John Lewis Home Insurance [Review]

Founded

1864

Company Type

Public Limited Company

Company Overview

The John Lewis Partnership is a British company best known for its department stores and supermarkets. The company’s permanent staff are regarded as ‘Partners’ who own technically own the company and share the benefits and profits.

As part of its expansion out of retail, John Lewis first moved into providing financial services and products in 2006. Its finance arm trades as John Lewis Finance.

Most of John Lewis’ Home Insurance products are provided and underwritten by Royal & Sun Alliance Insurance PLC.

John Lewis Home Insurance Review

- In terms of standard Home Insurance policies, John Lewis’s insurance premiums tend to be priced at the lower end of the market.

- John Lewis’s policy options range from essential to extravagant and most contain options that allow you to tailor your cover even more.

- John Lewis offer optional extra cover and services with their Home Insurance policies, such as cover for legal fees and a 24 hour phone line for home emergencies.

- In order to qualify for a Home Insurance policy from John Lewis, you may be expected to modify your home security to meet certain standards as outlined by your policy documents.

- John Lewis Home Insurance policies charge an APR of 21.1% if you choose to pay your premiums monthly.

- If you leave your property unoccupied for more than 60 consecutive days, let it to anyone, or use it for trade, professional or business purposes, some types of insurance cover will be restricted and some will not apply.

- With a John Lewis insurance policy, the maximum amount that you can insure a single valuable item in the home for is £3,000. However, with Specialist Home Insurance, different types of valuables have different cover limits and you can insure certain items for as much as £20,000 per item.

Buildings & Contents Policy Overview

John Lewis Finance provides a range of Home Insurance policies that offer different levels of cover. This allows homeowners to find the most appropriate level of cover to suit their needs and their budget.

Plus Home Insurance | Cover | Limit | Availability |

|---|---|---|

Buildings cover | £1,000,000 | Core Option 1 |

Contents Cover | £75,000 | Core Option 2 |

Buildings & Contents Cover | £1,000,000 / £75,000 | Core Option 3 |

Student Cover | £5,000 | Optional |

Garden Cover | £5,000 | Optional |

Home Emergency Cover | £1,000 | Optional |

Matching Sets Cover | £10,000 | Included |

Buildings Accidental Damage Cover | Limits determined by underwriting | Optional |

Contents Accidental Damage Cover | Limits determined by underwriting | Optional |

Personal Possessions Cover | £3,000 | Optional |

Specified Valuables Cover | £3,000 per item | Optional |

Bicycle Cover | Limits determined by underwriting | Optional | Policy Documents |

Also available from John Lewis is ‘Premier Select Home Insurance’. This policy offers the same cover as John Lewis’s Premier Home insurance policy, but allows people to personalise their cover. This allows policyholders to tailor their Home Insurance cover to their needs, e.g. by removing bicycle cover if you do not own a bicycle that needs insuring.

John Lewis Specialist Home Insurance

This unique John Lewis insurance policy is provided by Covéa Insurance PLC and is designed for policyholders with high-priced valuables. It is highly adjustable and comprehensive, but also more expensive than a standard policy due to its many additional options.

John Lewis’s Specialist Home Insurance is designed to cover, most of all, the loss or damage of high-price valuables, which is why the cover limit for valuable items is a lot higher than it would be in a standard policy.

As well as offering all of the cover options mentioned in the other policy options from John Lewis, Specialist Home Insurance also offers these unique cover options for your home and family:

- Cover for multiple homes, including properties outside of the UK

- An excess waiver that waives the policy’s standard excess of £250 on claims of more than £10,000

- Unlimited contents and buildings cover (separate limits apply per item or per claim)

- Unique trauma cover following violent crimes, affording £500 worth of counselling, £1,000 to cover temporary accommodation, and £15,000 to put towards improving home security or moving to a new home

- Limited cover for the belongings of guests and domestic staff that occupy an insured property

- Cover for the hiring of legal professionals and related legal expenses for all cases pertaining to personal injury, clinical negligence etc. relating to the insured property

- Cover for fatal injuries and disabilities, paying out a maximum of £100,000 for the death of a partner or to modify the home to accommodate a newly acquired permanent disability

- Extended replacement cover paying up to 115% of the sum insured for a damaged item that has increased in value beyond what it was insured for.

Additional Information About John Lewis Insurance

Exclusions

Each type of cover has its own specific exclusions outlined in your policy terms and conditions. In addition, John Lewis has exclusions that apply to all of their Home Insurance policies.

- Wear and tear: any damages caused by normal usage, natural ageing, or in the normal course of maintenance.

- Defective construction or design: Damages as a result of an item’s poor design or build.

- Existing or deliberate damage: Damage that existed prior to taking out your policy or damage caused deliberately.

- Illegal activities: Any damages or loss caused as a result of the building or item being used for illegal activities.

- Rot: Any damage or loss caused by rot, regardless of whether the rot is directly or indirectly caused by any other cover.

- Date change and computer virus: Any direct or indirect loss or damage caused by malfunctioning equipment, which includes computers and any items insured that contain a microchip.

- Pollution or contamination: Any damage or loss associated with pollution or contamination, including radioactive contamination, which was not the result of an intentional act.

- Sonic Bangs: Any loss, damage or expense of any kind caused by pressure waves from aircraft.

- Terrorism and War risks: Damage, loss, liability, or cost of any kind caused directly or indirectly from or in connection to acts of terrorism, war, invasion or revolution.

Additional Cover & Services

No Claims Discount Protection

Normally if you make a claim, you would lose 3 years of your no claims discount and need to build it back up. However, by adding this protection to your policy, you needn’t lose your entire no claims discount. With this protection, you will be able to make one claim in a 3 year period and your no claims discount will not be affected. For any other claims you make during these 3 years, your no claims discount will be reduced by 2 years per claim.

Claiming or using the following additional services will not affect your no claims bonus

24 hour emergency service

24 hour home emergency service is optional or included in some policies. Call when you encounter an emergency at home and contact the service to receive guidance on how to deal with the emergency and organise a tradesperson. You’re covered up to repairs up to £500 / £1,000 / £1,500. If you need to make a claim for a home emergency, the service will try to get a repairman to your home as soon as possible to prevent further damages to your home

Identity Theft Cover

Receive cover of up to £50,000 in the event of identity fraud. This will cover the cost administration fees, loss of earnings, telephone and postal expenses, and the notarising of fraud affidavits.

Legal Expenses

You are covered for up to £100,000 for legal fees and professional mediation relating to personal injury, consumer protection residential rights, employment and tax. You can also call a legal advice team offered as a complimentary services.

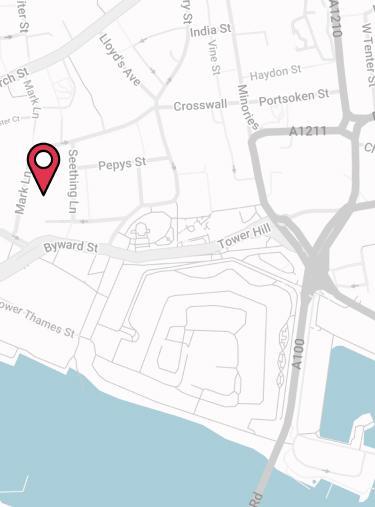

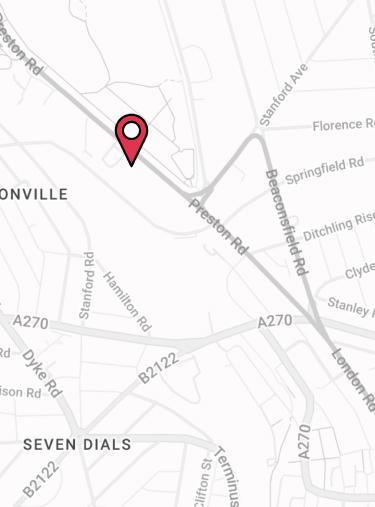

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

![John Lewis Home Insurance [Review] Image](https://media.drewberry.co.uk/couple-with-pram.svg)

![The AA Home Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2Fwatering-can-brushstroke-thumbnail.png&w=480&q=75&dpl=4216)

![Aviva Home Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FArchitect%402x.png&w=480&q=75&dpl=4216)