When PPI Provides a Solid Form of Protection

Payment protection insurance (PPI) has had a great deal of negative press over the previous year but this doesn’t mean to say the product isn’t of significant value to many individuals and households throughout the UK.

Even though consumers are somewhat apprehensive about taking out PPI currently, the demand for this type of insurance cover is as strong as ever as individuals look to protect themselves in the current economic climate.

Most of criticism of PPI has come from reports of mis-selling (where the cover isn’t appropriate) and the recent rate rises seen.

It is vitally important to run through your cover requirements and situation with a trained adviser to ensure this type of protection is appropriate. Most of the rate rises over the past year have been due to the large increase in unemployment seen in the UK.

PPI needs to be considered

With new rules restricting the promotion and sale of payment protection by lenders at the point of sale there is a real risk that many consumers will fail to consider this cover. Overlooking this safety net when taking out a loan could have serious consequences down the road if the loan holder has to take time of work due to accident, sickness or unemployment.

It is possible that the continued demand for PPI policies stems from the continuous media reports of government spending cuts proposed by the Conservative government, with a large potential impact on UK jobs.

As the government freely admits, the reduction in the budget deficit will be painful for all and projections of employment have come down since their planned cuts have been published.

Making sure PPI is appropriate

PPI isn’t right for everyone so it is really important to speak to an independent adviser to ensure you are eligible for the policy. It is vital to understand the cover provided and what is excluded.

Despite the bad press received, PPI can provide a valuable safety net to most individuals. The cover is really designed for individuals and couples who work full-time on a permanent contract basis.

Most of the confusion has stemmed from the fact that there are significant restrictions if you are self-employed or work on a fixed term contract. It is also very important to note that the accident and sickness side of the policy will not usually cover pre-existing medical conditions.

The most common type of PPI is mortgage payment protection insurance (MPPI) which covers monthly mortgage loan repayments. With this type of cover it is vital to note that it is designed to cover your permanent/primary residence and not a second or holiday home.

- Topics

- Mortgage Insurance

Contact Us

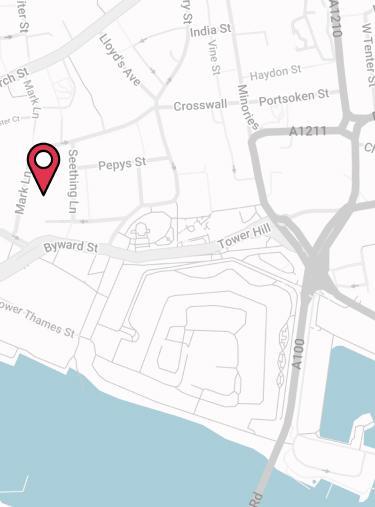

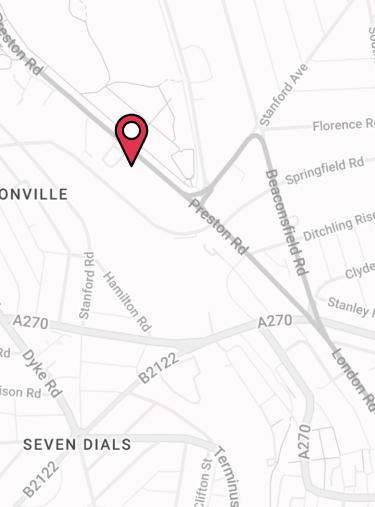

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.