Almost 75% of Britain’s Self-Employed Don’t Have a Personal Pension

Among the Self-Employed with a Pension, Over Half Have No Idea What It's Worth!

Our latest Drewberry Wealth & Protection Survey reveals that, although the ranks of the self-employed continue to swell, the average self-employed Briton is falling far behind in terms of their earnings, pension and insurance provision.

Neil Adams

Head of Financial Planning at Drewberry

- 73% of Britain’s self-employed still don’t have a personal pension while just over half (51%) of those who do don’t even know how much is in their pension pot. Among those who know how much they contribute to their self-employed pension plan, 91% contribute 10% or less of their take home pay to their pension.

- Self-employed Britons are twice as likely (71%) as their full-time counterparts (35%) to have just £200 or less to spend each month after meeting basic living expenses. In total, 63% of self-employed Britons describe their finances as ‘just about managing’ or worse.

- Among those who remembered when they started their self-employed pension plan, 34% of self-employed Britons didn’t start contributing to their personal pensions until they were at least 36-years old, compared to 11% of full-time employees.

- Just 25% of self-employed Britons have Life Insurance, compared to 39% of full-time employees. Only 5% of self-employed Britons have Critical Illness cover and just over 1% Income Protection even though 37% have less than £1,000 in cash savings to fall back upon (and no sick pay).

Self-Employed and Gig Economy Workers in Pension Crisis

Commenting on the findings of Drewberry’s 2017 Wealth and Protection survey, Director Tom Conner observes, “This year’s results highlight the pressures that are being exerted by the on-going ‘Uberisation’ we’re seeing in the UK’s employment market.

“Last year our 2016 survey clearly identified that the growth of the ‘gig economy’ meant that Britain’s self-employed were fast becoming a ‘financial underclass’. This year’s results show that nothing has arrested the decline,” he says.

“Today, the average self-employed Briton has far less discretionary income available each month than their employed counterparts,” says Conner, “with over 70% of self-employed respondents currently having £200 or less a month after meeting their regular outgoings.

“This explains why almost two out of three self-employed Britons now describe their finances as ‘just about managing’ or worse,” says Conner.

If You’re Self-Employed, How Would You Describe Your Finances?

Self-Employed Britons Dipping into their Pension Fund

Despite the heightened importance of making independent arrangements for a personal pension, a dismal 27% of Britain’s self-employed who are saving for retirement have one in place.

Although 18% of our survey group claimed to have a company pension from a previous employer, self-employed pension plans still come far too low down the list of priorities.

Indeed, two-thirds of self-employed workers with no personal pension plan said they simply couldn’t afford it.

Tom Conner

Director at Drewberry

“Money is now so tight for most self-employed professionals,” says Tom Conner, “that a great many of the self-employed saving for retirement are now using what they should be setting aside for their Personal Pension to subsidise the here and now.

“Pension contribution levels are woeful among the minority of UK workers who are currently funding self-employed pension plans,” he says, “with over 90% contributing less than 10% of their take home pay,” he says.

“With something like 3.7 million self-employed Britons still having no pension provision, extending auto-enrolment to this group looks like a real ‘life-line’.”

However, it could be a decade or more before auto-enrolment for the self-employed has been rolled out and average contributions reach worthwhile levels. In the meantime, they will be left to fend for themselves with a self-employed private pension, and this hasn’t worked out well so far.

Self-Employed Britons Saving for Retirement are Starting Too Late

Our survey also highlights that over a third of self-employed Britons don’t get around to funding a private pension plan until they’re in their mid-30s or later.

“As any adviser will tell you,” says Conner, “the long-term nature of a pension means that there’s a huge ‘opportunity cost’ to starting a self-employed pension plan later in life.

In a recent exercise, we calculated that someone who starts a self-employed pension plan at age 25 will have around twice the pension pot at age 65 as someone who waits until they’re 35 and four times as much as someone who doesn’t start until they’re 45 years old. This was based on a basic-rate taxpayer investing a flat £250 a month, along with the tax relief they receive, into a notional fund that delivers 6% pa compound growth.

It’s never too late to start a pension plan, they are available at almost any age.

However, starting a personal pension later in life means that you miss out on the opportunity to build your pension fund and as a result may have to work longer in order to save the money you need to retire comfortably.

John Spink

Head of Financial Planning at Drewberry

For Many Self-Employed, Saving for Retirement Comes Second

As well as not saving for retirement, only a quarter of the self-employed we surveyed have any form of Life Insurance while a paltry 1% have Income Protection.

The data also shows that over 19% of today’s self-employed are now in what were once considered their ‘retirement years’ and so might struggle to find affordable self-employed Income Protection anyway.

“However,” says Conner, “even if you allow for those in this age bracket, this still means that in today’s Britain there are over four million self-employed people whose entire livelihood is at risk if their health lets them down in the coming years.

Which Financial Products Do Self-Employed People Hold?

Self-Employed Pension Plans and Protection Options

Self-employed UK professionals are the group most at risk of losing their savings if something goes wrong, yet so few have bought protection products.

Drewberry specialists are available to offer impartial advice for self-employed professionals with all their protection and financial planning needs including self employed sickness insurance, life insurance and personal pension advice.

To help UK workers and the self-employed saving for retirement, Drewberry created its Pension Pot Calculator.

This tool will calculate a pension forecast for your pension pot based on your contributions and illustrates how long it’s likely to last based on the level of income you decide to draw.

Neil Adams

Pensions & Investments Specialist at Drewberry

Click the following link to see the full data from the annual Drewberry Wealth & Protection Survey 2017 →

- Topics

- Pensions

- Self Employed

Find > Organise > Simplify

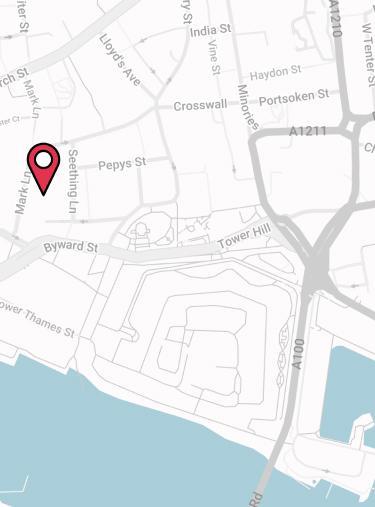

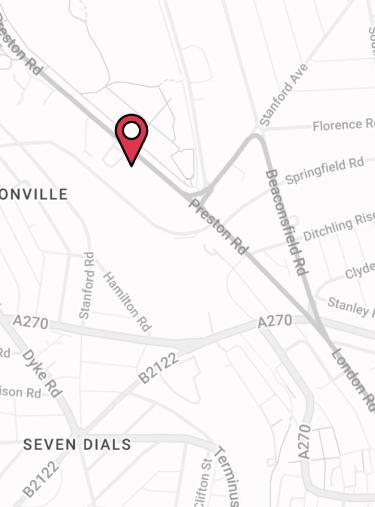

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.