Our Money Toolbox

All Our Tools & Research

Since Drewberry started operating all the way back in 2009, we’ve been dedicated to offering our clients financial advice the way we think it should be offered: clear, concise and with no strings attached.

We think it’s important our clients have all the options on the table before making any decisions; otherwise, how do you know if you’re making the best choice?

We have found one of the best ways to understand and support our clients is through our research, tools and guides. Below is a summary of all our best bits in one convenient place.

Our Research…

The 2018 Drewberry™ Protection Insurance Survey

Our Financial Calculators

We have created a number of tools to help our clients make better decisions when it comes to their finances whether that is making sure their income is adequately protection to working out how much their final salary pension could be worth.

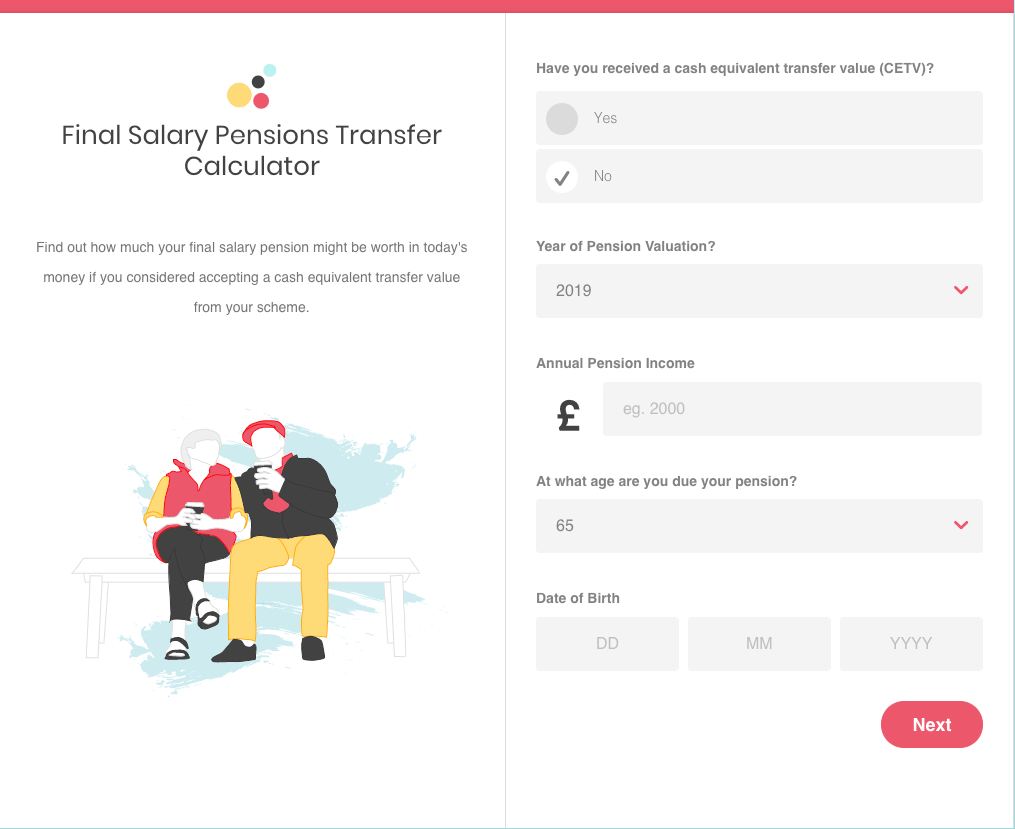

Final Salary Pension Transfer Calculator

A big part of knowing if a final salary pension transfer is right for you is knowing how fair your cash equivalent transfer value is. This calculator:

- Benchmarks your CETV against the market to check the deal you’re getting

- Takes into account metrics such as retirement age, life expectancy and deferment

- Comes with a free guide to defined benefit pension transfers.

Pension Income Drawdown Calculator

If you want to use income drawdown to fund your retirement, you’ll need to know how long your pension will last. This calculator:

- Works out how long your pension will last depending on the monthly income you want to take; OR

- Works out how much income you can take from your pension if you want it to last a set number of years

- Comes with a free guide to pension drawdown.

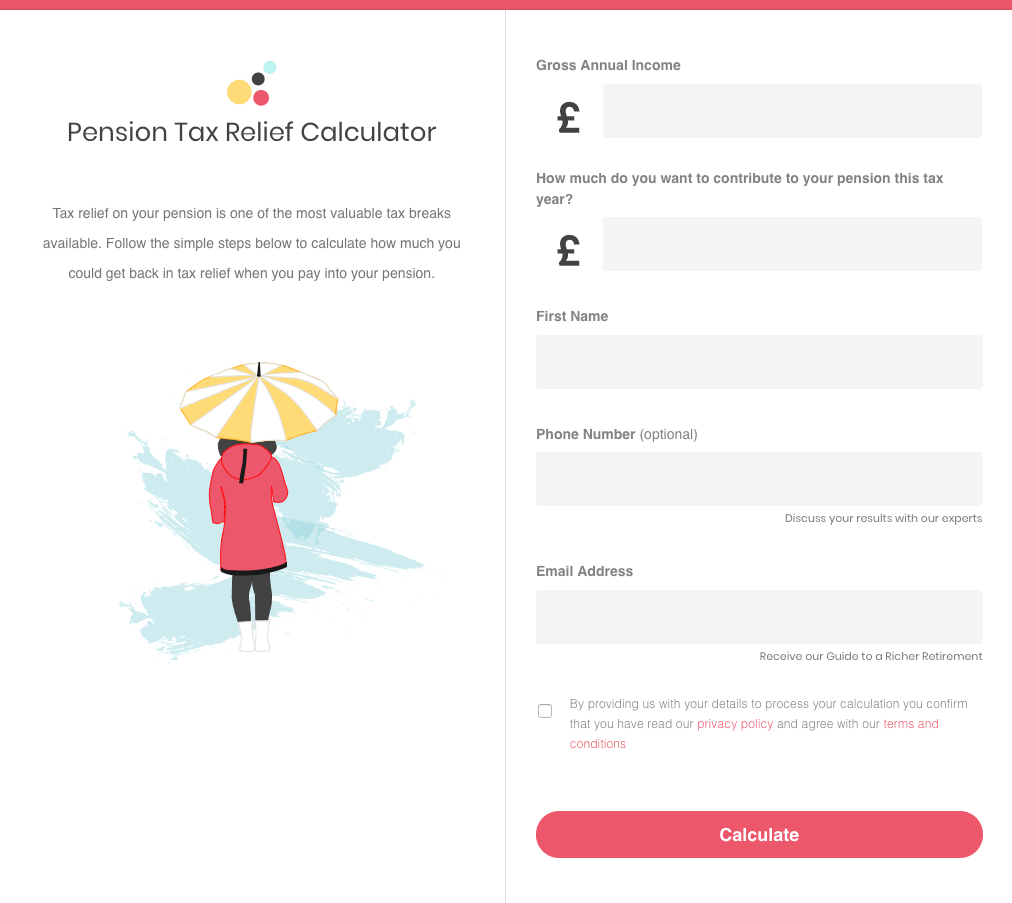

Pension Tax Relief Calculator

Pension tax relief is one of the most generous tax breaks you’ll ever likely receive from the government. This calculator will:

- Works out how much pension tax relief you could be entitled to

- Takes into account the tapered pension annual allowance

- Comes with a free guide to pension tax relief.

Pension Pot Calculator

How much will your pension be worth at retirement? And how long will that last? This calculator estimates:

- How much your pension be worth given current contributions; AND

- How long that will last in pension drawdown

- Also comes with a free guide to richer retirement.

Inheritance Tax Calculator

Forewarned is forearmed. If calculate your potential inheritance tax liability, you have time to work out how to reduce it. This calculator:

- Works out how much inheritance tax you might need to pay

- Includes the new main residence nil-rate band

- Comes with a free guide to inheritance tax planning

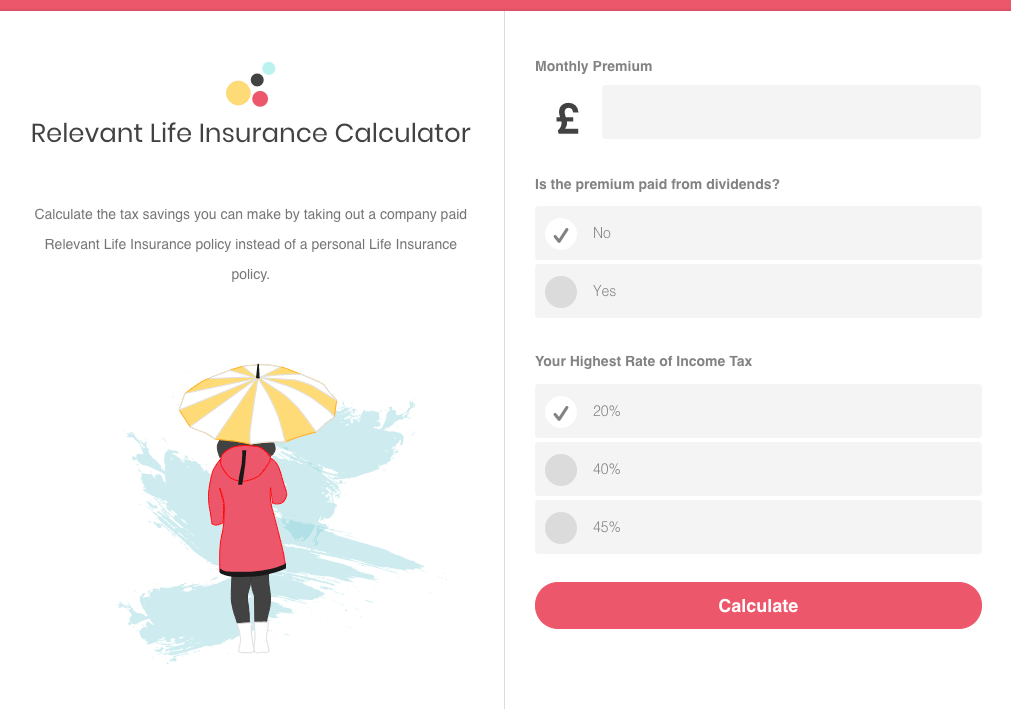

Relevant Life Insurance Calculator

If you’re a company director, did you know you could save up to 50% on life cover with Relevant Life Insurance? This calculator:

- Calculates the tax savings company directors could achieve with Relevant Life Insurance

- Allows you to adjust your National Insurance contributions, income tax bracket and corporation tax rate for more accurate results.

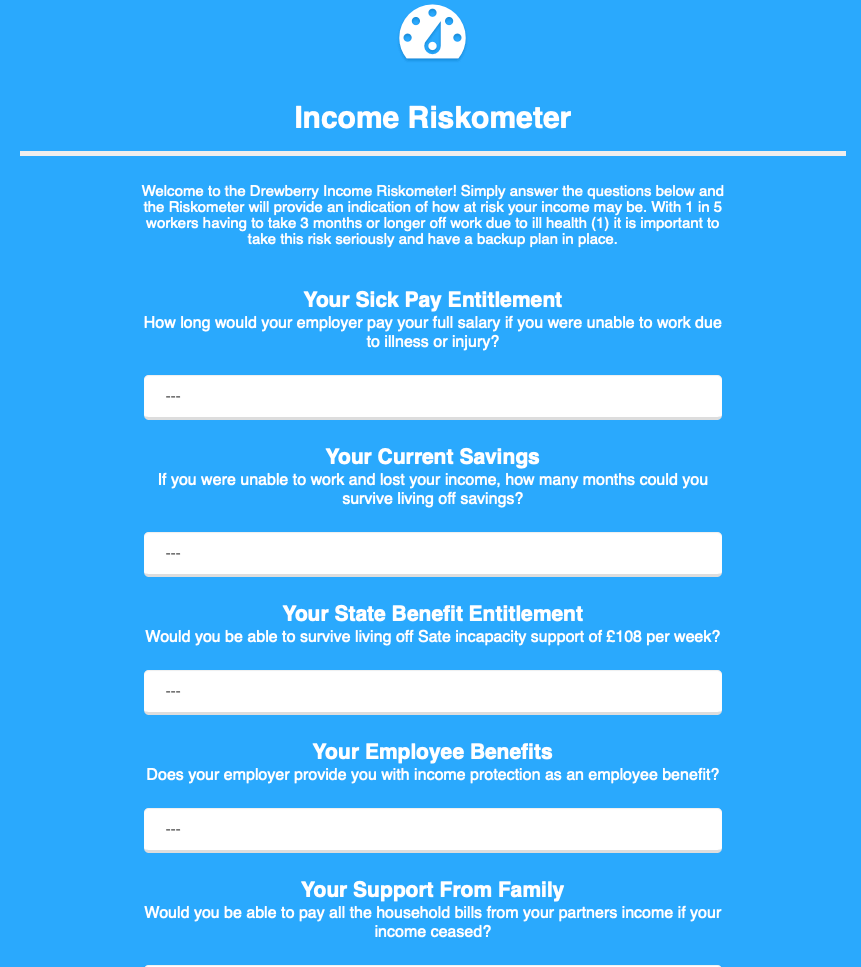

Income Riskometer

Let’s you see just how at risk you are if you could no longer earn your salary. This calculator:

- Pulls together all possible measures of income, such as state benefits and family support

- Takes into account savings, employee benefits and your sick pay entitlement.

Life Expectancy Calculator

Knowing your life expectancy is important for so many reasons, from your pension to inheritance tax. This calculator:

- Uses the government life expectancy data for the most up-to-date results

- Provides your life expectancy in terms of the risk of you dying by a certain age based on your age and gender.

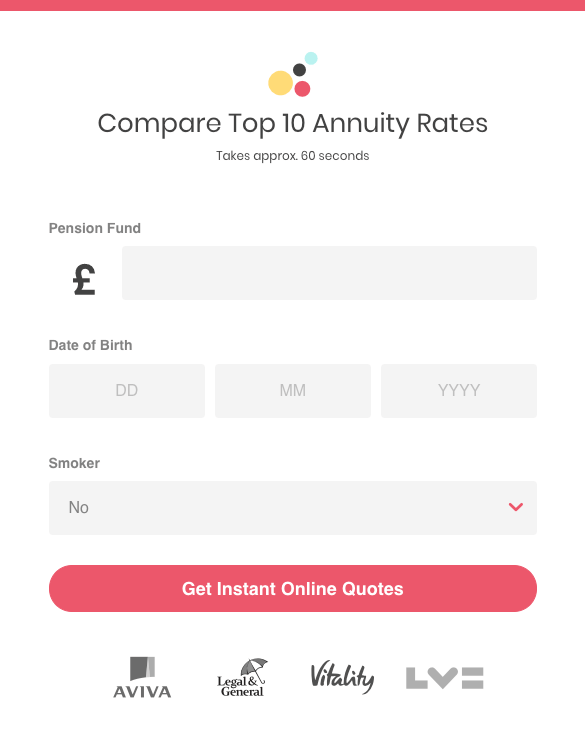

Annuity Rates Calculator

How much in annuity income will your pension buy? This calculator:

- Compares annuity rates from across the UK market

- Offers options for guaranteed and index-linked annuities.

Downloadable Guides

Making Sense of Your Investment Portfolio

- How to start an investment portfolio

- Why asset allocation is so important

- What’s the best way to spread risk?

- Advice on regular portfolio re-balancing once it’s up and running.

Making Sense of Pension Consolidation

- How to consolidate your old pensions into one lean, modern portfolio

- Our top five reasons for doing so

- The types of transfer you might need to consider

- Guidance on avoiding risks associated with consolidation.

Making Sense of Inheritance Tax

- How is inheritance tax calculated?

- Who has to pay inheritance tax?

- Can you reduce the size of your estate with gifts?

- What assets are exempt from IHT?

Making Sense of the Tapered Annual Allowance

- High earner? The tapered pension allowance could hit your savings

- Avoiding the tapered allowance tax trap

- Tax-free pension alternatives, such as VCTs and EIS

Making Sense of Final Salary Transfers

- Why are transfer values so high?

- Why a pension transfer could make sense for you

- Should you consider a partial transfer as a ‘halfway house’?

- The risks of a pension transfer

Guide to a Richer Retirement

- How much should you save into your pension?

- What kind of growth rate might your pension see?

- How to calculate pension tax relief

- Why are pension so important?

Investing Guide for Higher-Rate Taxpayers

- Tax-efficient investments for higher earners

- The lowdown on venture capital trusts and enterprise investment schemes

- Should you invest offshore?

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.