Does a Pulmonary Embolism Fall Under a Critical Illness Claim?

I’ve recently had a pulmonary embolism, is that covered under my Critical Illness Insurance?

I have reviewed some insurer documentation and generally a pulmonary embolism does not fall under a critical illness claim.

Conditions defined as critical illness do vary from insurer to insurer and include conditions such as cancer, heart attack, stroke, multiple sclerosis, blindness and kidney failure. To find the exact list you would need to look at your policy documentation. There will be a list of around 40 conditions.

Any medical conditions resulting from the pulmonary embolism may be covered by the policy so you could also check for these.

- Topics

- Mortgage Insurance

Frequently Asked Questions

Guaranteed or Reviewable Premiums for Mortgage Life Insurance?

Do You Need Life Insurance for a Mortgage? Is It Compulsory?

How Do I Take Out Joint Life Insurance?

Can I Change Mortgage Protection Insurance Providers?

What's the Maximum Payout Length on Mortgage Payment Protection?

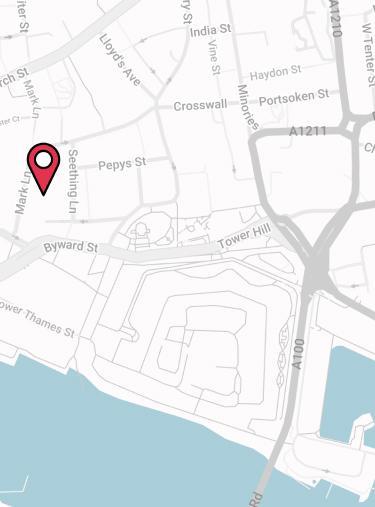

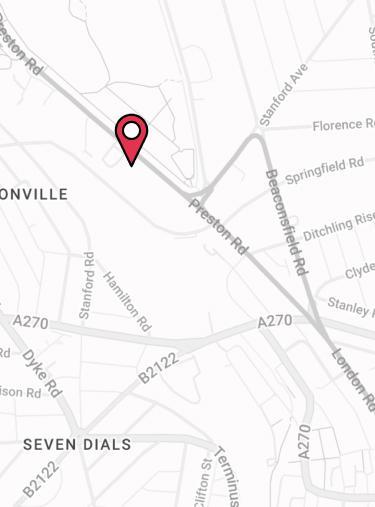

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.