It’s more the planning that goes on before setting it up that’s the difficult part. Once you actually get to understand what kind of trust it is, then the actual setting up part is fairly straightforward. It’s just filling in some paperwork and getting signatures, etc. I think it’s more about how you decide in advance the kind of trust that you’d like to set up.

Mastering Inheritance Tax: Strategies For Preserving Your Family’s Wealth [Video]

Andrew Southgate

Senior Chartered Financial Planner at Drewberry

Watch Drewberry’s Andrew Southgate discuss Inheritance Tax (IHT) and how to preserve your family’s wealth.

Video Transcript

Welcome to mastering inheritance tax strategies for preserving your family’s wealth. My name is Andy Southgate. I’m the Senior Chartered Financial Planner for Drewberry. I have 20 years’ experience in the wealth management profession, including 8 years spent in the Iberian Peninsula advising high-net worth and ultra high-net worth individuals and families.

Drewberry is a company that’s based in both London and Brighton. However, as we do the vast majority of our work virtually, we have clients all over the UK, including as far as the North of Scotland. We have a variety of specialisms, including corporate work and insurance. However, I work for the wealth planning side of the business.

Webinar Overview

Today we’re going to be talking specifically about inheritance tax, and how you can plan to legally avoid or reduce the amount payable on your estate. This is going to be an explanation of:

- Inheritance tax

- How it’s a very complicated regime

- The process of claiming inheritance tax reliefs and exemptions

- The main exemptions and reliefs available

- How to mitigate or eliminate inheritance tax

- Gifts & potentially exempt transfers

- Trusts & Business Property Relief

- Ensuring an inheritance tax liability

- How we at Drewberry can help you.

There’ll be a Q&A; you’ll be able to ask me any questions that you wish to ask.

What’s The History Of Inheritance Tax?

In 1986, Roy Jenkins, who was formerly Chancellor of the exchequer, stated that inheritance tax is a voluntary levy paid by those who distrust their heirs, more than they dislike the Inland Revenue.

Nigel Lawson, also a Chancellor, made a similar quote, “You can either do nothing and volunteer to pay it, or you can take steps to avoid it.”

These quotes have gone on to become famous in financial circles. And whilst these are sound bites, they do highlight the fact that, even today, inheritance tax is legally avoidable with careful planning. Yet, most people do not do so.

The key here is to plan in advance. Leaving matters late is, as we’ll see, not an option when it comes to mitigating inheritance tax.

What Is Inheritance Tax?

Inheritance tax is the tax on the estate of someone who has died, including all property, possessions, and money. The standard inheritance tax rate is 40%. It’s only charged on the part of your estate that’s above the tax-free threshold, which is currently £325,000.

That’s a very basic explanation. We’ll add further layers of complexity, and you’ll see just how much of a minefield this area is.

Let’s look at some of the rates applicable. So as per my previous comment, the rate charged on death is currently 40% after any thresholds are taken into account.

To give a simple example. If your estate is worth £1 million as a single person and you have an allowance available of £325,000, the amount chargeable to inheritance tax would be £675,000 at 40%. That gives you a tax bill of £270,000, payable by the estate, and that’s before any money is released to the beneficiaries of the estate.

Inheritance tax must be paid within 6 months before any money or assets can be released to those inheriting a legacy. After the 6-month period, interest will accrue.

Lifetime Rate

There is also something called a Lifetime Rate, applicable in certain circumstances. Should one gift money into a discretionary trust above the £325,000 threshold, an amount of 20% will be charged on the excess.

If a gift into trust was made of £500,000, then after the allowance of £325,000 has been used, the difference of 175k would be taxable at 20%, giving an immediate liability of £35,000. There’s more on this later when we talk about trusts. Let’s look at some statistics.

The Statistics

The £325,000 threshold for individuals was set in 2009. Jeremy Hunt has now frozen this until 2028. The allowance will, therefore, remain the same for almost 2 decades.

What does this mean? Well, if that threshold saw high inflation since its inception in 2009, it would now be worth £464,643, but it isn’t. It stayed the same. This is known as a stealth tax. These freezes will drag more people into the inheritance tax net.

Analysis by accountancy firm RSM reveals that 10,000 more families could end up paying inheritance tax. The value of their estates will rise. However, the threshold will remain the same, meaning families will have to shell out a larger chunk of their money, especially as inflation in the UK hits a 41 year high of 11.1%.

According to the wealth manager Brown & Brown Health and Employee Benefits, an extra £1 billion in inheritance tax could be paid from April 2026 to 2028. And with more people squeezed financially, you’re likely to see a rise in giving while living. This is lifetime giving to loved ones, particularly to adult children who are struggling to get by in the cost of living crisis.

The extended freeze on thresholds means people will need to seek advice, more than ever, in order to ensure that their families’ wealth is protected and ensure it’s distributed in line with their wishes.

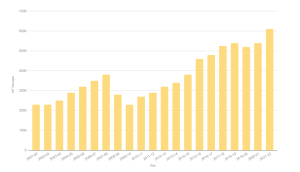

IHT Receipts

It’s also worth noting that inheritance tax receipts received by HMRC during the financial year 2021-22 were 6.1 billion, which was an increase of 14% or £729 million from the year prior. The good news is you can plan to avoid this.

It’s very clear from the chart from HMRC below; inheritance tax receipts have been on the rise substantially.

Exemptions & Reliefs

Inheritance tax is an extremely complicated tax. At the most recent count we performed, there were 94 reliefs and exemptions available under the inheritance tax legislation.

This makes it the tax with by far the most reliefs and exemptions available. To give you an idea of the scope of this, I’ve listed some of them here.

You can see things such as Heritage Property Relief, which includes:

- Works of art

- Scientific collections

- Stately homes, and more.

As well as:

- Death on active duty relief, which is for service personnel, ambulance drivers and so on, dying in the line of duty

- Gifts for national purposes exemptions.

And the above is just the start. Inheritance tax is extremely complex and should not be navigated alone. It’s likely you’ll need both financial advice and, most likely, a world qualified and experienced solicitor, at the very least, to ensure your affairs are in order and your estate is distributed in line with your wishes.

There are some commonly encountered reliefs and exemptions available that many people will end using.

Nil-Rate Band

Firstly, there’s a Nil-Rate band. It’s £325,000 per person and can be transferred between spouses with no tax owed.

Residence Nil-Rate Band

There’s also the Residence Nil-Rate band, which is £175,000. This is a relief that is automatically applied if the estate qualifies and is related to the inheritance of the main home.

The main home must pass to a lineal descendant. This can include children, grandchildren, stepchildren and foster children. There’s no definition provided as to what constitutes a main home. This is decided by the facts of each individual case.

For example, even if a person owns a property, then leaves and rents it out, it can still be considered a main home for the purposes of this allowance.

Tapering

The Residence Nil-Rate band also includes tapering, which applies when an estate is valued above £2 million. So, for every £2 that an estate goes above £2 million, £1 of the allowance is lost. For example, should an estate go over by £100,000, then £50k of the allowance would be lost. This can reduce to zero should the estate be large enough.

Gifting

Does inheritance tax apply to gifts? Everyone can gift up to £3,000 per annum to anyone they choose. This will be immediately outside their estate. You can also give as many small gifts of up to £250 per person as you wish each year. Any birthday or Christmas gifts you give from your regular income are exempt from inheritance tax.

You can also make regular payments to help with another person’s living costs. There’s no limit to how much you can give tax free as long as you can afford the payments after meeting your usual living costs and you pay from your regular monthly income. This includes things like paying rent for your child, paying into a savings account for a child under 18, or giving financial support to an elderly relative.

Gifts To Charity

Gifts to charities are also exempt from IHT, whether they’re made during your lifetime or on death through a will. Where 10% or more of the net estate is left to charity, the charitable bequest is tax free and the remainder of the estate will attract a 10% discount on the rate of IHT paid each tax year.

Marriage or Civil Partnership Gifts

You can give a tax-free gift to someone who is getting married or starting a civil partnership. You can gift up to £5,000 to a child, £2,500 to a grandchild or great grandchild, or £1,00 to any other person.

Take the scenario of a married couple called Bill and Susan, who have 2 children. They own a property worth £500k jointly and have other assets also worth £500k.

If Bill were to die leaving his half entirely to Susan, this would pass to Susan free of any inheritance tax. Were Susan to subsequently pass away, she could then use Bill’s allowances plus her own, meaning the entire amount of £1 million could be passed on free of inheritance tax to the children via their will.

How To Mitigate IHT Using Pensions

Let’s look at how you can mitigate inheritance tax using pensions. We’ll cover what you can put in your pension first.

Annual Allowance

The Annual Allowance is the maximum amount of pension savings an individual can make each year with a benefit of tax relief.

The annual allowance has changed several times since it was introduced in 2006 and is £60,000 currently. It was £40,000 in the last tax year.

Carry Forward Allowance

There’s also something called Carry Forward Allowance that allows you to make use of any annual allowance that you might not have used during the previous 3 tax years, provided you’re a member of a registered pension scheme during the relevant time period.

In effect, this gives you the ability to make more contributions than the £60,000 annual allowance if you have the allowances available from the previous 3 tax years.

To use carry forward, there are certain conditions that need to be met. But it’s beyond the scope of this presentation to go into those conditions. Please do contact us for help if you feel this is something you may benefit from.

Why Use Your Pension?

So, why would you use pensions as a way of mitigating inheritance tax?

Inheritance tax simply doesn’t apply when you pass on your pension money. This is because, unlike other investments, your pension isn’t part of your taxable estate. That’s why it’s tax efficient to keep your savings in a pension fund and pass it down to the future generation.

The money in your pension will not be covered by your will, so you have to tell your provider who you wish to be considered as your beneficiaries. They will take this into account when deciding who to pay your pension savings to.

When you place money into a pension, it’s immediately outside of your estate. However, because of the relatively lower amount you can place into a pension being set at £60,000 a year, older people may not have enough time left to fully mitigate inheritance tax.

However, there are other options which you’ll see later on.

Potentially Exempt Transfers

Let’s look at potentially exempt transfers. So what are these? These are commonly known as a PET. It enables an individual to make gifts of unlimited value which would become exempt from inheritance tax if the individual survives for a period of 7 years.

They only become chargeable if the person who made the gift dies within 7 years of making the transfer. But they’re assumed from the outset to be completely exempt and, as a result, no inheritance tax is payable at that time.

If somebody does die within the 7-year period, the PET will fail and it becomes a chargeable transfer. Tapering relief will apply at the rates seen below.

What About Trusts?

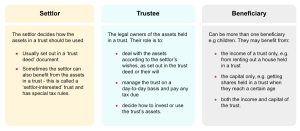

First of all, we’ll explain what they are and then go into how they can be used to mitigate inheritance tax.

A trust is a way of managing assets. That’s money, investments, land or buildings for people. There are different types of trusts, and they’re taxed differently.

Trusts involve someone the settler, the person who puts assets into a trust, the trustee which is the person who manages the trust, and the beneficiary, which is the person who benefits from the trust.

What Are Trusts For?

A trust is set up for a number of reasons. These are not exhaustive but they include:

- Controlling and protecting family assets

- When someone’s too young to handle their affairs

- When someone can’t handle their affairs because they’re incapacitated

- To pass on assets while you’re still alive

- To pass on assets when you pass away (a ‘will trust’)

- Under the rules of intestacy if someone dies without a will (in England and Wales).

There are 3 main roles in a trust:

Chargeable Lifetime Transfers

Let’s move on to something called a Chargeable Lifetime Transfer or CLT. CLT will arise when an individual makes a gift into something called a Relevant Property Trust.

A CLT will be subject to an immediate charge to inheritance tax at the rate of 20% where the value exceeds the Nil-Rate band of £325,000. The liability of inheritance tax rests with the person making the transfer. If that person survives for 7 years from the date of the gift, there will be no further inheritance tax payable. But also there is no refund of any inheritance tax paid at the outset.

As we’ll see, because of this immediate tax charge, often people will make transfers into trust below the Nil-Rate band of £325,000, which doesn’t give an immediate rise to a tax charge.

They are a very common planning tool and should definitely be considered by anyone looking to reduce or eliminate their inheritance tax liability.

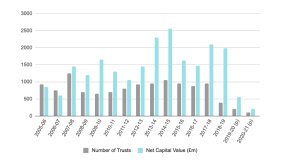

I put the following slide here to illustrate just how common the use of trust is, as you can see many billions flow into trusts every single year in the UK.

How Can A Trust Help Mitigate IHT?

Here, we’ll talk more about how a trust can be used to help. This is a complicated area of planning and financial advice must be sought.

Discounted Gift Trust

What is a discounted gift trust? This is a trust-based inheritance tax planning arrangement for those individuals who wish to undertake inheritance tax planning, but who are unable or unwilling to lose full access to the capital.

In other words, they’d like to mitigate the tax, but also like some access to the money invested. Discounted gift trust arrangements are provided by insurance companies in the UK.

So why is the term discounted used? The term discounted is used because the value transferred on establishing the trust is within the amount actually invested.

We’ll go through an example because this is quite complicated if you’re hearing it for the first time. This is because the person creating the trust is entitled to ongoing capital repayments. The person creating the trust, that’s the settler, is typically entitled to payments on specified dates at the outset, which will cease when they pass away. Payments from the trustees to the settler in a discounted gift trust are capital and not income.

The value of these future payments that the person creating the trust is entitled to is immediately outside the estate of that person. There is a complicated calculation done by the insurance company and it’s partially based on the life expectancy of the settler.

Any capital growth made by the investment over its course will be outside of the estate.

An Example

Let’s look at an example of this. Michelle gifts £100,000 into a discounted trust. From this, she wishes to receive £5,000 per year as an income for the rest of her life.

Based on her health, the value of her right to these £5,000 per year payments is deemed to be £40,000 at the outset. In other words, what’s happened is the insurance company has assessed her life expectancy and expects her to live for around 8 years. 8 years multiplied by £5,000 is £40,000. Therefore, £40,000 is the discount and is immediately outside of Michelle’s estate.

The remaining £60,000 is classed as a gift. If Michelle dies within 7 years, that £60,000 will come back into her estate for inheritance tax purposes, but not the original £100,000, crucially. If Michelle lives more than 7 years, the entire gift will not come back into her estate at all. Meanwhile, any investment growth experienced within the trust is outside of Michelle’s estate.

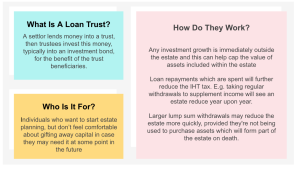

A Loan Trust

Let’s move on to something called a Loan Trust. This involves an individual establishing a trust, but rather than making a gift, the settler lends money to the trust.

This is a very simplified explanation. There are other technical aspects of this beyond the scope of this infographic. You should seek advice from us in this area.

Business Relief

Moving away from trusts and onto something called Business Relief, which formerly was known as Business Property Relief. This reduces the value of business property for inheritance tax. It’s available on the transfer of business assets during a lifetime or on death.

To qualify, the business asset must usually have been owned throughout the 2 years prior to death or transfer. No inheritance tax is payable on the transfer of qualifying business assets into a trust. Therefore, if selling a business, it’s possible to keep Business Relief by placing the proceeds into a trust. Those proceeds will remain outside of the estate provided the 2-year condition has been met.

Also, investing in shares which qualify for Business Relief has become a very popular estate planning option. It has 2 key benefits over the more traditional gifting route as a means to reduce your estate. The first thing is that the investment will be outside the estate after 2 years rather than the 7 years for gifts.

The investor will also retain access to the investment in full and any dividends that have been paid. So just 2 key points. It’s only 2 years rather than 7 and investment will still remain yours as well as any dividends payable.

It’s also possible for the proceeds of previously held business assets to be reinvested in qualifying shares in this way, and still maintain the relief available provided it’s done within 3 years of selling the original business asset.

However, these benefits have to be balanced against the increased investment risk of investing in smaller unlisted companies and the risk that business relief may be withdrawn if in future the business grows. For example, it becomes publicly listed.

A holding of shares in an unquoted company generally involves investing in smaller companies. They are usually not listed on the London Stock Exchange. So things like alternative investment market companies and also enterprise investment schemes.

These arrangements may well be suitable for those who wish to get assets outside of their estate very quickly. An added bonus is that it’s possible to obtain a 30% rebate for income tax on those with a high income tax bill using this method. So, it’s not just about inheritance tax planning. You can also get a 30% income tax rebate as well, which is very handy in many cases.

What About Insurance?

Let’s move onto insurance. We’ll firstly ask the question of can you use life insurance to pay inheritance tax? The answer is yes.

You can take out something called a Whole Of Life Insurance policy which remains enforced until your death. The idea is to cover the bill that you expect your heirs will have to pay. You should think of the insurance policies effectively as a gift to your heirs—which, to all intents and purposes, it’s because they’ll benefit from having an amount of money that will enable them to pay the bill and receive your legacy intact.

Let’s say you expect to be £200,000 over the threshold for inheritance tax. You would need a policy that will pay out £80,000 to cover the inheritance tax bill in full. That is, of course, 40% over the limit now. However, to avoid the proceeds of the policy also incurring inheritance tax, you’ll need to write it in trust so that the benefits fall outside your estate.

If your family doesn’t need your financial support, but you would like to leave them with a lump sum for funeral costs, for example, or to pay off debts; you can also take out something called over 50s Life Insurance.

Finally, if you’re giving a loved one a valuable gift in later life, you can also consider taking out a Level Term Insurance policy that will cover the inheritance tax bill on the gift. Should you die within 7 years again, it would have to be written in trust to be used this way.

Either way, it’s definitely worth speaking with us at Drewberry to ensure you receive the correct advice.

How Drewberry Can Help…

Before we move on to Q&A. How are we actually able to help you with any of this? We’ve talked about some of the basics around how inheritance tax works. We talked about trust arrangements, gifts and allowances, as well as insurance.

How To Make The Right Decisions When Inheritance Tax Planning?

We can provide you with professional regulated advice and a personalised financial plan. This will be realistic, achievable and based entirely on your goals.

We’ll also use financial forecasting software that will give you a clear picture of how your financial situation may evolve over the course of the rest of your life, taking into account inheritance tax along the way.

We’ll make sure that you don’t pay any more tax than you need to, whether that be inheritance tax or indeed any other kind of tax. We look at the legacies you wish to leave for family, loved ones and charities, and how that can be achieved.

We’ll also use the services of Brown & Brown Health and Employee Benefits, which is a FTSE listed company. They scan the entire market for us to find the best insurance, trust and investment options out there, at the lowest possible cost to you. You’ll also have access to a team of financial planners and wealth managers with hundreds of years of experience between them and advising clients.

We also have dedicated tax support specialists for more complicated scenarios that we often come across. We’ll regularly meet with you to review your plans to ensure that your financial plan stays on track. And, of course, make any adjustments that may become necessary, for example, as a result of legislative changes.

How To Get Started?

Well, we’re able to offer an initial consultation with you. We’ll cover the cost of this. Usually we’ll arrange 30 to 45 minute calls. We can get to know one another and we’ll explain everything to you during the call.

If you don’t want to take things further, that’s no problem. If, however, you feel you’d like to work with us, we can then look at going through a more formal process, which will be explained to you fully before we start.

Webinar Q&A

How difficult is it to set up a trust?

What’s the most commonly used strategy if over the inheritance tax limit?

It’s personal to you. I’ve seen these combinations of strategies where people do some gifting and also do some trust work, as well as pensions and insurance. It’s very rare that somebody just goes with one strategy.

The only time I’ve really seen that is when it’s ensuring a potentially exempt transfer where they’ve given money away and they just want to ensure that liability. Generally would be a multi-faceted approach. But it would be entirely down to you. People have different preferences.

Are step-grandchildren covered by the family property relief? (I.e. £1 million Nil-Rate)

The £325,000 Nil-Rate is applicable to every estate. I know step children are definitely covered. There’s no doubt about that. I would imagine if step children are, then step grandchildren also would be because it follows that they are lineal.

But you would need to get advice from a solicitor and get their opinion on it.

Can an offshore bond be reassigned to someone else to avoid it becoming part of the estate?

Yeah, it could be. It depends who they were, where they were, etc. But I would say that’s going to be a potentially exempt transfer because you’re assigning something from money or money’s worth. We have to look at the technical aspects of that.

I don’t have enough detail to give you a definitive answer, but yes, it could be done, but I would presume it would be a potentially exempt transfer.

Do I need to pay tax (like Capital Gains Tax) in order to move a property into trust?

Yes. You probably would. Depends on what type of trust and when. The other thing about that is you can create a trust within your will. Then the actual property wouldn’t necessarily need to move into trust. It would also depend on whether it was your own property that you lived in or a buy-to-let. That’s probably a reason to have a consultation with us just to understand the details.

Can trust be set up through financial power of attorney?

Potentially if you’ve got power of attorney, yes. You could set up a trust for somebody else if they needed to.

Is it a good idea to transfer a Defined Benefit Pension Scheme to a Defined Contribution Scheme in order to place funds outside an estate for IHT purposes, provided sufficient funds are available elsewhere?

Possibly. I have to assess the facts of the case. We do have somebody in-house that can help. There’s a specialist in this area and Defined Benefit Pension Schemes.

When assets pass from husband to wife, or the other way around, no IHT is due. When it passes to children, IHT is due and payable within 6 months?

Yeah, that’s absolutely correct. So when assets pass from husband to wife, no inheritance tax is due. When it passes to the children, inheritance tax becomes due, and it’s payable within 6 months.

Or rather, if you don’t pay within 6 months, you start to pay interest on it. It’s not illegal, but you want to be paying it within that 6 month period to avoid interest accruing.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.