Watch Drewberry’s John Spink and Jonathan Cooper talk to Paul Askham from Octopus Investments about how business owners can extract cash from their company tax efficiently.

Video Transcript

![John Spink Head of Financial Planning at Drewberry]()

John Spink

Head of Financial Planning at Drewberry

Hello and welcome to our Business Owner Webinar focusing on how you can extract profits from your business in a tax-efficient manner. You can hear three voices on this webinar: myself. John Spink, and Jonathan Cooper from Drewberry Financial Planning, along with Paul Askham from Octopus Investments,

Jonathan is our in-house technical guru at Dewberry, and he’s highly experienced and knowledgeable in tax planning for our business owner clients. Paul has been a direct development manager now with Octopus for 5 years and has a lot of experience in financial services totalling over 25 years. Octopus is one of our trusted business partners and a highly-respected provider of tax-efficient investment solutions. Welcome to you both.

At Drewberry, we work with a lot of business owners across a wide spectrum of industries and services. Something a lot of them have in common is being too busy managing the day-to-day activities of running a business, meaning they don’t get the opportunity to take time to plan for their own personal finances.

The result is missing out on available tax allowances and planning opportunities, which in turn has a negative impact on their future wealth and retirement plans.

Many business owners come to us having built up excess cash reserves beyond those needed for a rainy day. With some good financial planning, there are plenty of ways we can advise in such circumstances to be efficient within existing HMRC framework.

We all have the right to arrange our tax affairs in the most efficient way, and withdrawing cash from your company is no exception.

Given there are a number of ways to take money out of your limited company perfectly tax-efficiently without breaking the rules, the first big no-no is to consider practises or schemes the flout tax law or enter into murky waters. Such schemes are considered to be illegal tax evasion. If it sounds too good to be true, the chances are it generally is.

We work with our clients to ensure they extract profits from the companies using agreed allowances and solutions that are within HMRC rules and guidelines.

So enough from me. I’ll hand over to Jonathan, who’s on our technical team, to explain how we can work with business owners in a position to receive sound professional advice.

Before we do so, I am just going introduce you to a client we’re going to be working with today for this presentation. Vijay is a company director / owner who’s built up retained profit in the business totalling £244,000. So he’s come to us as an adviser to ask how he can start to maximise his allowances and ways of removing that money from his business in a tax-efficient way.

Vijay is the owner director of a software company and has £244,000 retained profit within the company. He is looking for a tax-efficient method to extract these profits from his business.

So without further ado, I’ll hand over Jonathan, who will take us through the some of the more traditional ways he can do so.

![Jonathan Cooper Senior Paraplanner at Drewberry]()

Jonathan Cooper

Senior Paraplanner at Drewberry

Thanks, John. Hello, everyone. So obviously the first thing we want to be do is ensure Vijay can pay his bills every month. So we want to get some money out using income tax allowances, etc. So we can get basically £50,000 out as salary for want of a better a description and you only really pay you only 5.3% tax on that.

The way we do that is splitting what’s drawn out between salary and dividends. Salary should be drawn at around £8,632 in this [2019/20] tax year.

That’s a very specific figure and it’s a specific figure for a reason, being that that it is £1 less than than when you start paying National Insurance tax. But importantly, you still get a credit for your state pension. So you pay no tax on that, but you are earning a year’s worth of accrual within the state’s pension regime, so that’s very important.

Thereafter, we’re going to start drawing dividends. The next £3,868 when added to the salary will equal your personal allowance, £12,500 in the current tax year. Again, that’s all tax-free. No income tax to pay, no National Insurance to pay.

The next £2,000 again will be dividends. And that is because each individual has a dividend allowance of £2,000 per tax year. Thereafter we will carry on drawing dividends, but we’re doing that in lieu of any further salary as dividends only attract 7.5% tax.

So by drawing a third further £35,500, we stay within the basic rate band, but we only pay 7.5%. So as I say, taking £50,000 out and only paid 5.3% tax. So £47,337.50 is that sum into Vijay’s pocket, which is pretty good going.

Thereafter, the most common way to continue to withdraw money would be through pensions. Now many people are sort of a bit nervous around pensions or a bit skeptical about them, but they are one of the most tax-efficient vehicles we have in the UK at the moment. The reason for that is you get tax relief on the way in — what you put in is tax-relievable.

Once it’s in there, it grows free of tax as well. And given certain freedoms that came in around a few years ago, there are some very good ways of pulling money out the other end when you retire in a very tax-efficient manner. One that’s often overlooked is that pension pots, if they’re set up correctly, are outside of your estate for inheritance tax so they are also an extremely good generational planning vehicle as well.

So how much can we put into a pension? If you’re paying a contribution yourself, that is from the salary you’ve taken from the company after you’ve paid tax on it, then you’re limited to what you can put in and that is broadly 100% of earnings.

Now, salary counts is earnings, but dividends don’t. So in our example here, Vijay was only drawing £8,632 in salary, so he is limited to that amount as a maximum tax relievable pension contribution. However, that salary link isn’t present if the employer makes the pension contribution instead.

Instead, that’s limited by a wholly and exclusively for the purpose of trade test and something called the annual allowance, which is £40,000 per year. So Vijay here could probably put in a good £40,000 this tax year and that would be defined as an employer contribution and be tax-relievable.

IMPORTANT NOTICE 🧐

The Annual Allowance is increasing from £40,000 to £60,000 in April 2023.

But it gets better than that because there is a piece of legislation called carry forward. Now what this does is it allows you to sweep up unused amounts of contribution allowance from the previous three tax years.

So if we look at Vijay and how this could work for him, then we can see what really useful planning tool this can be. So Vijay, when he set this company up, joined a pension scheme and just set it up as a £1,000 contribution into his pension each month and kind of forgot about it to be honest with you.

So as we can see in the 2016/17 tax year, he put his £1,000 a month in, or £12,000 per year, but that is £28,000 less than the £40,000 annual allowance. So he has £28,000 of available carry forward that he can use in the current tax year.

Same applies for 2017/18 and the same again in 2018/19. Coupled with the £40,000 annual allowance for this year, then he can actually pay an employer pension contribution of £124,000.

He can get that out of the company, get the corporation tax relief on it, and pay no tax on it. So we’ve now managed to get £174,000 out of the company, at an effective rate of tax of 1.53%.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

Thanks, Jonathan, thanks for running through that example. I think there’s some really insightful information there that might be surprising for many people listening today is the extent of what you can invest via a company into a pension.

A number of questions, the sort of thing I often get asked by clients that I thought I should go into today. So, first one is in terms of annual allowances, are they aligned with my business, so my corporate tax year, or are they aligned with the tax year?

![Jonathan Cooper Senior Paraplanner at Drewberry]()

Jonathan Cooper

So personal allowances in terms of pensions and income tax and what have you, they are aligned with the tax year. If you’re making employer contributions then your company’s accounting year may not run in line with the tax year, so those pension contributions would be accountable within the tax year in which you make those contributions.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

Another question that came up and you mentioned something called a wholly and exclusively for the purpose of trade in respect to employer contributions. Who decides on that definition, is it something that is done by myself or my accountant?

So by HMRC’s own admission, it’s a bit of a grey area and it really comes down to the local inspector of taxes.

What the wholly and exclusively test is really trying to do is just to make sure that the remuneration packages as a whole, i.e. salary, dividends and any other benefits and pension contributions, aren’t disproportionate to the work carried out by that person within the company.

So if you’re a company owner / director and you’re generating 100% of the profits or a large chunk of the profits then you’re not likely to have an issue with this.

Where there might be an issue is if there are sleeping partners, perhaps a spouse or something, and they only have a very minor role within the company and you’re trying to put some contributions in at the same level for them, then HMRC might take a bit of a different view on that.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

OK. In terms of the carry forward excise, you mentioned 3 years. Are there any circumstances that we can go beyond that? Is 3 years the limit?

![Jonathan Cooper Senior Paraplanner at Drewberry]()

Jonathan Cooper

3 three years is the limit. It’s a use it or lose it along with the likes with your [capital gains tax] CGT allowance and your personal allowances, it’s available for that year. So basically in our example here, Vijay, if he didn’t make that contribution, he’d lose the ability to carry forward from the the earliest year, which is 2016/17.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

OK. And can all people use at 3 year allowance or are there any examples where that might not apply to someone?

![Jonathan Cooper Senior Paraplanner at Drewberry]()

Jonathan Cooper

The main reason people cannot claim it in full is because they haven’t been an active member of a pension scheme. So that’s what the legislation says, “an active member”, but essentially that means even if you have an old pension scheme from way back when that you’ve forgotten about as long it’s there and it’s got your name on it, then you can use this carry forward.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

OK. And in terms of limits to my pension, you mentioned the the annual allowances, is there an overall limit I can have in terms of the value of my pension pot?

![Jonathan Cooper Senior Paraplanner at Drewberry]()

Jonathan Cooper

Yes. So that’s known as the lifetime allowance. As we’re seeing, you know, pensions are extremely tax-efficient. So the government wished to curb this. So one method is the annual allowance, the other is the lifetime allowance. And that is the total amounts of pension savings you can accrue over your lifetime. So the current limits on that [in 2019/20] is £1.055 million.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

So what are the implications if I go beyond that?

![Jonathan Cooper Senior Paraplanner at Drewberry]()

Jonathan Cooper

Then the taxman takes his chunk basically on the bit above the lifetime allowance. How you take the bit above the lifetime allowance out of the pension determines what tax you pay. If you take it as a one-off lump sum it’s at 55%, if you draw it more as a regular income than you pay income tax on that, plus you pay an additional 25%.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

Right, thanks for that. It’s been a really good example of going through the most traditional ways of extracting profit from a business.

As per my introduction I’d like to pass you over to Paul from Octopus. He’s going to take you through an area of tax-efficient investments that you might not all be familiar with.

![Paul Askham from Octopus]()

Paul Askham

Octopus Investments

Thanks, John. Hello, everyone. Yes. So Octopus Investments are a tax efficient investment provider. We operate in a space where we utilise government incentives for investing in smaller companies to give tax breaks to clients such as a Vijay.

These particular types of investments don’t come without their risks — they’re not suitable for everybody and obviously under the guidance of a financial adviser this is how the business comes to us.

Clearly, tax legislation can change at any point in time, and investment into smaller companies can be more volatile than investment into large FTSE 100 stocks. Individual tax circumstances are obviously different and at the time of writing, they would be applicable to that very investment as and when that’s made. So just just a few areas there to be aware of about the nature and the risks involved in the investment.

A little bit about Octopus: Octopus have been around for 20 years. Now we are the largest provider of these tax efficient investments in this particular space, both in venture capital trusts, enterprise investment schemes and inheritance tax portfolios that qualify for business property relief.

And as a specialist asset manager that work with smaller businesses, we’ve helped support well over 450 companies in their growth and development and going on to good things for the UK economy and our assets under management are now well north of £7 billion.

So we’ve got a long established track record in this space.

So what do we mean by tax-efficient investments? I think potentially sometimes on the face of it they can sound a little bit scary but these are not schemes, these are not loopholes — we’re just utilising government incentives to invest in smaller companies with allowable tax benefits. And what they actually do realistically is sit there right alongside traditional tax-efficient investments that pretty much most people in the Drewberry portfolio will use, such as ISAs and pensions.

You get your tax breaks with those two products and have for years and years and years now. Business property relief and venture capital trusts sit right alongside those. And they’re very complimentary.

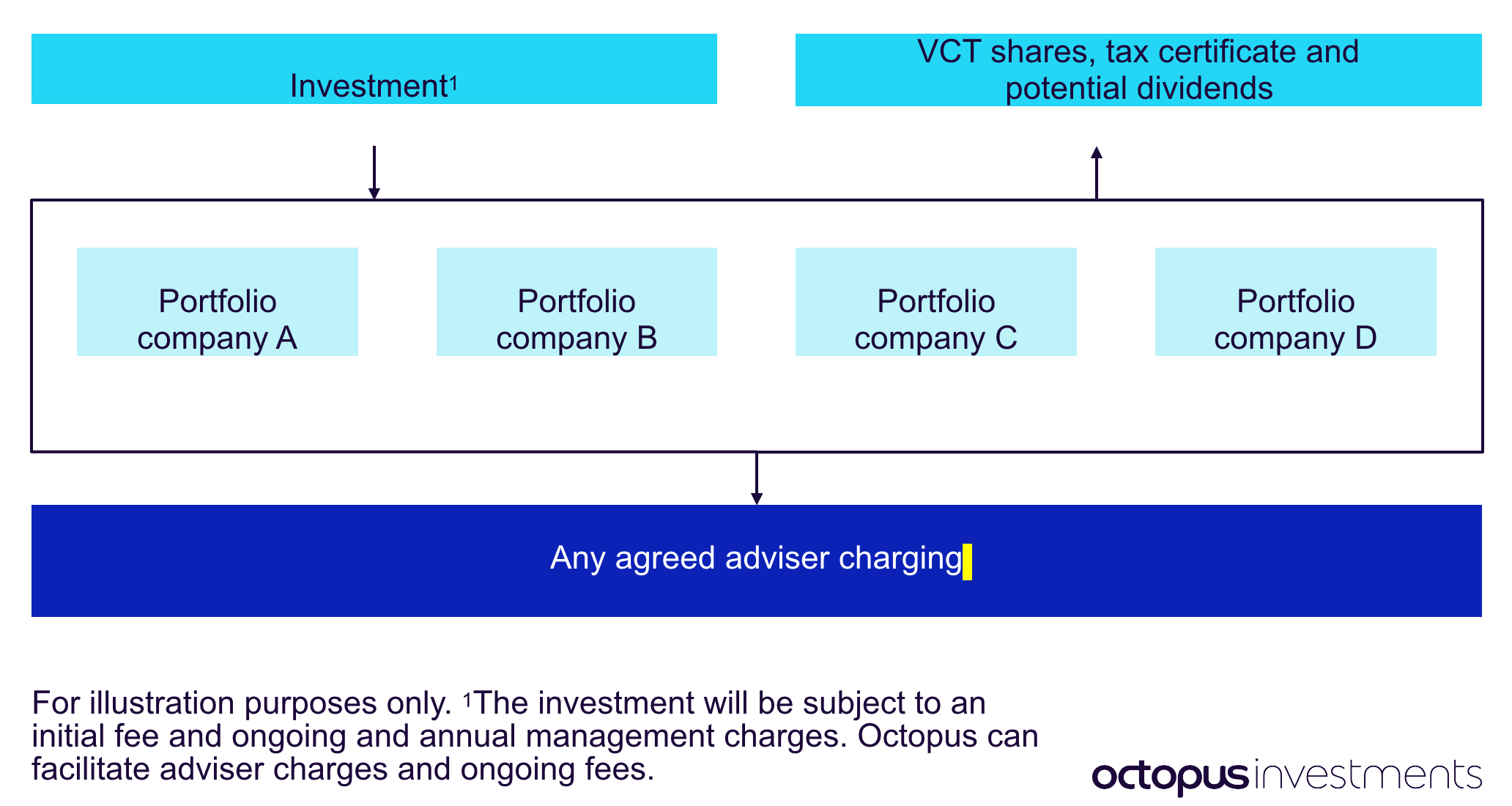

What we’re going to do today, however, and in Vijay’s circumstances, is consider the venture capital trust structure. And this is how it looks. So should a client decide to go ahead with the investment into a VCT in any particular tax year, they will send their cheque into the relevant provider and they will purchase shares in that venture capital trust.

As you can see from the slide here, the venture capital trusts will then distribute those monies into the underlying companies that it holds within that portfolio. In this instance, we just highlight in it that these four companies company A, B, C and D.

![Octopus VCT Structure]()

The norm is that this these portfolios are a lot more diversified, but this is just a kind of illustrative purposes. Once invested, the VCT will send out a share certificate to the client to say that you hold X amount of shares in said VCT and a tax certificate to allow you to go and claim your tax relief.

Many VCTs also target an extra tax benefit of paying out potential tax-free dividends along the way.

So quite a tax efficient investment vehicle overall. VCTs have actually been around in the marketplace in the UK for a long time. And as we’ve already heard, this is an encouragement for the public to invest into smaller companies, to help the UK, help entrepreneurs and help us prosper, grow our businesses, employ people, pay tax all good things that the UK requires.

The maximum amount that any individual can put into a VCT in anyone’s tax year £200,000. This is individuals only — this isn’t from a corporate. It must be an individual investment because what you are doing is claiming against your individual income tax liability for that tax year.

The government will allow you up to 30% income tax relief against the investment targeting those tax free dividends. And should there be any growth within the VCT that will also be free of any capital gains tax.

So how does this play out for Vijay in what Jonathan’s already taken in through with regards to his effective income tax solution alongside his dividend taxation from taking the money out of his business and pension contributions? Well, VCTs are an alternative.

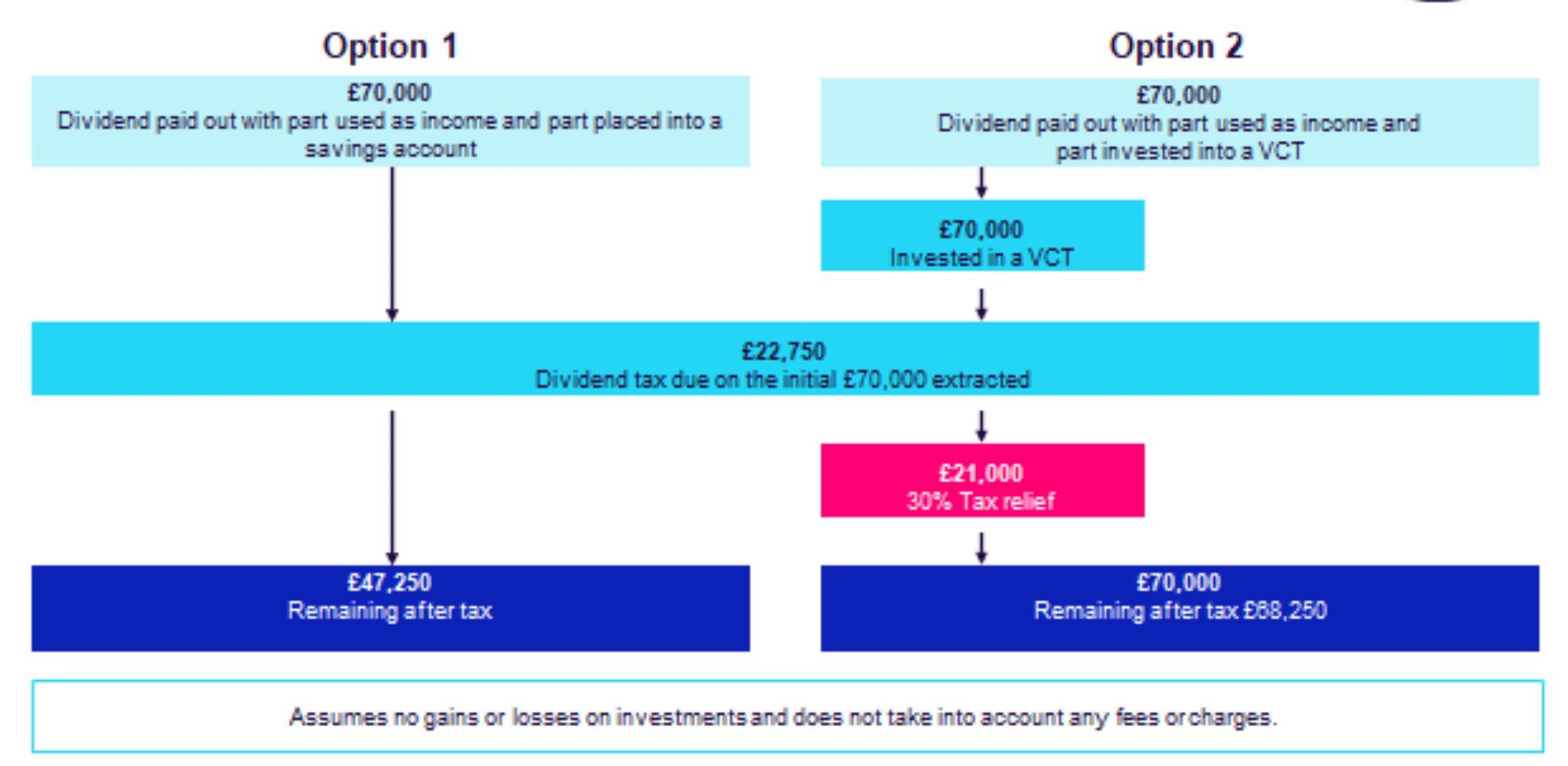

And again, Vijay here has got £70,000 pounds worth of retained profit that he’d still like to extract from his business this tax year.

And in option one scenario, simply what he could do is pay himself back £70,000 as a dividend, taking him into the higher tax bracket of dividend tax, which will now be 32.5%, as opposed to 7.5%, which Jonathan’s already used for his basic rate and therefore incurring a £22,750 tax liability.

Clearly, Vijay can walk away with the difference after tax or, in option 2, he can pay himself the same dividend from his business, creating the same tax charge. But here, where he’s created himself a tax charge, he can drop that money into a VCT and claim back 30% tax relief, which in this situation is £21,000.

So it’s cost Vijay another £1,750 pounds in this scenario to take a further £70,000 pounds out of his business. Quite a tax-efficient means of doing so.

![VCT extraction explained]()

![John Spink Head of Financial Planning at Drewberry]()

John Spink

Great, thanks.

Well, that’s a really good insight into the world of VCTs and I think it demonstrates that with good advice and planning, there are many ways you can extract profits from company with a very low effective rate of tax.

And the example you say with Vijay having taken salary up to the [National Insurance] NI limits and dividend payments at basic rates by using all the allowances from his pensions and VCTs, to generate extraction from the business of £244,000 with an effective tax 1.81%, which is a lot lower than you’d expect.

And in terms of VCTs there’s a few questions we get asked as they aren’t so well-known. In terms of the tax certificates that you get for VCTs, how do you claim for those?

![Paul Askham from Octopus]()

Paul Askham

OK, so once the money is invested and allotted into the VCT, the tax certificate and the share certificate is generally sent out around about 4 weeks after that allotment’s made.

The tax certificate is the piece of paper that you need to either go via your accountant and claim your tax back through your accountant or self-assessment at the relevant time of year. Or you can make an interim claim to HMRC at any stage during the course of the year.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

Great, OK. In terms of the pension side, Jonathan was talking about sort of previous years and carry forwards. Are there any similar allowances or tax breaks you can use with VCTs?

![Paul Askham from Octopus]()

Paul Askham

There isn’t with a Venture Capital Trust, it’s all about the tax liability that your claim against in the current tax year and therefore when the investment is made in that tax year. So you couldn’t carry back as with the quite nice routes that you can take through a pension, it’s all about the tax year that you’re in.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

And in terms of the investment themselves, is it just in start up companies is that correct?

![Paul Askham from Octopus]()

Paul Askham

It’s a good question.

Obviously, when companies first come to a provider for venture capital, HMRC sets guidelines to say how big those companies can be to ensure that they they qualify for receipt of venture capital.

If they qualify and get taken to a VCT, they can start to take venture capital investment contributions. However, how big those companies grow beyond that point and while they still say inside the VCT is really exactly what the government wants providers to be doing with these VCTs.

We want to be taking small entrepreneurial businesses, growing them effectively, helping them to employ people and do really good things for the economy. So dependent on the VCT and the provided that you look to go with, you could probably find VCT is out there still, maybe just a small startup companies or some with a mix like Octopus where you’re going to have some some smaller companies on that first round of funding for venture capital and some big ones that are well on their journey to hopefully good things.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

So taking the right advice on that is obviously very important.

![Paul Askham from Octopus]()

Paul Askham

Yes.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

So, in terms of selling VCTs or VCT shares, how would I go about doing that?

![Paul Askham from Octopus]()

Paul Askham

So VCT shares themselves are a fairly illiquid, which is one of the reasons why they’re deemed a slightly higher risk. So kind of how to how to get out at the other end when you want to realise your investment, which is beyond the 5 year holding point. Now they are shares after all, so you could go to a stockbroker to live to sell them on the open market.

What they don’t attract on the second time round when you go to sell your VCT shares is the income tax relief that you have been able to claim first time round. Therefore, they’re not as valuable. Therefore, there’s not really a second hand market.

What Octopus do as a provider is to offer a buyback service at certain points during the year. This isn’t always guaranteed, but it’s something that we put there to to look to create a market for people wanting to sell their VCT shares. We offer a buyback service at the moment where we will buy those shares back at current slight discount to their price of 5%.

![John Spink Head of Financial Planning at Drewberry]()

John Spink

Obviously we looked at Vijay as an example today, are there any other sort of key tax opportunities with VCTs.

![Paul Askham from Octopus]()

Paul Askham

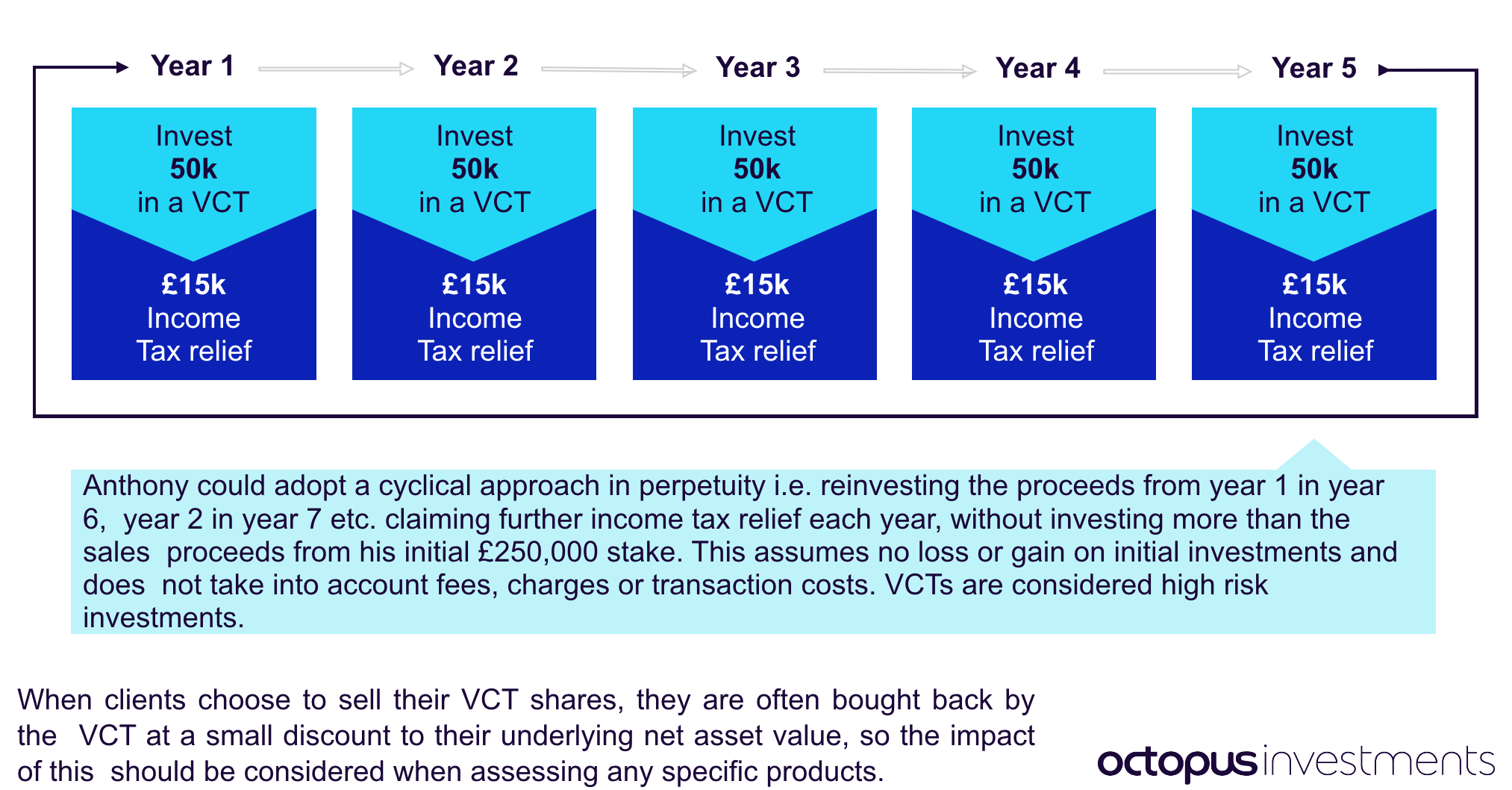

Yes, absolutely. So the way that legislation has gone in the UK, particularly around pensions and kind of the restrictions, as Jonathan mentioned, with the annual allowances and lifetime allowance problems, we’ve seen a number of clients now who are potentially looking to invest into a VCT year on year, such as an annual ISA or an annual pension subscription.

So in this scenario here we’ve got a gentleman who has the ability to invest £50,000 into a VCT every year for a 5 year period. Clearly, he’s got the income tax liability to be able to claim back his full 30%, which is £15,000.

Now, when we get to year 6, as you can imagine, as we’ve just discussed buying back shares, he can look to sell his first year’s investment and what advisers and their clients are looking to do is maybe rolling that investment back around again into another VCT to claim tax relief.

As you can see here, that becomes self-perpetuating on money that you’ve already used. Taken from a business or assets that you’ve got personally. And it can become quite a tax-efficient means of negating some tax liability you’ve got.

![VCT 5 year recycling]()

![John Spink Head of Financial Planning at Drewberry]()

John Spink

Thanks for that. And also thank you again to Jonathan for talking through the other more traditional ways of tax planning. I hope today that you’ve you’ll see learn something and take taking back before we discuss today. Is any further information while you’d like us to provide advice on your individual circumstances, please be in contact at contact details now appearing on the screen.

And we look forward to speaking sometime in future. Thanks very much.