Annuities are not fully index linked. There is a cap on them.

How To Achieve A Comfortable Retirement [VIDEO]

Andrew Southgate

Senior Chartered Financial Planner at Drewberry

Watch Drewberry’s Andrew Southgate discuss your retirement options and how best to achieve a comfortable lifestyle.

Video Transcript

Okay, ladies and gentlemen. Let’s kick this off and start the presentation. So welcome to everybody. My name is Andy Southgate. I’m the Senior Chartered Financial Planner for Drewberry. I have 20 years experience in the wealth management profession, including eight years spent in the Iberian Peninsula advising high net worth and ultra high net worth individuals, families and trusts.

Drewberry is a company based in both London and Brighton. However, as we do the vast majority of our work virtually, we have clients all over the UK, including as far as the north of Scotland. We have a variety of specialisms, including corporate work and insurance. I work for the wealth planning side of the business.

Today we’re going to be talking specifically about the options people have at retirement. At the end, there will be a Q&A session.

Webinar Overview

I’ll just take you through what we’ll cover today and what the agenda is. First of all, we’ll talk about lifestyle in retirement, then something called the retirement smile.

We’ll talk about the advantages and disadvantages of annuities. Taking tax-free lump sums from your pension. We’ll then look at consolidation options for existing and older pensions, then move on to defined benefit schemes.

Finally, we’ll finish up by talking about using savings and investments in retirement to provide an income. Then how you might downsize your property and release capital to provide an income. Then finally, we’ll move on to how Drewberry can help you with all of this.

Firstly, just a quick regulatory slide. The value of pensions and investments, or the income derived from them, can decrease as well as increase. You may not necessarily get back the amount that you invested.

What Lifestyle Do You Want In Retirement?

Regardless of whether you are one year away from retirement or 10, it’s important to have an idea of what you’ll do when you stop work and where you’ll do it. Examples of good questions to ask yourself are.

- What do I actually want to do with my time?

- What hobbies and interests might I pursue?

- Will I work part time or do voluntary work?

- Will I spend more time with family, travel more often and so on and so on.

- And in what location do I want to do this?

- Do I want to move? And if so where to?

- And finally, how much does all this cost?

What Is Your Expenditure?

A really great starting point is to divide up your expenditure into three areas. You can use today’s figures for this as it’s a really good place to begin. We can help you translate that into future figures because we have software that can help.

Firstly look at your essential expenditure. That’s things like groceries, utilities, transport clothes, hairdressing, et cetera. Then you should look at your everyday leisure and lifestyle expenses. These are things like hobbies, restaurant meals out, local travel, theatre, cinema, gym and club memberships and so on. Finally look at the luxury items. Things that in an ideal world you’d like to do. It could be extensive travel, gifts to family, hotel stays, second homes. The list is endless.

Once you’ve done this, you should have come up with a monthly or annual expenditure figure. The next aspect is to figure out whether this can be achieved based on your current resources and if not, what can be done about it. That’s where we can help.

The Retirement Smile

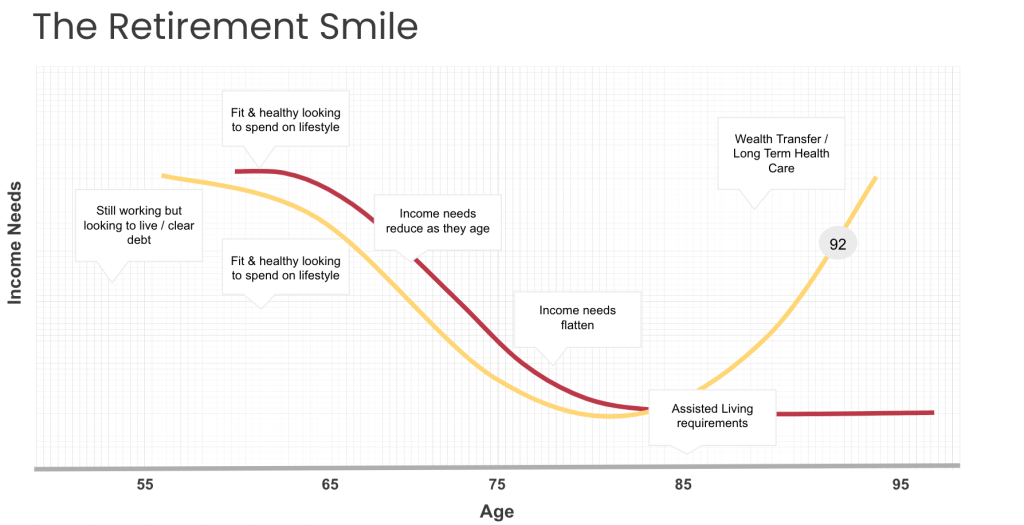

This next slide is known as the retirement smile, and of course there are usually smiles all around when one retires and can enjoy plenty of free time.

This slide, though, is showing the retirement journey in terms of expenditure needs from a study that was done by Standard Life. It shows the difference between what people think retirement expenditure looks like over time versus what it actually looks like.

There are two lines. The red line shows what people think expenditure looks like. The yellow line shows what it actually looks like.

In many cases, people generally have a very good idea of what expenditure may look like from their late 50s through to around their early 80s.

You can see that early on, people are fit and healthy and looking to spend more money and enjoy life. As people age, their expenditure reduces gradually, reflecting the fact that people slow down gently as they get older.

Failing To Factor In Reality

People generally understand how things are likely to progress up until around their early 80s. After this point, you’ll see the two lines start to diverge. This is because a lot of people fail to factor in the reality. Which is that assisted living, that is the cost of care homes, or carers visiting one’s home and so on, is hugely expensive.

Those who live into their mid 80s and beyond are likely to see a very dramatic increase in their expenditure. This will need to be funded essentially by you. That will be until your assets reduce and reach a certain level as stipulated by your local authority. This figure varies regionally in the UK. It’s worth remembering at this point, that later in life, local authorities have powers to sell your home in many situations, or to put a legal charge over it and sell it when you pass away to cover your care costs.

Protecting Your Assets

If the thought of losing almost all of your assets and your home sounds incredibly unappealing to you, perhaps because you’d like to leave a legacy to children or to loved ones. The good news is you can use estate planning to avoid this and as a bonus to avoid inheritance taxes at the same time. But you need to do so early. It’s pretty much impossible to leave things until the point at which you need care because by then it’s simply too late.

So please do talk to us about how we’re able to help.

We’re Living Longer & Need To Plan For It

You can see on the below chart looking at UK life expectancy and as it shows, this has been on the increase since the early 1980s and did slightly drop during 2020. That was because of the pandemic. The point here is that this is an average, and many people will live longer than this.

Planning early is important to ensure there’s enough money to see you through retirement. The following graph gives us an example of someone retiring at the age of 65 who has a target income of £20,000 per annum. This person can expect to live until the age of 80.

The Risk Of Ruin

The below graph shows the falling income that occurs when living longer than expected. The gap between estimated life expectancy and death, and the reduced income that results is what we refer to as the risk of ruin. Obviously this is not a position that you want to be in.

Options For Funding Retirement

Now in our second section, let’s look at some of the options you have to fund retirement.

Let’s talk about the options you have with any pension schemes you may be a member of.

Annuities

Firstly, we’ll go through annuities and answer the question, what is an annuity? An annuity provides you with a regular guaranteed income in retirement.

You can buy an annuity with some or all of your pension pot as long as it’s not a defined benefit scheme. It pays income usually for life. When you use money from your pension pot to buy an annuity, you’re able to take up to a quarter (25%) of the amount as tax free cash if you wish. You can then use the rest to buy an annuity. The income you get is taxed as savings. Annuities are sold by insurance companies.

Advantages Of Annuities

Let look at some of the advantages of annuities. Firstly it’s guaranteed for life, so you’ll never run out of income. You’re also able to build in options to have the annuity increased every year, in line with inflation. This will protect your income from increases in the cost of living, which as we know, is a very hot topic at the moment.

You’re also able to build in death benefits for your spouse. So if you pass away they can receive a percentage of the income you leave behind. Often around 50%. If you have a shortened life expectancy, it’s also possible to get a higher level of income at the outset if that’s appropriate for your circumstances.

Disadvantages Of Annuities

Unfortunately, annuities do come with some disadvantages. The income you’ll typically receive is low. Adding options, such as linking the payments to inflation and providing benefits for your spouse, unfortunately makes the income even lower at the outset.

As a result of this, as well as pensions freedoms, annuities have declined in popularity in recent years. Your annuity cannot usually pass your children when you pass away. If you die early and haven’t built in any options, such as a spouse’s pension, the insurance company simply keeps the money regardless of whether you have received back what you’ve put in. It’s important to take advice as to whether or not you should be considering an annuity as part of your retirement planning.

One of the biggest mistakes people make when purchasing an annuity is that of buying it from their own pension provider. For example, they have a pension with Aviva, then they buy an annuity also from Aviva. There’s no need to do this. You’re actually able to shop around from all the different insurance companies out there and get a better deal.

In the vast majority of cases, you will find a better deal by going elsewhere, so we’ll be able to help you with this.

Pension Drawdown

Let’s look at another way to withdraw from a pension. Pension drawdown, a way to take flexible income from your pension savings.

Over your career, you will hopefully have built up pension savings, either workplace or private pensions. If these are defined contribution pensions as opposed to defined benefit, then you’ll end up with one or more pension pots. You can use the money in your pension to then support you in retirement.

There are several ways to access this money. Drawdown is one of them. Drawdown allows you to make withdrawals of money from your pension pot. The withdrawals are classed as income and are subject to income tax. Although of course, the usual tax-free lump sum of 25% is still available.

You can take as much or as little as you like within the limits of the size of your pension pot. When you set up a drawdown scheme, you’ll draw money out of the pension fund for years to come.

The fund itself needs to be set up to try and make your pension savings last as long as possible. Being invested in assets, such as stocks and shares, your fund will rise and fall with the movement of the stock market. This can deliver strong growth, but can also put you at risk of losing money.

The blend of investments in your drawdown fund can therefore be crucial. You want a mix of assets that can deliver steady growth over the long term, whilst being as resilient as possible in the face of stock market dips. This can be a challenging decision to make, which is why it’s so important to seek financial advice when considering or choosing a drawdown scheme.

Advantages Of Drawdown

What are the advantages then? The main upside is that you can vary your income if you need to spend more in a particular year. You can simply increase the amount of money you take. On the other hand, if you have a low spend year, you can reduce your income and lower your tax bill at the same time.

Another possible benefit is that it has the potential to deliver higher overall income than an annuity. You’re also able to use the drawdown initially and then use some or all of the money later on to buy an annuity. There’s a lot of flexibility and a lot of choice.

Another significant benefit is that you retain ownership of your own pension, unlike with annuity where you surrender the pot. This means that your family can inherit any unspent pension pot when you die, free of inheritance tax. This is particularly advantageous for your beneficiaries if you happen to die sooner than expected.

Disadvantages Of Drawdown

What are the disadvantages of drawdown? The main thing to remember about drawdown is that your pension pot is of limited size, so unlike an annuity, which pays a guaranteed income for life, a drawdown scheme can run out of money. Pension pots can also lose value. If the market performs badly, they can shrink even if you don’t take any income.

Taking money out during a period of low performance makes it much harder for the pot to grow again. Drawdown funds can therefore shrink much faster than expected. If the market performs poorly, this makes it hard to judge how long they will last or how much income you can safely take. It is perfectly possible for drawdown to underperform annuities.

Due to such risks, drawdown schemes need ongoing attention from you by working with your financial advisor—unlike an annuity which takes care of itself once it’s set up. We can help you decide what level of income is appropriate to take from your pot both now and in future, using sophisticated financial forecasting software that we have available for our clients.

What happens to drawdown when you pass away? When you set up a drawdown scheme, you must specify the person or people who will receive any remaining benefits in the event of your death. Any person named in this way is known as a nominated beneficiary. Your nominated beneficiaries will inherit your remaining drawdown fund tax free if you die before the age of 75.

If you die later than 75, they’ll still inherit the fund, but must pay income tax on any money that they take from it. The tax will be charged at the highest marginal rate.

Looking at annuity income over the last 15 years, it dropped quite considerably but has increased recently, owing to improvements in interest rates among other factors. The timing of the purchase of an annuity can be very important. For example, you could have had almost £8000 a year out of an annuity then. It then dropped at its lowest point to just under £5000, in fact around £4700. You can see the differences that can be played out over a period of time.

Uncrystallised Funds Pension Lump Sum

Let’s move on to uncrystallised funds pension lump sum. It does sound really technical, however, it is in fact very simple. It’s a withdrawal of funds directly from the pension pot into which you’ve been saving up. It’s possible to do this at any point once you reach the age of 55 or 57 from 2028, provided you haven’t already accessed the post in some other way, such as setting up a drawdown scheme or buying an annuity.

As you won’t have already taken a 25% tax-free lump sum, when you take an uncrystallised lump sum, 25% of the money is tax free. The remaining 75% is taxed as ordinary income, depending on the rate of income tax you’re paying at the time. You don’t have to take the entire pot in one go. You can take smaller amounts as and when you choose.

Advantages Of Uncrystallised Funds

The main advantage of drawing your pension in this way is short term. If you haven’t decided how you wish to use your pension funds over the longer term, this is a way of extracting at least some of the funds. It also helps to minimise your tax bill whilst you make a decision about what to do longer term.

Another advantage would be if you wish to withdraw your entire pension pot in one go. This is likely to be cheaper than drawdown, although we caution against this very strongly in most cases. Other than that, drawdown offers far more flexibility as to how you withdraw income and tax-free lump sums in most circumstances. Drawdown would be the preferred option, with the caveat that you should talk to us about your specific situation if you’re thinking of going down this route.

Consolidation Options

Let’s move on to consolidation options with pension schemes. Throughout your working life, you may have built up several pensions either through your workplace or personally. As time goes on, it may become appropriate to combine them all into one pot. Typically, this would be more suitable for defined contribution schemes. However, it is possible under certain circumstances to move money out of defined benefit schemes.

The advantages of combining pots are simple. You may be able to lower costs in some cases. A significant advantage is that your pot has a greater chance to grow if it isn’t being impeded by high costs.

It’s possible you’ll also have access to a far wider choice of investment options to suit you. This is especially true if you have older schemes. The admin time will be reduced significantly and looking after one pot is far easier than managing lots of different pots.

You’ll also be able to nominate all your beneficiaries in the event of your passing away in just one scheme. Whilst passing away clearly isn’t an advantage, you will at least have the peace of mind that the people you wish to benefit will receive your legacy.

Some of the advantages of combining pension pots are little known. Some older schemes may have valuable benefits, such as guaranteed rates of growth, guaranteed annuity rates or bonuses that apply when you reach the scheme retirement age. These can be extremely valuable and therefore it is important you use a financial advisor to help you to identify these and what they mean to you should they exist.

Some older pension schemes may also come with penalties and various exit charges should you leave the scheme. It’s important to know if penalties may hinder your retirement plans by moving out of the scheme. At Drewberry, we’ll be able to look at all your pension schemes and help put you in an informed position about what choices you have, what the best course of action for you is based on your specific circumstances.

Defined Contribution Vs Defined Benefit Pension Schemes

Let’s look at defined benefit versus defined contribution schemes. Defined benefits pensions enjoy significant advantages over defined contribution pensions, such as guaranteed inflation-linked income for life. This is extremely valuable in today’s very expensive world.

Savings & Investments

Moving away from pensions, let’s talk about how you can use savings and investments in retirement. Many people build savings and investments throughout their lifetimes. For example, using ISIS share portfolios, national savings and so on to build a pot of money that sits outside their pension.

One option that’s available is that these savings and investments can be used to provide an income in retirement. For example, all accounts could be consolidated into a structured financial plan that provides a regular income and/or the facility to withdraw tax-efficient lump sums.

There are many advantages to using this strategy. Your savings can be professionally managed. Tax allowances can be fully utilised. There is total flexibility to see the amount and frequency of payments made. Your savings pot will also have the opportunity to grow over time and keep pace with increases in the cost of living.

Using Allowances Effectively

It’s really crucial to use allowances effectively. Each individual has an ISA allowance of £20,000, pension contribution allowance of £40,000 per annum, and a personal income allowance (or income tax allowance) of £12,570 per annum.

It’s worth exploring whether you’ll be better off using some of these allowances as a couple. For example, if one of you is a high earner whilst you’re accumulating, then you’ll be able to draw down on these tax efficiently when you reach retirement. We do a lot of work for clients in this area. By efficiently using their allowances, they can build wealth over time without incurring a huge taxation burden.

Often we advise people to use their savings and investments first in retirement, prior to touching their pensions. This is because pensions can be passed on free of inheritance tax. Therefore using savings and investments will lower the value of an estate, meaning that inheritance tax can be reduced or even mitigated entirely in some cases.

There are disadvantages, of course. The level of income is not guaranteed and any savings pot is finite. Once it’s gone, it’s gone. Taxation rules can change over time and they’ll be changing in a very negative way this upcoming April. Investment markets can also fall as well as rise. Therefore it’s very important to seek professional advice before embarking down this route to ensure your money lasts throughout your retirement.

Downsizing

Another popular option is downsizing. Many people consider downsizing their homes in retirement. This can help to release capital to supplement retirement income. You may also be able to pay off any mortgages or debt, lower your utility bills and lower the cost of work and maintenance. Perhaps you’d also like to make gifts to children or grandchildren.

There are some downsides to downsizing that should be considered. Firstly, there’ll be less room for guests. You also have to live with fewer possessions and this will likely come with a change of lifestyle, possibly even a change of area, and for some people, a perceived loss of status.

The really big potential downside (this is a very newsworthy topic at the moment) is that your home may not be worth what you think it is. House prices in the UK in general are falling and they’re set to fall further. If you wish to downsize your home at the moment, in most cases you have to accept a lower offer to make this happen. Therefore, whilst downsizing may be a valuable option for some it isn’t without its risks.

We’ve talked about lifestyle, we’ve talked about pension, savings, investments and indeed, downsizing. So how can we help you make the right decisions for your retirement?

How Can Drewberry Help You Achieve A Comfortable Retirement?

We can provide you with professional regulated advice and provide you with a personalised retirement plan that’s realistic and achievable. It’s based entirely on your goals.

We use sophisticated financial forecasting software to give you a clear picture of how your financial situation may evolve over the course of the rest of your life. We also make sure you don’t pay any more tax than you need to, ensuring more of your money is available for you to use during retirement. We look at any legacies you wish to leave for family, loved ones and charities and how this can be achieved.

We also use the services of Quilter, an FTSE listed company who have scanned the entire market for us to find the best pension investment and savings options out there, at the lowest possible cost to you.

You’ll have access to a team of financial planners and wealth managers with hundreds of years of experience between them and advising clients. We also have dedicated tax support specialists for more complicated scenarios we often come across.

We will regularly meet with you to review your plans to ensure that your retirement stays on track financially and of course, make any adjustments that may become necessary.

Book Your Free 45 Minute Consultation

So how do you get started? We’re able to offer an initial consultation with you and we will cover the cost of this. Usually we arrange a virtual meeting or call with you for around 30 to 45 minutes so we can get to know one another. We’ll explain everything to you during the call. If you don’t want to take things further, that’s absolutely no problem at all.

If, however, you feel you’d like to work with us, then we can then look at going through a formal process which we explain to you fully when we meet. To book your free consultation book a time in my diary.

Thank you so very much for listening. We’ll move forward to any questions that you may have.

Webinar Q&A

My recent experience with inflation indexation suggests that annuities may not be fully index linked. In other words, capped. Is this generally the case?

With a pension pot you have 25% tax free, if you leave your pension pot to your wife, does she also get 25% tax free?

No, your wife would not get your pension pot 25% tax free if you left it to her because you have already taken the 25% yourself. But she would receive it free of inheritance tax. If you pass away prior to the age of 75, she wouldn’t pay any further taxes at all. If it was after 75, then she would pay income tax if she decided to take any money out.

Can you explain the relationship with Quilter in a little more detail?

Drewberry use the services of Quilter. We have to pay for that. What they do is they help us out with all our investments and pensions research. They also negotiate on our behalf with the providers to bring down the costs of things like investment funds. Quilter also do a lot of our compliance work for us, which means we don’t have to do that in-house, saving us a lot of time and money.

If you have several pension plans (providers), does crystallising one affect the others? For example, preventing subsequent UFPLS choice?

Crystallising one does not affect the others, so you would be able to take uncrystallised lump sums from the other schemes as well.

The only thing that would be affected potentially would be your lifetime allowance, because each time you make a crystallisation, that counts towards lifetime allowance.

I have a defined benefit pension and a SIPP. If/when I start getting the pension from the defined benefit one, can my SIPP go to my beneficiary tax free on my death?

Yes, it can. It will depend on whether you passed away before 75 or after, but it would be free of inheritance tax in both scenarios.

If you passed away after 75, then it’s income tax on your beneficiaries when they take money out of that pension pot.

Can you give me an indication of investment returns in drawdown? Typically 4% is stated but what is your view?

Investment returns in drawdown 3.5 to 4% currently, is a fair figure without touching the capital.

It would then depend on your view later on when drawing down whether or not you were prepared to run down capital to a certain extent. Especially later on in retirement where you may not have as much time left—it would really just depend on the size of the pot. But if you were looking to keep capital on an even keel, then investment return you quoted is reasonable.

Is it likely the 25% tax free lump sum will be tinkered with as per news media comments?

The genuine answer is, I can’t give you one because we simply don’t know. What I can say is that successive governments have tinkered with pensions a great deal. We’ve had pensions freedom come in, for example. We’ve had various changes to the lifetime allowance, the annual allowance and so on.

There’s also talk all the time, more or less of reducing the ability to make contributions tax efficiently, in the sense that the government sometimes talk about taking that away from higher rate taxpayers and equalising it.

We just have to wait and see and then deal with it at the time. Unfortunately, financial advisors don’t get the inside track on these these government decisions, I’m afraid.

Please explain a bit more about IHT on unused pension. If I have two pension pots and have started taking pension for one pot, can the second be left to children IHT free?

If you have two pension pots, yes it can, you can leave the second one to children free of inheritance tax.

You mentioned pensions are outside of IHT, but Martin Lewis last night said they were not once accessed? I have accessed one of my pension pots which is in drawdown now.

Pensions are outside of inheritance tax, that’s the way it is.

The only time that the money from the pension would go back into your estate is when you actually remove it from that pension scheme. So if you withdraw X amount of money then that money, once it’s in your bank account is also in your estate.

But presumably the reason that most people take money from a pension scheme is generally to spend it. Therefore it shouldn’t be around in your bank account, hopefully for too long increasing the value of your estate.

If you were to use pension funds to buy other assets, such as property or shares, then they would be in your estate too. But whilst they’re in a pension scheme, especially in drawdown, you’re not going to be paying inheritance tax on that should you pass away.

Can I take 25% tax free from funds in SIPP (not in drawdown)? My provider says no because some of the funds came from crystallised pension scheme?

It sounds as if your provider is correct. Of course you can take 25% from a pension funding a SIPP. But if the fund that went into that SIPP originally has already been crystallised in some way, then no. Presumably the 25% would have been taken at the time. I’d need more context. It seems like your provider is correct, but that might be wrong.

Contact Us

85 Queen Victoria Street

London

EC4V 4AB

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.