1 in 5 UK Workers Sleepwalking Towards a ‘Retirement Crisis’

- 22% don’t believe they’ll ever be financially secure enough to retire

- 27% believe saving up to 5% of salary into a pension is sufficient to fund retirement

- 40% are relying on their bank savings to help support their retirement

- Cash ISAs remain over three times as popular as stocks and shares ISAs despite interest rates

One fifth of the UK workforce is unsure how they will fund their retirement and have no idea of how much their current pensions are worth, according to research[1] issued today from Wealth and Protection specialist, Drewberry.

Drewberry’s latest annual survey of 2,000 British workers (conducted by One Poll) paints a disheartening picture of a growing disparity between those who are expecting to retire in relative comfort and those who doubt whether they’ll ever be able to stop working.

Annual survey key findings

The latest results highlight that, as a nation, Britain has made painfully little progress in addressing the retirement gap.

Drewberry surveyed 2,000 UK workers and found that far too many either had no idea of how to fund their retirement or were clearly pursuing approaches that have little hope of delivering a worthwhile level of income in retirement.

As director of Drewberry, Tom Conner explains, “the views expressed by the self employed survey participants were especially troubling. According to our findings, just over a quarter (27.7%) of sole traders thought they’d be able to retire by age 65, while almost 46% said they couldn’t see how they’d ever be able to afford retirement. This compares with just 19% of employed respondents who said the same thing.

“Clearly the UK’s self employed workers are far more pessimistic than their employed peers,” says Conner, “although our findings suggest that a good many full-time employees are probably over estimating the value of their current pension arrangements.

“It’s now almost 30 years since the personal pension was launched in the UK,” says Conner, “but despite the success they’ve enjoyed, too few UK savers have come to terms with the fact that the onus now lies on the individual. Around 1 in 5 of all respondents think they’ll never be financially secure enough to retire – even though most will recognise that they simply can’t go on working forever.”

Interesting Findings

1 in 5 Britons…are still unsure as to how they’ll fund their retirement.

More than 1 in 5 UK savers (22%)…don’t expect to be able to retire until after the age of 65, if at all.

Over 1 in 5…have no idea of how much their current pensions are worth

Well over a quarter of UK savers (27.3%) …believe that saving somewhere between 0 and 5% of their salary to a pension will be sufficient to fund their retirement [it’s not!]

Over-reliance on savings and property

Meanwhile, a worrying percentage of respondents (40%) are relying on their bank savings to help support their retirement – even though UK interest rates have fallen through the floor – while almost 24% of Britons expect their property investments to help subsidise their retirement. Almost 8% of respondents stated that buy-to-let investment would deliver additional income in retirement but twice as many thought the equity in their home would do the same thing.

“This is probably one of this year’s most worrying findings,” says Conner. “We think that spiralling property values have created a false sense of affluence for many UK homeowners. While it’s true that their biggest asset is now worth more than it once was, their home is an illiquid asset as well as their main residence.

Based on average UK property prices[2], a retired couple that’s actually in a position to sell the family home and ‘downsize’ will be lucky to clear £100,000 after stamp duty, transaction fees and moving costs. With today’s annuity rates this equates to a measly, RPI index-linked income of around £2,500 a year. This isn’t much to show for two people.

Cash ISAs “all but redundant for most”

The annual Drewberry survey also examined a number of other emerging trends among UK workers.

As Tom Conner explains, “There’s also clear evidence that UK savers are far too slow to adapt to changing financial circumstances. Well over 50% of respondents still use bank accounts as a core way to build their savings despite the fact that, effectively, we no longer have interest rates in the UK.

“Meanwhile, some 44% still have cash ISAs even though the combination of ultra low interest rates and the new tax allowances for earned interest have made them all but redundant for most.

“Only 13% of those surveyed claimed to have a stocks and shares ISA despite the fact that they are far better positioned for long-term growth.”

“It’s clear that the UK still has a long way to go if it is to improve the outlook for those reaching retirement in the next decade or two. Unlike previous generations,” he says, “we have become a nation that’s unwilling to save toward the future cost of retirement or to pay for the advice that most of us will need in order to build a successful retirement portfolio.”

More Interesting Findings

- Britons are three times as likely to insure their pets as their income…more than three times as many people in UK have pet insurance (22.9%) than income protection insurance (7.1%)

- Almost 1 in 5 Britons (18%)…admit to having at least one bank or savings account they’ve kept secret from their partner

- 1 in 5 people…have no idea how they would cope financially if they suffered long-term incapacity (19.75%). More than 40% wrongfully believe they could rely on their savings while another 10% expect their parents to bail them out

Sources

[1] Drewberry’s research was conducted among 2,000 employed and self-employed UK citizens during August 2016. The survey was conducted by One Poll. The key findings of the survey can be viewed at: https://www.drewberryinsurance.co.uk/knowledge/research/personal-finance-survey-2016

[2] Royal London Policy Paper 6 – The Downsizing Delusion 2016

Find > Organise > Simplify

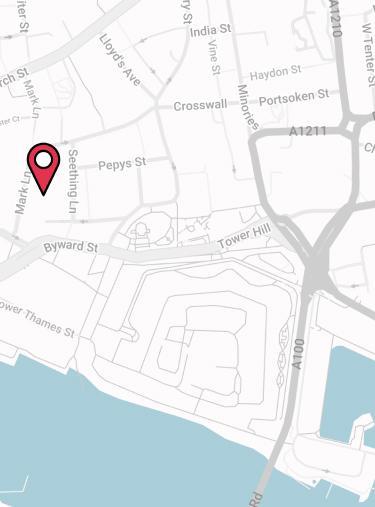

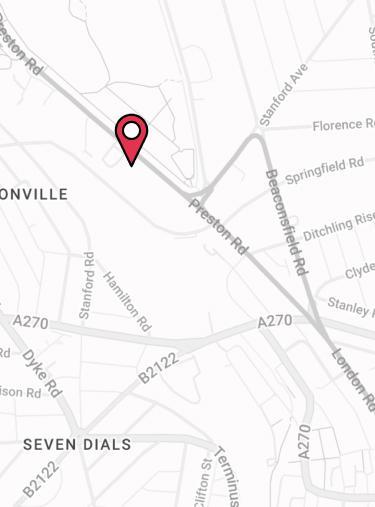

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.