If you’re looking for Private Health Insurance with the highest level of cover, you’re in the right place. Comprehensive Health Insurance includes inpatient and outpatient coverage, and various services in between.

Most UK providers offer several cover options, and comprehensive policies sit right at the top. This guide to Comprehensive Health Insurance has all you need to know about buying a policy, including how it works, the costs, and what it covers.

What Is Comprehensive Health Insurance?

Comprehensive Health Insurance provides private healthcare in private facilities in the UK. These policies give you the highest level of health coverage. Your policy will include:

- Inpatient and day-patient care

- Outpatient care, such as diagnostic testing and consultations

- An extensive hospital list

- A range of additional services, such as virtual GPs

- Access to drugs and treatments the NHS doesn’t provide due to cost.

A Comprehensive Health policy is the best Private Health Insurance available. You can skip long NHS waiting lists and get the treatment you need. It offers peace of mind, as you know you’ve got cover in place should you need it for healthcare.

Why Is It Important?

In a time where the NHS is under pressure, Comprehensive Health Insurance speeds up the process of getting treatment. From diagnostic tests to high-quality care, a policy provides peace of mind and reassurance.

You can’t predict the future, so you never know when you may need to access healthcare. But one thing is for sure, you don’t want to be waiting around if you’re not feeling well.

This is where Comprehensive Health Insurance makes a world of difference. It will allow you to get high quality treatment, fast.

Alex Weir

Independent Protection Specialist

How Does Comprehensive Health Insurance Work?

Comprehensive Health Insurance works in the same way as Private Health Insurance. What makes it comprehensive is how much cover you have on your policy.

You’ll pay for premiums, either monthly or yearly, through your personal bank account. If you then develop a condition or suffer an injury listed on the policy T&Cs, you can make a claim.

Does It Replace The NHS?

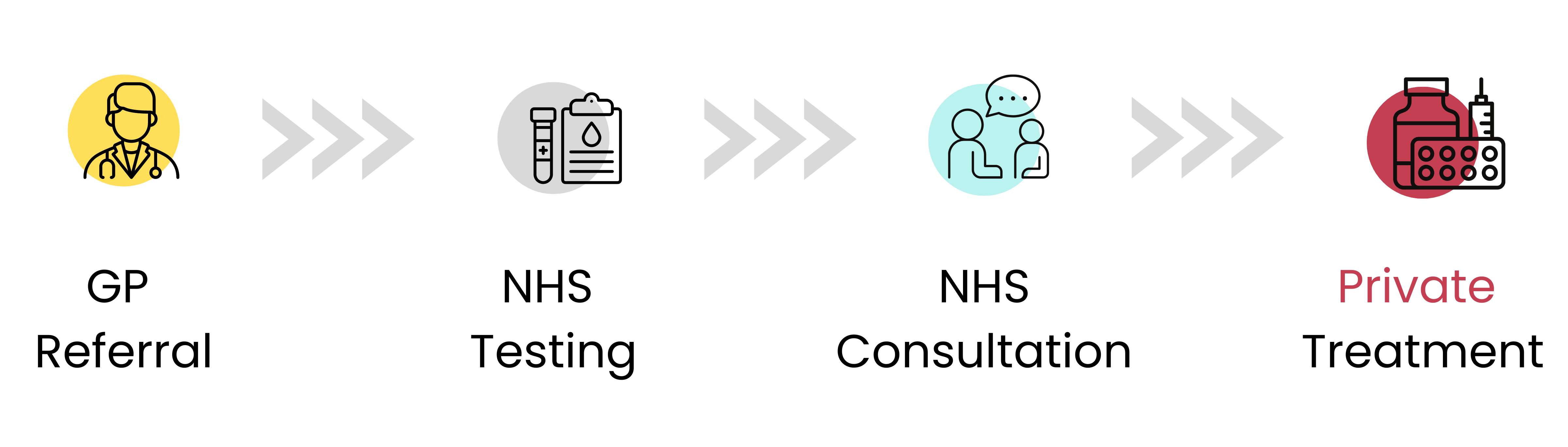

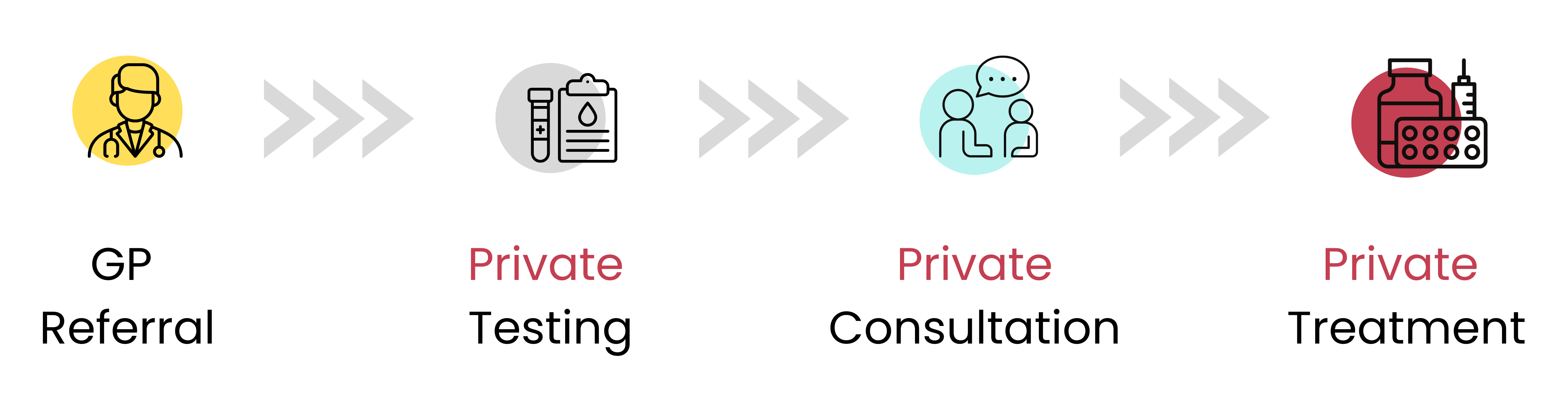

Comprehensive Health Insurance supplements the NHS, rather than replace it. But how often you need to rely on the NHS will depend on the level of cover you have on your policy. You’ll still visit your GP, but the process of receiving treatment will depend on your policy. For example, with comprehensive cover, your GP can refer you on to a private consultant for diagnostics.

Basic Vs Comprehensive Health Insurance

The main difference between Basic and Comprehensive Health Insurance is the level of cover that you get. In particular the level of Outpatient cover you get.

Basic Health Insurance Without Outpatient Cover

When you purchase a Basic Health Insurance policy, the likelihood is that you won’t get any outpatient cover. This means you’ll use the NHS for diagnosis and up to the point of private inpatient care. Given there can be significant waiting lists for NHS outpatient appointments, this could delay your treatment.

Comprehensive Health Insurance With Outpatient Cover

Comprehensive Health Insurance on the other hand, provides you with unlimited outpatient cover. As a result your GP will refer you directly to a private facility for all diagnostic tests and treatment. This will significantly reduce the amount of time you have to wait to get diagnosed or get treated.

In addition to covering outpatient in full, a comprehensive plan provides extended cover for other treatments, such as physiotherapy, cognitive behavioural therapy and acupuncture.

Chronic Vs. Acute Conditions

Even the very best Comprehensive Health Insurance only covers certain conditions. This is because all your medical needs (both private or NHS treatment) are split into two categories, chronic and acute:

- Chronic conditions

These conditions stay with you for life, requiring ongoing treatment. Asthma and diabetes sit within this category as they can’t be cured, only managed - Acute conditions

These conditions are curable through treatment. For example, a joint requiring a replacement is an acute condition, as it can be ‘fixed’ via surgery. Another example is cataract removal.

Private Health Insurance, no matter what level of cover you have, will only cover you for acute conditions which can be treated. As a result, you will never fully say goodbye to the NHS.

Regardless of the level of cover you opt for, the truth of the matter is, you’ll always need the NHS. Emergency treatment, chronic conditions, and routine pregnancy is always in the hands of the National Health Service.

Private Health Insurance is therefore there to compliment the NHS rather than replace it.

Sophie Guiver

Independent Protection Specialist

What Does Comprehensive Health Insurance Cover?

You now understand how Comprehensive Health Insurance works, but what does it cover? The best Comprehensive Health Insurance includes cover that basic plans may offer as an optional extra, such as outpatient cover and psychiatric care.

Level Of Cover

Regardless of the level of cover you have, your GP will always be your first point of contact for any health concerns. They can then refer you to a private facility. All policies, whether Comprehensive or not, split medical care into two areas: Inpatient or Outpatient:

- Inpatient / day-patient care

Any care where you need a hospital bed, either overnight (inpatient) or just for the day (day-patient). This would most commonly be after surgery - Outpatient care

All care and procedures where you don’t require a hospital bed. This includes diagnostic tests, scans and treatment, such as physiotherapy.

All Comprehensive Health Insurance policies cover inpatient and day-patient treatment as standard. It also includes full outpatient care unlike more basic policies. Because of this, you’ll skip NHS waiting lists and be diagnosed privately.

To give you a better idea about what is covered, most UK providers of Comprehensive Health Insurance will include:

- Diagnostic / medical tests such as blood tests, CT and MRI scans

- Surgery as inpatient or day-patient

- Hospital overnight stays and nursing care

- Extensive cancer care and treatment

- Outpatient treatment

- Mental health support

- Alternative therapies

- Physiotherapy.

Additional Policy Options

As well as the above, in some cases you will be able to add the below additional policy options to Comprehensive Cover:

- International cover

International Health Insurance provides cover overseas if you have a medical emergency abroad - Routine dental and optical care

All policies cover procedures, such as wisdom tooth extraction and cataract removal, as standard. But Comprehensive Health Insurance doesn’t cover everyday routine treatment, such as dental check ups and eye tests. You can add these to your policy for a higher premium - Upgraded hospital list

You’ll choose a hospital list that determines where you can receive treatment. For an extra premium, you can upgrade this to a premier list or one including Central London facilities.

Cancer Cover

All Comprehensive Health Insurance policies include Cancer Cover as standard. This is one of the most valuable aspects of a health plan.

Should you be diagnosed with cancer, your policy can cover:

- Access to cancer drugs, therapies and treatments the NHS doesn’t offer

- New experimental medicine

- Chemotherapy / radiotherapy

- Biological therapies

- Cancer surgery / reconstruction

- Cash towards prosthetics / wigs needed as a result of cancer treatment.

Additional Benefits

Many UK Private Medical Insurance providers offer a great range of extra benefits. These are often free on top of your policy and aim to further support your health and wellbeing.

You may get access to the following extras:

- Virtual GP services

- Health screenings

- Physiotherapy sessions

- Stress and mental health support

- Second medical opinions

- Everyday rewards and discounts.

What Doesn’t Comprehensive Health Insurance Cover?

While a comprehensive plan has the highest level of cover, all policies have exclusions. This is true for every type of Private Medical Insurance. The following exclusions apply to everyone:

- Alcohol & substance abuse

- Pre-existing conditions

- Routine pregnancy

- Kidney dialysis

- HIV & AIDS

- Cosmetic surgery

- Fertility treatment

- Mobility aids, such as wheelchairs & mobility scooters

- Self-inflicted injuries.

Do I Need Comprehensive Health Insurance?

It’s not for us to tell you if you need Comprehensive Health Insurance or not. It’s not a policy you have to have, however it is one that, if you can afford it, is a nice to have.

It is definitely worth considering if you:

- Want access to private health services

- Prefer flexibility over where and how you receive treatment

- Want peace of mind that you can get the care you need as quick as possible

- Want to skip long NHS waiting lists

- Can afford monthly Health Insurance premiums.

Access Treatment Quicker

The NHS is a well-renowned service in the UK, which we’re all lucky to access free of charge. However, funding cuts and staff shortages are causing unprecedented pressure. As healthcare demands increase, waiting lists are getting longer and longer.

As it stands, the latest figures from September 2023 show:

- 7.77 million people in the UK are awaiting treatment—a record high

- Almost 3.29 million of these have been waiting longer than 18 weeks

- The median wait time for treatment is 14.7 weeks (nearly double pre-pandemic levels).

Should you suffer from persistent symptoms, waiting 18 weeks for treatment is not ideal. Delayed care can worsen symptoms and even prevent you from working and earning an income.

The sooner you can access the care you need, the quicker you’ll recover and get back to your normal, healthy self. This is where Comprehensive Health Insurance steps in and ensures you get the medical care you need.

GP Appointments When You Need Them

It’s not just hospital appointments that are hard to get. Booking a GP appointment is also a difficult task and doesn’t help delays in treatment.

Comprehensive Health Insurance includes virtual GP services, so you can speak to a registered GP sooner rather than later. This helps to prevent symptoms worsening and having to take time off work due to poor health.

We can’t say if you need Comprehensive Health Insurance, as it’s dependent on your circumstances and unique needs.

But it’s always worth considering, as it can speed up your diagnosis and treatment.

Alex Weir

Independent Protection Specialist

Health Insurance Client Stories

How Much Does Comprehensive Health Insurance Cost?

Insurers price premiums on a range of personal and policy factors (we’ll explain these next). So it’s difficult to give you a figure for how much Comprehensive Health Insurance costs.

However, to give you an idea of how much you could expect your monthly premiums to be, we have provided some examples below based on different factors.

The Provider

When comparing Comprehensive Health Insurance, premiums differ from provider to provider. Each one has its own appetite to risk and may offer different services to one another.

Here you can see how the cost of Comprehensive Health Insurance differs, based on:

- A 40-year-old individual working a low-risk office job

- Individual is a non-smoker

- Comprehensive cover

- £100 excess.

| Different Providers | |

|---|---|

|

|

| £91.84 | £138.58 |

The Level Of Outpatient Cover

Since you’re here, it’s likely you’re considering a comprehensive policy. But we thought it’d be good to show you how the costs can change depending on how comprehensive a policy is.

You can choose between:

- No outpatient cover (a basic policy)

- Limited outpatient cover, up to £,1000 (mid-range policy)

- Full outpatient cover (comprehensive policy).

Using the same factors, these quotes show the monthly Health Insurance cost for outpatient cover.

| Type Of Policy | Outpatient Cover | Cost |

|---|---|---|

| Basic | £0 | £65.13 |

| Mid-Range | £1,000 | £84.67 |

| Comprehensive | Full cover | £91.84 |

The Excess Amount

An excess is how much you’ll pay upfront before your Comprehensive Health Insurance kicks in. The higher your excess, the lower your premiums. You’ll pay this excess per claim or per policy year. It’s essential you check which one applies.

Excesses begin at £0 and go up to £5,000. This policy option should match your affordability. If you can afford to pay £500 upfront, for example, an excess of £500 is suitable.

These quotes show how excesses can affect the cost of Comprehensive Medical Insurance. These quotes are based on the same factors above.

| Excess Amount | Monthly Premium |

|---|---|

| £100 | £91.84 |

| £250 | £86.73 |

| £500 | £79.08 |

Your Age

How old you are when you buy a Comprehensive Medical Insurance policy has an effect on the cost of your plan. The older you are, the likelihood of becoming unwell or injured is higher.

To cover this extra risk, insurers often increase the premiums. Using the same factors, here are some quotes for cover at different ages.

| Age | Monthly Premium |

|---|---|

| 30 year old | £72.91 |

| 40 year old | £91.84 |

| 50 year old | £128.50 |

Smoking Status

If you smoke, you may find the cost is higher than a policy for a non-smoker. While this isn’t the case for every insurer, it’s worthwhile keeping in mind when comparing quotes.

Since the habit increases your risk of health issues, some insurers do charge more. We’ve got an example below from AXA to show you the difference between smokers and non-smokers. This is based on a 40-year-old office worker, wanting comprehensive cover and a £100 excess.

| Smoker Vs. Non-Smoker | |

|---|---|

| 🚬 | 🚭 |

| £92.68 | £72.42 |

Treatment Facilities

When you buy a policy, you’ll pick a hospital network. This determines which private hospitals you can visit.

Policies have several ‘tiers’ of private facilities. The best private hospitals in the country, such as those in Central London, are the priciest to receive medical care in.

The more comprehensive your network and the pricier the facilities, the more you’ll pay for cover. You can limit your hospital list and reduce the cost of your premiums. These are often limited to local private facilities and private wings of NHS hospitals.

Your Location

Insurers take your location into consideration when setting up your policy. If you live somewhere with some of the top private hospitals, premiums will be higher.

How To Reduce The Cost Of Comprehensive Health Insurance

A comprehensive policy is the most expensive type of Health Insurance, as it provides the highest level of cover. However, there are several ways of reducing costs, but it’s important to note that doing so can impact your cover.

Add An Excess

An excess is the amount you’re willing to pay upfront towards the cost of your private healthcare. The insurer then covers the rest.

Excesses range from £0 to £5,000. The higher the excess amount, the lower your premiums. But your chosen excess needs to be affordable for you.

GOOD TO KNOW! 🧐

Adding an excess won’t affect how comprehensive your policy is, it lowers the premiums.

Reducing Outpatient Cover

A fully comprehensive policy has no limits on outpatient treatment. Your insurer covers the cost in full, excluding any excess you add on.

However, comprehensive outpatient cover does cost the most. If you’re looking to cut costs, you can choose a mid-range policy instead. This still provides you with outpatient cover, but it’s capped to a specific amount. Typically, insurers cap this at £1,000 per policy year.

6 Week NHS Wait

With the 6 week wait option, if you need inpatient care, your insurer will check the NHS waiting list in your local area. If the wait for that medical treatment is less than 6 weeks, you have it under the NHS.

It’s only if the procedure you need isn’t available on the NHS or the wait is longer than 6 weeks that your insurance kicks in. It’s important to note that this only applies to inpatient care. Your entitlement to outpatient care is unaffected.

IMPORTANT NOTICE 🧐

Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.

Which Medical Underwriting Should I Choose?

The medical underwriting you choose will impact the coverage you receive. The insurer examines any pre-existing conditions you’ve suffered from in the past and decides whether to offer cover for them.

There are two types of underwriting available to you:

- Full medical underwriting (FMU)

You declare your full medical history to the insurer from the start. This option tends to come with a considerable amount of paperwork. The insurer typically excludes pre-existing conditions from the outset of the policy - Moratorium underwriting

The most common option. Moratorium doesn’t need an upfront declaration of your medical history. Instead, any pre-existing medical conditions you’ve had in the 5 years up to the policy start date will probably be excluded.

Which Underwriting Is The Most Comprehensive?

The answer to this depends on your circumstances and medical history. It’s impossible for us to say which underwriting is best for you without knowing more about you first.

Certain medical conditions may be better disclosed on a full medical underwriting application. Some may be covered in the future if the policy has moratorium underwriting.

A significant part of our service is to make sure our clients get the best possible cover for their personal circumstances.

Our specialists have a strong understanding of the underwriting options and can provide advice on which type is best. For specialist advice, get in touch on 02074425880 or email help@drewberry.co.uk.

Sophie Guiver

Independent Protection Specialist

Who Are The Best UK Comprehensive Health Insurance Providers?

Our specialists have built strong relationships with all the top UK health insurers. The insurers listed below make up the core offering. However, we do have access to more specialist providers, depending on your occupation and medical history.

The cost of a policy is dependent on the factors we’ve mentioned, so it’s vital to compare all the top insurers to find the most competitive cover.

If you already have Comprehensive Medical Insurance, a market review is recommended every few years to ensure your policy is still the most competitive. We can help with this review if you need a financial adviser in your corner.

Health Insurance Product Reviews

Compare Comprehensive Health Insurance Quotes & Get Specialist Advice

Being aware of all the options available when looking for the greatest level of cover can be a bit of a minefield.

Our specialist advisers are here to cut through the jargon and undertake the research to find you the best cover for your circumstances.

If you’d like our help arranging your a Comprehensive Health Insurance policy, give us a call today on 02074425880. One of our advisers will be happy to help. Alternatively, you can email help@drewberry.co.uk.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4060 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=4058)