Are you nearing retirement and thinking about a Senior Health Insurance policy? You’ve come to the right place. You can get access to private healthcare even if you’re aged above 65, so it’s definitely something you should consider.

In this guide, we’ll explain all there is to know about getting Health Insurance in your senior years.

What Is Senior Health Insurance?

Health Insurance for seniors is the same as a personal Private Medical Insurance (PMI) plan, except the age restrictions aren’t as limited. It’s designed specifically for those aged 65 and above.

It covers private medical costs for those in or approaching retirement. You pay a monthly premium which provides you with access to private treatment for acute medical conditions in private facilities.

Many senior citizens are opting for Health Insurance plans to cover the cost of medical treatment, which is more likely to be needed as we age. For example, a hip replacement or cancer care. Having a policy in place allows you to:

- Skip long NHS waiting lists

- Receive private care when you need it most

- Get access to drugs which aren’t on the NHS.

Why Is Private Healthcare Important For Seniors?

As we age, we’re more likely to become unwell or suffer an injury. These health concerns can be more serious than someone in their 20s.

There’s no sugar coating it – our bodies become more fragile the older we get. This is what makes Health Insurance for seniors so important. Rather than waiting around for NHS care, a Comprehensive Health Insurance policy can speed up your treatment.

You can receive the medical attention you need faster and enjoy private facilities and flexible visiting hours.

How Does Senior Health Insurance Work?

Health Insurance for seniors works in exactly the same way as personal Private Health Insurance.

You’ll pay for the premiums from your own bank account. Once your policy is active, you’ll be able to make a claim if you need treatment (as long as it’s covered by your policy) and receive care privately.

Does It Replace The NHS?

No, Heal Insurance is designed to supplement the NHS, not replace it. When you take out a policy, you aren’t leaving the NHS behind completely.

The NHS will always be there for certain health issues, but the level of which will depend on how much cover you have. We explain this in more detail next.

You’ll still visit your GP and the process of receiving treatment will depend on whether you add outpatient cover to your policy.

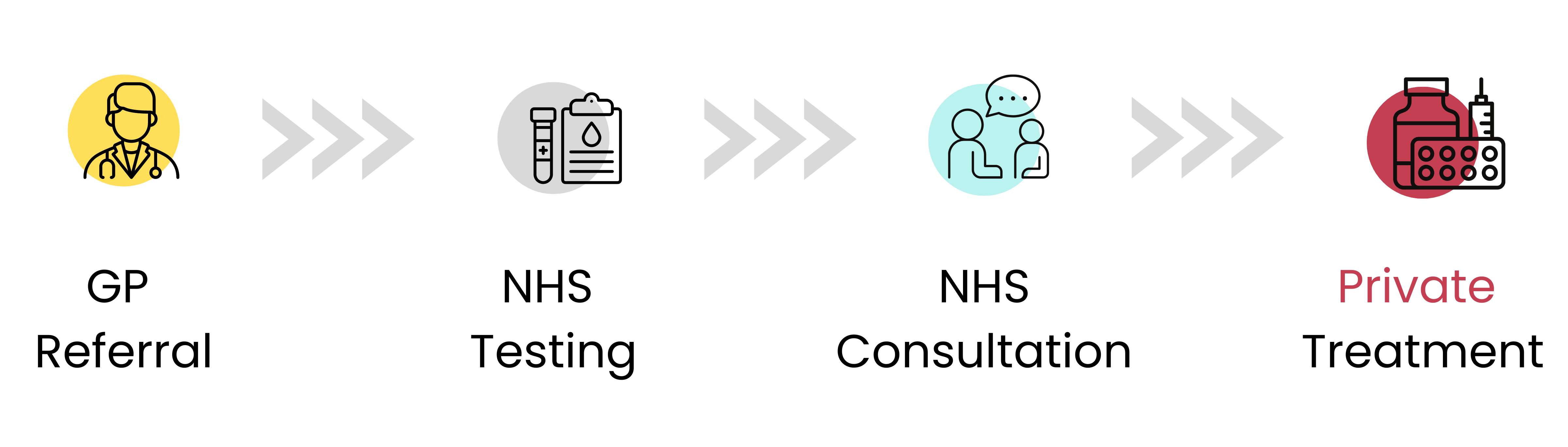

Senior Health Insurance With No Outpatient Cover

If you have a basic health policy that doesn’t include outpatient cover, your GP will refer you to the NHS for all tests, consultations, and diagnostics. After these medical tests, you’ll be referred to a private facility for care.

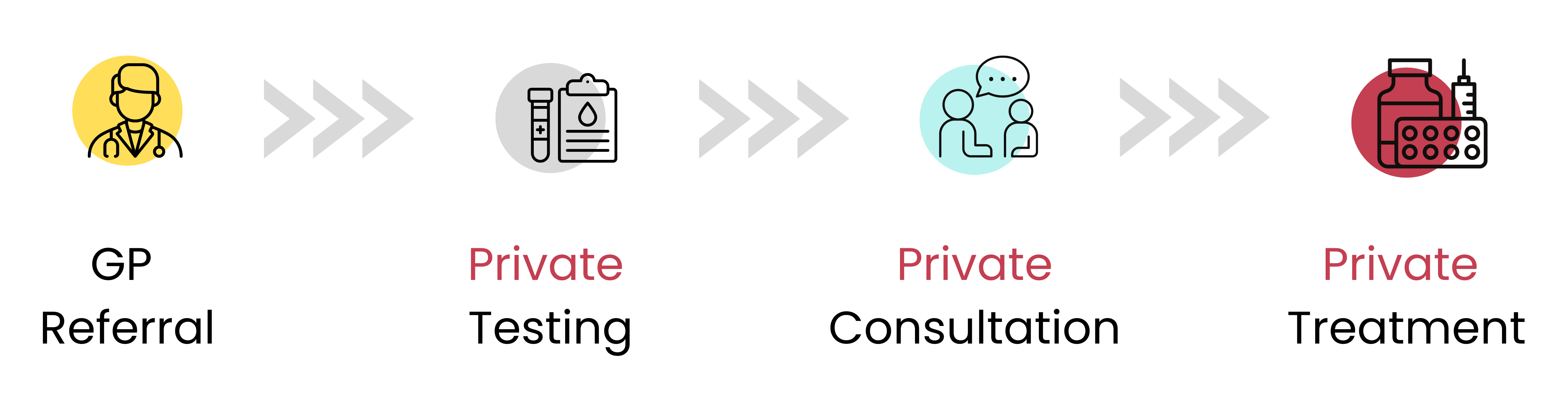

Senior Health Insurance With Outpatient Cover

If you pay extra for outpatient cover, your journey to private treatment looks a little different. Instead of your GP referring you to the NHS, you’ll be referred straight to a private facility. This pathway to private medical care is typically a quicker process than through the NHS.

It’s important to remember that no matter your age or your level of cover, not all conditions are covered by a private health policy. In some situations, you’ll still receive full medical care from the NHS.

SPECIALIST TIP 🤓

While you’ll need to be referred by your GP for private health care, in most cases this can be done via Virtual GP services.

Chronic vs Acute Conditions

When it comes to health conditions, there are two main types. Chronic and acute.

- Chronic conditions

This type of condition is one that is unfortunately with you for life. Unlike other conditions which can be cured with treatment, these can only be managed. For example, diabetes and asthma - Acute conditions

Acute conditions on the other hand can be cured. They are conditions which will pass with time and medical treatment. For example cataracts needing surgery or joint pain requiring a joint replacement.

It’s important to understand that Senior Health Insurance only covers acute conditions. This is the case for all types of Health Insurance though. So when taking out a policy, whether aged 30 or 70, you will still need to rely on the NHS for certain treatment.

Health Insurance Client Stories

What Does Senior Health Insurance Cover?

We know that Senior Health Insurance will only cover acute conditions, but what exactly does this mean? When taking out a policy, it’s important to understand exactly what is covered.

Inpatient Or Outpatient Treatment

All medical treatment, whether it’s private or NHS, is split into two categories: Inpatient/Day-Patient and Outpatient.

All private health insurers cover inpatient procedures as standard. But when choosing your Seniors Health Insurance policy, you’ll have the option to add Outpatient cover. Here’s the difference between the two:

- Inpatient / Day-Patient Care

Any treatment which requires a hospital bed, either overnight (inpatient) or for the day (day-patient). This includes surgeries - Outpatient Care

Any treatment you have without needing a hospital bed. Diagnostic tests and scans, as well as physiotherapy, for example, are normally carried out as an outpatient.

SPECIALIST TIP 🤓

While adding outpatient care does increase premiums, we tend to recommend some level of outpatient cover with your Private Medical Insurance. It can considerably speed up the diagnosis of conditions compared to waiting for the NHS.

As standard most Health Insurance providers will provide a policy which includes the following:

- Cancer care and treatment (more on that later)

- Diagnostic testing, such as MRI scans and blood tests

- Private hospitals and nursing care

- Surgery as inpatient or day-patient.

Depending on the level of cover you choose, you may also get:

- Outpatient treatment

- Mental health cover

- Complementary therapies

- Physiotherapy.

Cancer Cover

You’ll find that all health insurers in the UK offer some level of Cancer Care in their policies as standard.

It’s one of the most valuable parts of your Senior Health Insurance as it can offer access to drugs and treatments not yet available on the NHS. Some insurers will even have access to new experimental medicine.

Cancer care generally includes:

- Chemotherapy / radiotherapy

- Bone strengthening drugs

- Surgical procedures

- Money towards prosthesis / wigs you require as a result of cancer treatment.

SPECIALIST TIP 🤓

Some insurers let you add extra cover, such as Dental and Optical Care to your policy as an optional add-on too.

What Doesn’t Medical Insurance For The Elderly Cover?

Like all insurance policies, there are certain things which are excluded from your policy. It doesn’t matter if you’re aged over 65, these exclusions apply to everyone.

- Pre-existing conditions

- Emergency care

- Issues related to alcohol / substance abuse

- Pregnancy / fertility treatment

- Cosmetic treatment which isn’t medically necessary

- HIV / AIDS

- Kidney dialysis

- Self-inflicted injuries, such as those sustained through dangerous sports / hobbies.

Do I Need Private Medical Insurance as an Older Person?

As we get older, it’s normal for our bodies to become more susceptible to a variety of health problems. It’s only human. But often it means elderly people need more healthcare.

While the NHS is free to use, there are long waiting lists. For someone a little older, waiting for diagnosis and treatment can be worrisome, which is why specialist Health Insurance exists for senior citizens.

With NHS waiting lists rising, many are waiting longer for treatment. This can be significantly detrimental to your quality of life if you’re suffering from a painful health condition.

As of July 2025, BMA data shows that:

- Approximately 6.25 million individual patients were waiting for treatment

- Around 2.87 million of those patients had been waiting more than 18 weeks, and 191,600 of these patients had been waiting more than a year for treatment

- The median waiting time for was 13.1 weeks – a significant increase from the pre-COVID median wait of 7.3 weeks in July 2019.

Private Health Insurance doesn’t cover disabilities or chronic conditions. However, it can make all the difference when it comes to skipping waiting lists for acute treatment such as joint replacements.

You should consider Private Medical Insurance if you:

- Want access to private healthcare services

- Prefer flexibility over where and how you receive treatment

- Want peace of mind that you can get the care you need as quick as possible

- Want to skip long NHS waiting lists

- Can afford monthly Health Insurance premiums.

Senior Health Insurance FAQs

Can I get Health Insurance over 60 or 65?

You can take out Private Health Insurance cover after the age of 65. While not every health provider will offer quotes for those in that age band, there are many that do. Many insurers have policies aimed at the over-50s.

As an older person, you’ll need a specialist policy as most UK insurers have an upper age limit for applications. This normally sits at 65, but some can go as high as 80.

While it’s possible to get health coverage as a senior, it can be complicated. You may have a pre-existing health condition to declare, which can affect your eligibility. It’s always worth speaking to a financial adviser, such as one of us at Drewberry™.

Is Senior Health Insurance more expensive?

Health Insurance for seniors is more expensive than insurance for a younger person. This is due to the increased risk of deteriorating health, and therefore, a claim.

Some of the most common treatments needed by older patients include joint replacements. But hip replacements, for example, start at around £10,000—an expensive procedure.

Our team of specialists have the knowledge and market access to find you the most suitable Health Insurance policy for you, at the most competitive prices. If you’d like to discuss your options, please give us a call on 02074425880. You can also email help@drewberry.co.uk, and one of our advisers will be happy to help you.

Can I switch my existing cover?

Yes, you can. At Drewberry, we speak to many individuals who’ve held their policy with the same insurer for decades. When we conduct a full review, we tend to find the premiums are no longer competitive compared to the rest of the market.

Switching Health Insurance policies can be tricky if the insurer covers certain conditions as they might not always be transferred over to a new policy. By switching cover with Continued Personal Medical Exclusions (CPME) you can move to a new insurer with no change in your policy terms. This is especially beneficial for older people, as most will have a past medical history.

Can I get international cover as a senior citizen?

Yes. If you’re a frequent flyer, you might be better off securing an International Health Insurance policy. It provides more comprehensive cover for travel overseas.

Our team has experience helping expats and seniors who spend a significant amount of time abroad. So if your retirement plans include some holidays and you want to ensure your health is protected no matter what, it’s a good idea.

The international market is very different from the UK, with broader policy coverage and a different group of providers to consider. If international health cover is something you need, please don’t hesitate to give us a call on 02074425880. Our specialist advisers can help you with European or Worldwide cover.

How Much Does Health Insurance For Seniors Cost?

How much your Senior Private Health Insurance policy costs will depend on several factors. Some of which are within your control, however others, such as age, aren’t.

To give you a better idea of how these factors can impact the cost of a policy, here are some example quotes.

Factor 1: The Provider

Each provider will charge a different monthly premium. This is because each insurer has its own appetite for risk and can offer different services and benefits. Due to this, it’s always good to shop around when looking for senior health coverage.

To highlight how costs can vary from provider to provider, we’ve provided an example. This is based on:

- A 65 year old

- Comprehensive cover

- £250 excess

- Non-smoker.

Different Providers | |

|---|---|

|

|

£192.96 a month | £245 a month |

Factor 2: The Level Of Outpatient Cover

We’ve already mentioned this, but if you want to include outpatient treatment in your Senior Health Insurance cover, you can expect to pay more.

A mid-range plan might provide you with up to £1,000 worth of outpatient cover, whereas a comprehensive plan provides full cover.

Using the same factors as above, we’ve provided quotes below so you can see how different levels of outpatient care impact cost.

Level Of Outpatient Cover | Type Of Policy | Outpatient Cover | Cost |

|---|---|---|

Basic | £0 | £136.85 |

Mid-Range | £1,000 | £150.02 |

Comprehensive | Full Cover | £192.96 |

Factor 3: Excess

An excess is the amount you pay upfront towards your care before the medical insurance kicks in to cover the rest. The higher your excess, the lower your premiums. You’ll either pay this excess per claim or per policy year. It’s essential you check which one applies.

Excesses start at £0 and go all the way up to £5,000. To give you an idea of how this can affect premiums, here are some examples. This is based on the same 65-year-old as above.

Level Of Excess | Excess Amount | Monthly Premium |

|---|---|

£250 | £177.90 |

£500 | £162.21 |

£1,000 | £136.04 |

Factor 4: Your Age

None of us are getting any younger, and as we age, the more likely we are to become unwell. As a result, age plays a significant role in the cost of Health Insurance, not just for those aged above 65, but for everyone buying a policy.

Using the same example as above, we provided some examples of Senior Health Insurance costs based on different ages.

65 Years Old | 70 Years Old | 75 Years Old |

|---|---|---|

£177.90 | £227.67 | £318.97 |

Factor 5: Smoker Status

Some providers (but not all) will charge smokers more than non-smokers. This is due to the increased health risks associated with the habit.

We’ve provided an example below from AXA to give you an idea of how costs can vary. This is based on a 65-year-old retiree, wanting comprehensive cover and a £250 excess.

Smoker Vs Non-Smoker | |

|---|---|

🚬 | 🚭 |

£270.67 a month | £245 a month |

Factor 6: Treatment Facilities

Having a Senior Health Insurance policy in place doesn’t automatically make you eligible for treatment in all private facilities. When you take out a policy, you’ll need to choose a hospital network. This determines the private facilities you can have treatment in.

Policies have several ‘tiers’ of private facilities. The best private hospitals in the country, such as those based in Central London, are the priciest to receive medical care in.

The more comprehensive your network and the pricier the facilities, the more you’ll pay for cover. So if you’re not too fussed about receiving care in a top facility, you can limit your hospital network and reduce the cost of your premiums. These are limited to offering care in local private facilities and private wings of NHS facilities.

Factor 7: Your Location

Location is another factor taken into consideration when it comes to your Health Insurance. If you live somewhere with high-profile private hospitals, such as Central London, premiums will rise to reflect this.

SPECIALIST TIP 🤓

There are some providers, such as Freedom, that don’t base premiums on location. Providers like this could be more suitable if you live in London as, unlike others, they won’t rate premiums on your postcode.

6 Week Wait Option

Some providers offer a 6 week NHS wait option. Your policy will only pay out if the NHS waiting list for the inpatient treatment you need is longer than 6 weeks. Or if the NHS doesn’t offer the procedure you need. Otherwise, you have the treatment on the NHS.

This only applies to inpatient treatment. Outpatient care is unaffected as this is an optional add-on to your policy. You’ll always receive care privately with this add-on.

IMPORTANT NOTICE 🧐

Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.

Health Insurance Product Reviews

Who Are The Best UK Health Insurance Companies For Seniors?

Our team of specialists provide independent financial advice, comparing all the top UK private medical insurers. Though there are more specialised insurers, the core market is made up of the following Senior Private Health Insurance providers:

Your location, age and medical history all have a significant impact on the price of cover. Couple these factors with any potential policy exclusions and you can see why it is important to do your research.

We’ll speak to all the leading insurers on your behalf, as no two providers underwrite their policy in the same way. And we understand the importance of getting your Health Insurance right.

Additional Benefits

The UK Health Insurance market has grown over time, with every insurer offering a variety of free extra benefits to policyholders. The latest of which includes a number of benefits to support your health and wellbeing.

The best Private Medical Insurance policies now often include:

- Remote GP services

- Health checks

- Physiotherapy

- Stress and mental health support

- Second medical opinions

- Rewards and discounts.

Compare Senior Health Insurance Quotes and Get Specialist Advice

We’re aware all the policy options and terms of Senior Private Health Insurance can be complex. It might be overwhelming to figure out the most suitable cover for your particular circumstances. It also becomes more complicated if you have pre-existing medical conditions.

Fortunately, the team at Drewberry is here to help. If you’d like one of our advisers to talk you through your options or help set up your Senior Health Insurance, give us a call on 02074425880. You can also email our team help@drewberry.co.uk, if you’d prefer.

Why Speak to Us?

When it comes to protecting your health, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4084 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=4189)