you’re either back in work or your claim has ‘used up’ the policy (i.e. exceeded the maximum permitted claim length, which is usually 12 or 24 months).

What Are My Mortgage Payment Protection Options?

The maximum benefit that you can insure with Mortgage Accident, Sickness and Unemployment (ASU) cover is typically capped at a maximum of 125% of your mortgage. Mortgage Payment Insurance policies generally pay out for an absolute maximum of 24 months.

Accident, Sickness and Unemployment Cover

MPPI plans often combine unemployment with illness and injury, which provides protection for your mortgage against both kinds of risks.

Accident and Sickness Cover

You can choose Accident and Sickness cover exclusively, which may well be a better option for the self-employed, who would struggle to claim on an unemployment policy.

Unemployment Insurance

In the same way that you can opt only for Accident and Sickness cover, you can also tailor your Mortgage Protection plan to cover only unemployment.

Is Anything Excluded by Mortgage Payment Insurance?

If you’re self-employed, you probably won’t be able to claim on the unemployment element of the policy. This is because, even if you have no work coming in, you’re still technically employed by yourself.

The same can be said if you work through your own limited company and lose a major contract. As you’re still technically employed, you’ll likely find it difficult to make a successful claim with the insurer for unemployment.

Other areas not covered by Mortgage PPI include

- Dismissal due to poor performance or gross negligence

- Voluntary redundancy / unemployment (with the exception of leaving work to become a carer)

- The natural end of seasonal or contract work

- Unemployment if you had knowledge of redundancy risk before taking out the plan

- Sickness due to pre-existing medical conditions

- Self-inflicted injuries.

Mortgage Payment Protection or Income Protection Insurance?

Depending on your needs and circumstances, you may find that Income Protection Insurance is a potential alternative to Mortgage Payment Protection. Like MPPI, Income Protection pays you a benefit each month if you’re out of work due to illness or injury.

The benefit you’ll receive from Income Protection, however, is determined by your income and not linked to the cost of your mortgage.

Typically, the amount of cover you receive from Income Protection is between 50% and up to around 70% of your monthly income. This means it can stretch to cover more of your daily expenses, such as bills and other costs over and above your mortgage.

Find out more about the difference between Income Protection and Payment Protection.

What Does Mortgage Life Insurance Cover?

Mortgage Life Insurance is designed to pay out a lump sum upon death to repay your remaining mortgage.

It protects your loved ones from the risk of being evicted from the family home because they can’t afford to keep up with the mortgage after the dip in household income caused by a death in the family.

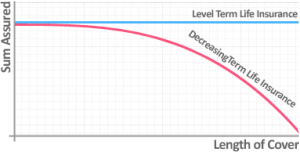

There are two types of Mortgage Life Insurance: Level Mortgage Insurance and Decreasing Mortgage Insurance.

Level Life Cover

Level Term Mortgage Life Insurance is a Life Insurance policy where the amount of cover remains level over the term of the policy.

Level term plans are usually used to cover an interest-only mortgage loan. With these mortgages, you don’t repay any of the borrowed capital until the end of the loan and so need a level benefit to ensure your mortgage can always be paid off.

These types of Mortgage Life Insurance plans are usually more expensive because even as your risk of claiming on your policy goes up in line with your age, your benefit stays the same.

Decreasing Life Cover

Decreasing Term Mortgage Life Insurance sees the amount life cover you receive decrease over time.

Decreasing term plans tend to be better for covering capital / principal repayment mortgages as the benefit falls alongside the outstanding debt.

This type of cover is often cheaper than level cover because the amount you’ll receive falls over time.

However, one of the risks of Decreasing Term Life Insurance is that your benefit decreases at a rate that exceeds your mortgage interest rate.

Mortgage Insurance interest rates are typically set at between 8% and 10% to ensure this doesn’t happen. If it does, your Mortgage Life Insurance policy wouldn’t be large enough to pay off the loan in full.

Mortgage Life Insurance Exclusions

Mortgage Life Insurance typically covers all causes of death. However, death as a result of self-inflicted injuries is generally excluded until you’ve held the policy for 12 months.

Life Insurance often includes Terminal Illness Benefit as standard, which means the policy pays out early if you’re diagnosed with a condition that means you have less than 12 months to live.

However, if those 12 months you’ve been given to live are in the last year of the Mortgage Life Insurance policy, you usually won’t get the early pay out.

Crucially, the biggest thing Mortgage Life Insurance may not cover is death as a result of undisclosed pre-existing condition. That’s why we ask you to be as open and honest during the application as possible so all the cards are on the table from the start. Even if you’re not sure whether it’s relevant, it’s best to declare it anyway just to be safe.

What Are My Mortgage Life Insurance Options?

You have a few options when it comes to taking out a Mortgage Life Insurance policy. An independent adviser can help you find the right fit for your needs.

Including Critical Illness Cover

When taking out Mortgage Life Cover it is possible to add Critical Illness Cover to your Life plan. Combining the two means your plan will pay out on death or if you were to suffer a serious illness / injury as listed in the policy terms.

Mortgage Life Insurance with Critical Illness Insurance covers anywhere between 40 to over 100 specific critical illnesses depending on your insurer. Common conditions include heart attack, stroke, cancer, Parkinson’s disease and multiple sclerosis.

Critical Illness plans also cover certain types of physical disabilities, including total permanent loss of vision or the loss of a limb.

What’s Not Covered By Critical Illness Insurance?

It is also important to note that the insurer will assess the severity of your condition at claim stage. It’s sometimes the case that minor forms of the conditions that are covered by Critical Illness Insurance would not trigger a payout.

Joint or Single Mortgage Life Insurance

Most couples purchase a home together, so they’ll have to decide whether it’s best to purchase Joint Mortgage Life Insurance or Individual Mortgage Life Insurance.

With Joint Mortgage Life Insurance, you and your partner pay the premiums together and the policy covers both of you. However, the drawback is that Joint Mortgage Life Insurance only pays out once – most commonly on a joint life first deathbasis.

This means the policy pays out once, on the death of the first partner, after which the policy ends. The remaining person is left without any Life Insurance, which they may still want even though their mortgage is paid off and which is more expensive to set-up the older you are.

Another problem with Joint Life Insurance is that divorce can complicate things. While some insurers will allow you to split your joint policy into two single policies if you divorce, others won’t.

This, again, means that you will need to reapply for Life Insurance later on in life.

Two Single Mortgage Life Insurance policies will initially be slightly more expensive than a joint policy.

However, it’s not usually a large increase in premium. What’s more, doing it this way ensures you secure double the benefit because both partners receive a payout.

Samantha Haffenden-Angear

Independent Protection Specialist

Get Mortgage Insurance Advice and Compare Quotes

Taking out a mortgage is a big commitment which needs protecting. But with the help of the specialists at Drewberry, you’ll discover the important details of the different Mortgage Protection Insurance policies and find the right protection for your family and your home.

For fee-free advice and help finding the most suitable policy, call 02084327333, email help@drewberry.co.uk, or compare Mortgage Life Insurance quotes / Mortgage Payment Protection quotes.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4074 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

- Topics

- Mortgage Insurance

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.