We Offered Our Team a Health MOT… Here’s Why You Should, Too

Square Health is one of the leading providers of tech-focused healthcare and medical solutions for the insurance industry and works with a numbers of providers to offer policyholders access to the Square Health’s services.

As an advice firm recommending products to our clients that include Square Health’s benefits, it made sense for us to trial these firsthand. Moreover, arranging a screening for our own employees gave us a great opportunity for the staff to better understand their own health and wellbeing.

The importance of employee wellness is increasingly recognised by more businesses through a whole range of initiatives. In light of this, corporate health screenings can be a great starting point to empower workers to better understand and manage their health.

What is a Business Health Screening?

The health screenings carried out by Square Health are extremely thorough and delve into the full medical profile of the individual. A qualified nurse conducts the screening, with checks including:

- Full blood profile

- Urinalysis

- Body mass index

- Overview of past and present health issues.

With an average employee age at Drewberry of around 31 we have a relatively young work force who tend to assume they’re fighting fit and in decent health, especially given that most are regular gym-goers. However, just because you’re not actively ill doesn’t always mean you’re in perfect health.

Interestingly, the results did throw up a number of issues and whilst thankfully no one was at ‘death’s door’, there were some raised blood pressures and cholesterol readings, high blood sugar levels in a couple of cases and even other abnormalities that will require some lifestyle adjustment. There may be a review of the office cake and biscuit policy as well!

Why Provide an Employee Health Assessment?

With the UK sickness absence rate steadily falling but presenteeism on the rise, the impact of sick employees being at work but unproductive due to ill health has a very real detrimental effect on businesses.

According to a 2018 CIPD / Simplyhealth Health and Well-being at Work Survey, presenteeism has more than tripled since 2010. The impact of presenteeism has been the subject of several reports over the years, particularly looking at the possible correlation with the UK’s poor productivity.

There are a number of ways businesses can tackle employee ill-health and promote workplace wellbeing, from simply providing communal fruit and healthy snacks or more innovative solutions such as office yoga.

As a business this also allows us to identify ways of helping employees improve their health, be it arranging team sport activity days or just encouraging staff to take time away from their desk and have regular breaks.

Square Health are one of a number of suppliers of corporate health screening solutions; businesses may also find a range of services on offer through employee benefits policies such as Group Income Protection or Group Critical Illness Insurance, who may give workers access to employee assistance programs offering preventative healthcare measures.

Such measures often bundled with an employee benefits programs might include:

- Access to helplines for advice on mental health problems and stress

- Occupational therapy / physiotherapy for those diagnosed with musculoskeletal issues (a key reason behind sickness absence)

- Discounted gym memberships.

Providing a health screening can allow you as an employer to get in front of employee health problems and potential absences before they happen as it provides an understanding of future health risks. You can be more proactive in encouraging mitigating or preventative action if any health problems, or preclusions to health problems, crop up on the screenings.

It also increases employee engagement and satisfaction — the corporate health screening day created a real buzz in the office and was a great opportunity for staff to think about their own health and wellbeing and begin to take steps to make improvements.

Drewberry would encourage any company to consider this for their staff as we firmly believe it can have a very positive effect on employee wellbeing and wider health engagement.

About Drewberry

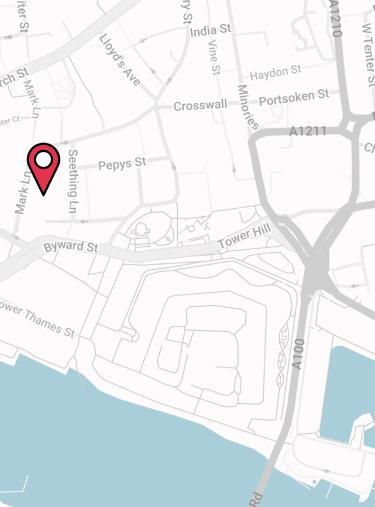

Our goal is simple: to improve our clients’ financial wellbeing.

We help our clients take control of their finances by building lasting relationships where we support them to make informed decisions.

We provide financial advice services to individuals and businesses throughout the UK. Whether it’s setting up personal insurance to protect your lifestyle, managing your pensions, investments and other assets to improve your financial future or setting up employee benefits for a company, we’re here to help.

- Topics

- Business Owner

Contact Us

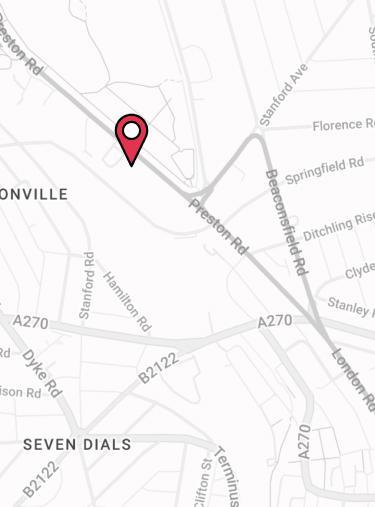

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.