What Insurance Would Pay Off My Mortgage On Death?

I am looking for Mortgage Protection Insurance that would pay off my mortgage in the event of death so my family would be left with the house (debt free). Is there some kind of specific mortgage death insurance cover available?

Yes, Mortgage Protection Life Insurance pays out a tax-free cash lump sum should you pass away and is specifically designed to cover mortgage loans.

This type of cover comes in two main forms:

Decreasing Mortgage Life Insurance

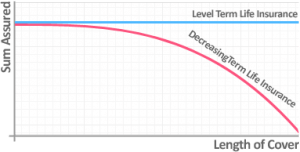

With a decreasing plan the level of cover declines over time inline with the outstanding balance on your repayment mortgage.

You would typically align the length of cover with the remaining term of your mortgage so if you were to die the Life Insurance would pay out a lump sum equal to the balance outstanding on your repayment mortgage.

Ensuring you have adequate Life Insurance in place means your loved ones can avoid financial difficulty during such tough times and remain in the family home.

As the level of cover declines over time this is the most cost-effective method of gaining cover.

Level Term Mortgage Life Insurance?

Level Term policies are most commonly used for family protection or to protect an interest only mortgage. The level of cover remains fixed over the term of the plan, along with the amount of debt outstanding on your loan if you’ve opted for an interest-only mortgage.

Joint cover for couples

With both types of cover it is possible to take out a Joint Mortgage Life Insurance plan so if either partner on a joint mortgage were to pass away the loan could be repaid in full, thus avoiding the remaining partner being left with a potentially unmanageable debt.

It is also possible to add Critical Illness Cover to the plan so the policy would also payout in the event of a ‘critical illness condition’ (such as a heart attack) in addition to covering death.

Need Help?

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to talk to us.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4100 and growing independent client reviews rating us at 4.92 / 5.

- Topics

- Mortgage Insurance

Frequently Asked Questions

Should Life Insurance Cover the Term of Your Mortgage?

Can You Take Out Mortgage Life Insurance With Critical Illness Cover?

Is It Worth Taking Out Mortgage Life Insurance?

Do You Need Life Insurance for a Mortgage? Is It Compulsory?

What Insurances Do I Need to Take Out for Mortgage Protection?

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.