Level or Decreasing Term Mortgage Life Insurance?

There are two types of Mortgage Life Insurance that you can choose from, both of which are tailored to suit different types of mortgages.

- Level Term Mortgage Life Insurance

Has a level of cover which remains fixed over time and is therefore best-suited to cover interest-only mortgage loans. - Decreasing Term Mortgage Life Insurance

Is designed to cover capital / principal repayment mortgages, where your Life Insurance sum assured falls over time along with your mortgage.

Both of these types of policies have benefits and drawbacks that make them more or less suitable for certain people and situations.

As such, you will need to think carefully about whether you need Level or Decreasing cover to protect your mortgage.

- Term Mortgage Life Insurance will pay out a lump sum to your loved ones in the event of your death. It’s referred to as ‘term’ insurance because it’s usually set to match the fixed term of your mortgage.

- Provides peace of mind knowing your loved ones can remain in the family home should the worst happen.

- Include Critical Illness Cover to protect against the risk of serious illnesses such as cancers, hearts attacks and strokes.

People turn to Life Insurance because their mortgage is one of their largest financial commitments and many worry about what would happen to the debt, their family and their home if they passed away before they could pay off the loan.

What is Decreasing Term Mortgage Life Insurance?

As the name suggests, Decreasing Term Mortgage Life Insurance is a type of insurance that decreases over time alongside a capital / principal repayment mortgage loan.

How Does It Work?

As you repay your mortgage, the amount that you are covered for decreases each year, eventually to zero like the mortgage balance, and your policy ends.

Given that the outstanding balance of your mortgage decreases over time, it makes sense that the amount that you have it insured for decreases as well. Otherwise, you may be paying more than necessary for cover over and above the mortgage that you don’t need.

The Pros and Cons of Decreasing Cover

Pros

| Cons

|

|---|---|

Cheaper than Level Term Mortgage Insurance | If your benefit decreases faster rate than your mortgage’s interest rate, you could be left with a shortfall at claim. |

Matches the value of your mortgage debt as it decreases | Typically covers only the mortgage only and won’t pay out more to cover other debts or expenses. |

A decreasing policy that falls alongside your mortgage means you don’t have to pay for extra cover on top | There will not usually be much if any lump sum left over after repaying the mortgage for your family |

Decreasing Term policies are likely to be the less expensive that Level Term cover because your level of cover decreases over time in line with your mortgage.

One issue you may have with this type of mortgage protection policy is that it will not provide your loved ones with any financial support aside from paying off you mortgage.

If you miss any mortgage payments or your Life Insurance policy decreases at a rate that exceeds the interest rate of your mortgage, there is also a possibility that your policy’s payout won’t cover your mortgage debt in full.

Do I Need Reducing Mortgage Life Insurance?

If you have a capital / principal repayment mortgage, decreasing term life insurance would likely be the best mortgage protection product for you.

It will provide you with the right amount of cover to pay off your mortgage, reducing over time to match your repayment mortgage.

However, Decreasing Term Life Insurance isn’t the best option if you want to leave a lump sum behind over and above your outstanding mortgage.

If you want to cover your mortgage as well as financially support your loved ones, you may need to look at other Life Insurance options, including Level Term Life Insurance, which provides a fixed payout across the policy’s term or Family Income Benefit which provides a regular income.

What is Level Term Mortgage Life Insurance

Level Term Mortgage Life Insurance is designed to pay out a fixed benefit, so it will pay out the same amount in year one of the policy as in the policy’s final year.

As such, it’s typically used to cover interest-only mortgages, where the amount of capital you owe the mortgage lender doesn’t shrink over time because you’re only repaying the interest.

How Does Level Term Life Insurance Work?

The level of cover your policy offers will typically be set to be equal to your mortgage debt to ensure that your insurance will cover the entire cost of your mortgage. Similarly, the length of cover is also set to last as long as your mortgage loan.

If you were to pass away before you managed to pay off your mortgage, your loved ones would use the payout from your insurance policy to pay off your mortgage in full and avoid having to give up their home.

Advantages and Disadvantages of Level Term Cover

Pros

| Cons

|

|---|---|

Fixed cover for the life of the policy | More expensive as the amount stays fixed even as the risk of you claiming increases with age |

A fixed benefit can leave an additional lump sum behind for your family after repaying the mortgage | If used for a decreasing mortgage, the amount you’ll receive above the mortgage balance in the first years of the policy will be vastly lower than that you’d receive in the last years |

Possible to index-link your benefit so that it doesn’t get eroded by inflation | If you choose not to index-link your policy, the benefit could be worth less in real (i.e. in inflation-adjusted terms) when you come to claim |

One of the most appealing aspects of a Level Term Mortgage Insurance policy is that your insurance coverage is guaranteed and won’t change. This means that you won’t be at risk of your insurance payout falling short of covering your debt.

By taking out insurance over and above your outstanding debt, you have the benefit of providing your loved ones with additional financial support on top of covering your mortgage.

What’s left of your Life Insurance payout after paying off the mortgage can be put towards other financial burdens, like bills and everyday expenses.

Do I Need Level Term Mortgage Life Insurance?

Level Term Mortgage Life Insurance is available for any type of mortgage but it’s usually used to cover interest-only mortgages. This is because interest-only mortgages require you to pay off the loan interest regularly but outstanding capital remains fixed.

It is possible to take out Level Term Mortgage Insurance with other types of mortgages, but it may not always be the most cost effective option.

Level or Decreasing Term Mortgage Life Insurance?

The choice that you make between Level and Decreasing Mortgage Term Insurance depends predominantly on the following factors:

- The type of mortgage loan you have

- What you want to protect with your insurance policy.

As well as choosing between Level or Decreasing Mortgage Insurance, you’ll need to think about the different options these policies provide.

This can include everything from adding Critical Illness Cover to whether Joint Mortgage Insurance is right for you and your partner.

Get Specialist Mortgage Insurance Advice

We are here to make sure you clearly understand clearly your insurance options and are able to make an informed decision when it comes to protecting your mortgage.

Why Speak To Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4078 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

If it is all getting a little confusing and you need some guidance please don’t hesitate to get in touch.

Pop us a call on 02084327333 or email help@drewberry.co.uk.

Tom Conner

Director at Drewberry

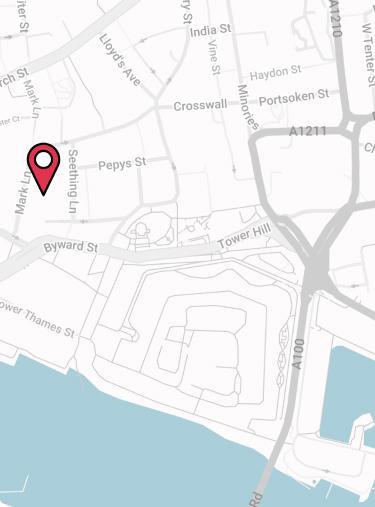

Contact Us

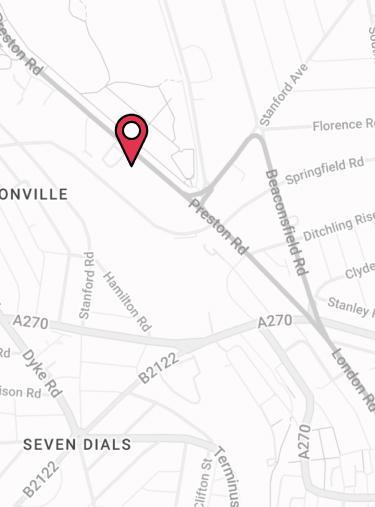

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.