What is the Best Home Insurance?

There are a number of different elements you should look out for when buying Home Insurance, what is important for one person might not be so important for another.

Comparing the market is very important and it is not only comparing Home Insurance premiums but also comparing the various aspects and limits of the policies.

Personal possessions, outbuildings and cover limits…

For instance, if you travel frequently, you may be more interested in a policy that covers your personal possessions and valuables, such as laptops, outside your home and even abroad.

Some policies include cover for sheds, outbuildings and gardens as standard, while for others this is only an optional extra. The same is true for accidental damage cover.

It is vitally important to find a balance between the level of cover provided and a monthly premium you can afford. Whatever you need from your buildings and contents insurance, it always pays to do the research to ensure you get the best Home insurance for you.

Compare Top UK Home Insurance Providers

The below information describes the top tier of Home Insurance policy available from a selection of leading UK Home Insurance providers.

How Much Does the Best Buildings and Contents Insurance Cost?

No two Home Insurance policies will cost the same because there are so many deciding factors that influence how your policy is priced. For that reason, we’ve included below some of the main things that insurers and underwriters consider when pricing your premiums.

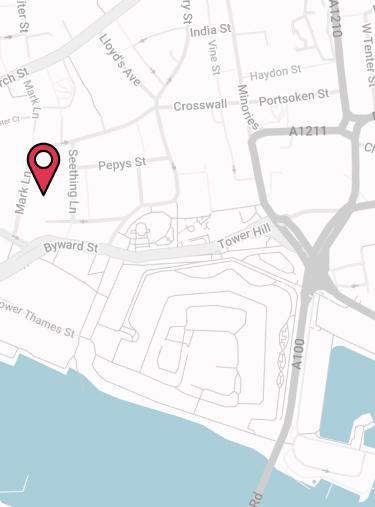

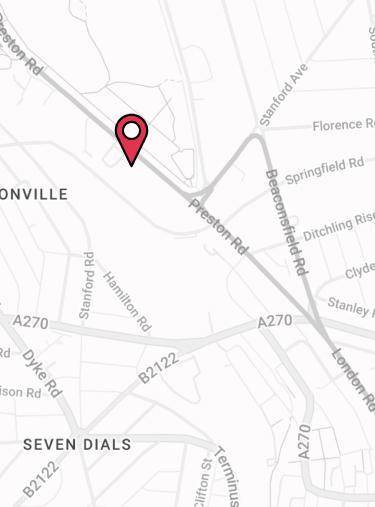

- Your address

Your address can tell your insurer a lot about your home, the likelihood of claiming on your policy, and the cost of your claims. For example, if you live in an area that tends to get exceptionally cold, your insurer may increase the cost of your policy to balance the increased risk of your home’s pipes freezing in the winter.

- Type of building

Different types of buildings have different types of risks that may affect your policy’s cost. If you live in an old house, you are more likely to encounter issues with pipes and pests, which may add to the cost of your Home Insurance policy. If you live in a larger, expensive house then the best Home Insurance policy for you may be one with unlimited buildings cover.

- Excess

This is an option to add to your policy that means that you will agree to pay a certain amount per claim to cover the cost of any loss or damage covered by your policy. By increasing the amount of excess that you are willing to pay, you can reduce your Home Insurance premiums.

- Security

Some insurers will not supply you with an insurance policy unless the security of your home meets a certain standard. Meanwhile, insurers will also price your insurance policy depending on how secure your home is. For example, if you have a burglar alarm installed in your home, you may have the cost of your insurance reduced slightly.

- Contents Value

Most insurers will allow you to choose the level of contents cover you need for your home, but if the contents of your home are highly valuable you inevitably need to pay more for your cover. If you want your home’s contents insured, the best Home Insurance will include unlimited contents cover, although there will often be a limit on how much you can claim per item.

- Living Situation

Having children or pets in the home may increase the cost of a policy because they have a tendency to damage things. In addition, the number of people living in the home and amount of time that you regularly spend in the home could affect the cost of cover.

- Claims History

If you are renewing your Home Insurance policy, the number of claims that you have made and their severity will influence the new cost of your premiums.

You may find the cost of your Home Insurance going up over time. This is because certain factors as well as your increased risk of claiming will affect the cost of your policy, such as inflation, the insurer’s financial situation, and the increase of Insurance Premium Tax.

Other Home Insurance Definitions

Valuables Cover

Definition: Different from personal possessions cover, this cover protects high-value belongings, such as paintings, jewellery, and antiques.

What to look for: If you do not own any valuable items in your home, then you likely won’t need this cover. This type of cover requires you to have each valuable item valued and specified in your policy and for this reason you should look to insure only your most valuable items. This is because this cover can get more expensive the more valuables you add to your policy, especially if they are high-risk items like jewellery or watches.

The most comprehensive Home Insurance policies tend to have a higher valuables cover limit, while the best Home Insurance policies typically cover these valuables outside the home, including abroad.

Matching Sets Cover

Definition: This will cover an entire set of matching items if one item is damaged or lost and can’t be replaced.

What to look for: Only the best Home Insurance policies offer this with their standard policies. Most offer it as an optional cover that you can add to your policy. This cover isn’t always necessary if you are not overly concerned about your matching sets being completely uniform. However, if this is a concern for you, then this could work in your benefit.

Alternative Accommodation

Definition: If your home is unsafe or you need to stay elsewhere while repairs are made to it, this cover will pay for temporary accommodation.

What to look for: If you have relatives that you may be able to stay with in the event of an emergency, this cover may not be necessary. But, if you do want to add this cover to your policy, be aware that some insurers will only pay out for a certain number of nights in temporary accommodation.

The best Home Insurance will provide cover for you, your family and even your pets if you can’t live in your home due to an emergency, either until the repairs are done, for a set number of days or up to a cash limit.

Family Legal Cover

Definition: This cover will pay out to help you cover some or all legal expenses if you or your family face certain personal legal matters, such as protection of property or personal injury claims.

What to look for: Many of the top UK home insurers include this cover with your policy automatically, so you may not need to worry about adding it.

Home Emergency Cover

Definition: If you face a home emergency and need fast repairs, insurers may pay out to cover the cost of hiring a tradesperson to perform emergency repairs.

What to look for: Some of the best Home Insurance companies include an emergency service and helpline with this cover and will arrange emergency repairs for you at any time of day. This can be a great benefit if you one day wake up in the middle of the night to a burst pipe.

![Aviva Home Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FArchitect%402x.png&w=480&q=75&dpl=4139)

![The AA Home Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2Fwatering-can-brushstroke-thumbnail.png&w=480&q=75&dpl=4139)

![John Lewis Home Insurance [Review] Image](https://media.drewberry.co.uk/couple-with-pram.svg)