It is important make sure you have the right form of protection as there are two main forms of Mortgage Insurance advice we provide:

- Mortgage Payment Protection Insurance

Temporarily pays out monthly benefits to cover the cost of your mortgage payments if you are unable to work due to accident or sickness.

- Mortgage Life Insurance

Pays out a lump sum in the event of death that will cover the total remaining mortgage debt, allowing loved ones to pay off the mortgage all at once.

Missing your mortgage repayments due to ill health or death could put you and your loved ones at risk of losing your home. That is why many people want to make sure they have adequate Mortgage Insurance in place should something happen to them.

Is Mortgage Insurance Compulsory?

This said, no Mortgage Insurance is compulsory. Taking out a mortgage without insurance is absolutely possible.

However, there are a lot of benefits to Mortgage Protection that could save you and your loved ones from losing your home if the worst were to one day happen.

- Would your loved ones cope financially if you became too ill or injured to work, or worst still passed away?

- Could they cover the mortgage and any other financial obligations such as council tax, utilities and other general living costs without you?

Do I Need Mortgage Insurance?

A mortgage can take a lifetime to pay off and missing your mortgage payments can have severe consequences, resulting in increased interest rates, additional fines, or even losing your home altogether.

For these reasons, Mortgage Protection Insurance can be a valuable safety net to prevent the worst from happening

If any of these factors got in the way of you paying your mortgage, how would you / your family cope?

While some people may be capable of using their savings to keep up with their mortgage payments, that may not be a viable option for everyone.

What are the Different Types of Mortgage Protection?

There are two different types of Mortgage Protection Insurance, one will cover your mortgage repayments if you are too ill injured to work while the other will pay off your mortgage in full if you were to die.

Mortgage Payment Protection Insurance

Mortgage Payment Protection is designed to protect your monthly mortgage payments. If you become too ill to work or injure yourself, you can claim on your policy and begin receiving monthly benefits for a limited period.

These benefits will cover the cost of your monthly mortgage payments and, depending on your policy, give you a little bit to spare to help you afford other expenses while you are out of work.

- Step 1

You take out a policy that insures you for the value of your monthly mortgage payments.

- Step 2

You fall ill or are injured and become unable to work or earn an income.

- Step 3

You provide the necessary paperwork to make a claim with your insurer including evidence you are unable to work.

- Step 4

After your deferred / excess period, your insurer begins paying monthly benefits to cover your mortgage payments.

- Step 5

You can continue claiming until you are well enough to return to work or until you reach the end of your claim period (typically between 12 and 24 months).

Mortgage Life Insurance

Mortgage Life Insurance is designed to take care of your mortgage and provide financial support for your loved ones if you were to pass away.

Upon your death, your loved ones would be able to claim a lump sum equivalent to or more than the cost of your mortgage. This is then used to pay off your remaining mortgage debt and ensure that your loved ones can afford to stay in their home.

- Step 1

Purchase Mortgage Life Insurance policy for the value of your mortgage debt

- Step 2

You pass away

- Step 3

Your loved ones present a death certificate to the insurer and make a claim

- Step 4

The insurer pays out a tax-free cash lump sum of equal if not greater value than your mortgage.

- Step 5

Your loved ones use the insurance payout to pay off the remaining mortgage debt.

- Step 6

Any of the payout that is left over can be used to cover other expenses, such as funeral costs or general monthly expenditure.

How Much Does Mortgage Insurance Cost?

The cost of Mortgage Insurance is impossible to say for sure due to the vast array of options that are available. Your unique circumstances and the insurer you choose for your policy will both have an impact on your monthly premium.

We’ve put together some example prices of Mortgage Insurance for an individual of three different ages in the table below.

Given that Mortgage Payment Protection and Mortgage Life Insurance are designed to do two very different things, the cost of them is very different.

Mortgage Payment Protection

To provide example costs of mortgage payment protection insurance we’ve assumed:

- The individual is healthy

- They’re a non-smoker

- They’re an office worker

- They want a 4 week deferral period

- They’re looking for £1,000 a month of cover to protect their mortgage.

Mortgage Life Insurance

To provide example costs of Mortgagee Life Insurance, we’ve assumed:

- The individual is healthy

- They’re a non-smoker

- They’re an office worker

- They’re looking for £250,000 worth of cover decreasing over 25 years.

Is Mortgage PPI the Same as Income Protection?

While Mortgage Payment Protection insures your mortgage payments, Income Protection insures your income.

Typically, Mortgage PPI would cover the cost of your monthly mortgage payments, while cover for Income Protection can cover as much as 65% of your typical monthly earnings.

Income Protection is sometimes seen as more comprehensive than Mortgage Payment Insurance because of its more robust definitions of incapacity and the fact that it’s medically underwritten from the outset.

If you want to make sure that you have a means of meeting your mortgage payments if you need time off of work, it’s often a better option to choose Income Protection over Mortgage Payment Insurance.

This is because Income Protection uses an Own Occupation definition of incapacity rather than Suited Occupation, which is what most PPI policies tend to use.

With Income Protection, your claim will be accepted as long as you are unable to perform your duties in your current occupation. Most PPI policies, however, won’t allow you to claim if they think that you are still capable of performing at a job that is suited to your skill set or qualifications.

To discuss whether Mortgage Payment Protection or Income Protection is better for your circumstances, speak to an adviser.

Should I Have My Mortgage Life Insurance Written in Trust?

We usually advise that you have your Life Insurance policies written in trust as a precaution. By writing your Mortgage Life Insurance policy into trust, you can avoid having your payout affected by inheritance tax.

Writing your policy in trust will also ensure that your loved ones receive the payout of your policy as soon as they need it.

Without being written in trust, your insurance payout will have to go through probate before it can be given to your beneficiaries, which can take as long as 6 months.

Should I Get Joint Mortgage Protection Insurance?

Joint Mortgage Insurance can save you and your partner money if you want to insure both of you, however it does come with its issues.

Joint Life, first death policies will only pay out once when the first partner dies, leaving the surviving partner without any Life Insurance cover after the mortgage has been paid off.

With Joint Mortgage Payment Protection, each partner will usually only be insured for 50% of the mortgage. It is possible to adjust this if one partner is paying more for the mortgage, but you will need to take out a separate policy if you want to be insured for the full value of your mortgage each.

Should I Add Critical Illness Cover to My Mortgage Life Insurance?

While Critical Illness Cover is a valuable type of protection, it doesn’t offer a great amount of protection if you fall ill or injure yourself in a way that is not recognised by your insurer as ‘critical’.

In addition, Mortgage Life Insurance with Critical Illness policies will only pay out once for either critical illness or death, which means if you claim for a critical illness with this policy you lose your Life Insurance cover and the policy will terminate.

If you’re looking for comprehensive sickness insurance to protect yourself and your mortgage, a better option than adding Critical Illness Cover to your Life Insurance may be Income Protection, but this will of course depend on your circumstances and is best discussed with an adviser.

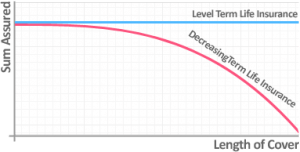

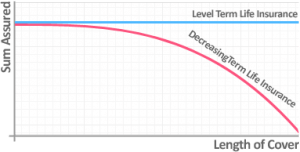

Which Type of Life Insurance is Right for my Mortgage?

Level Term Mortgage Life Insurance is designed to protect an interest-only mortgage.

With a Level Term policy, the payout of your Life Insurance policy will always stay at the same value.

No matter when you or your loved ones claim on your policy, the payout will always be the same, leaving you with a consistent amount of cover to reflect the fact that your mortgage balance doesn’t decline over time with an interest-only mortgage.

Decreasing Term Mortgage Life Insurance is designed to protect capital / principal repayment mortgages.

As you regularly pay off portions of your mortgage debt, the payout you will receive from your Life Insurance also falls to reflect your reducing mortgage balance. It’s the more cost-effective of the two types of Life Insurance as the amount you’ll receive in a payout falls over time.

Need Help? Get Mortgage Insurance Advice

There is a lot that you need to decide on when you purchase Mortgage Protection Insurance and the right decision is not always clear.

Our specialists are here to help you find the most suitable cover to protect your home and your loved ones.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4075 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

If it is all getting a little confusing and you need some Mortgage Insurance advice then please do not hesitate to get in touch.

Pop us a call on 02084327333 or email us at help@drewberry.co.uk.