Inheritance Tax and Trusts

Inheritance tax is due at 40% on assets passing from deceased individuals to their beneficiaries if the deceased person’s estate – the sum of most assets they own on death – exceeds the £325,000 nil-rate band inheritance tax threshold. Since 2017/18, there’s been an additional nil-rate band for individuals passing on their main residence to direct descendants.

There also may be inheritance tax due on direct gifts made during to individual’s if the gift-giver dies within 7 years (and potentially up to 14 years) of making the gift.

Trusts are one option on the table to potentially reduce your inheritance tax liability with careful planning but they’re not simple and need careful consideration and specialist advice.

What is a Trust?

A trust is a legal arrangement through which you can give assets to someone so they can look after them for the benefit of a third party.

For instance, you may put some of your cash in trust for your children with the proviso that the managers of the trust don’t release the cash until your children reach a certain age.

There are three important roles relating to trusts:

- The settlor

The person who puts the assets into the trust - The trustee

The person who owns the assets in the trust and is responsible for managing the trust’s affairs, from buying, selling and investing the trust’s contents - The beneficiary

The person who the trust is set up for and is usually unable to manage the assets themselves, perhaps because they’re too young or not particularly good at managing money. The assets in the trust are held for the benefit of the beneficiary.

A trust can be a way to move money out of your estate, thereby potentially reducing an inheritance tax bill due on death. The settlor decides how the assets in the trust should be used in what’s known as the trust deed.

The trustees are the legal owners of the assets in the trust, with responsibility to:

- Deal with the assets according to the settlor’s wishes

- Manage the day-to-day running of the trust and pay and tax due

- Decide how to invest the trust’s assets.

Beneficiaries can benefit from:

- The income of the trust only, for example returns on investments held in trust

- The capital only, for example getting shares held in trust when they reach a certain age

- Both the income and capital from the trust.

There are numerous rules that apply when setting up a trust, all of which vary depending on the type of trust that you use.

For gifts into trust, inheritance tax may be due on the gifts if the individual making the gifts into trust (the settlor) dies within 7 years (and potentially up to 14 years) of making the gift

Trusts are NOT usually entirely free from inheritance tax.

For most types of trust, inheritance tax is charged at a lesser rate (20%) on assets ‘settled’ into the trust at the time the gift is settled – this is known as the lifetime rate because most gifts into trust are chargeable lifetime transfers (CLTs). There may be further inheritance tax due depending on the gap between you making the gift and your death.

Making Inheritance Tax Gifts into Trust

You can make gifts into trust in your lifetime, most of which will be chargeable lifetime transfers (CLTs) and therefore subject to a 20% lifetime charge if the settlor has exceeded their £325,000 nil rate band threshold.

The inheritance tax bill on setting up most trusts will be the value of the property ‘settled’ into the trust, less any inheritance tax allowance you haven’t used in the last seven years. So, if you placed assets worth £400,000 into trust and hadn’t used your allowance elsewhere, you would pay £15,000 (20% of the £75,000 in excess of the £325,000 allowance).

Certain gifts into trust are considered potentially exempt transfers (PETs) instead, which means there’s no immediate charge to pay when putting assets into a trust but inheritance tax may be due on the gift if the person putting the assets into the trust (the settlor) dies within 7 years (and potentially up to 14 years) of making the gift.

Although trusts can offer an effective means to reduce IHT liability, they’re not a one-off purchase. An effective trust will need to be monitored and reviewed regularly to ensure that it continues to do its job.

In most cases, any assets within a trust will be re-assessed for inheritance tax every 10 years to take account of changing valuations.

In most instances, any cash or property that’s put into such a trust will attract an immediate 20% IHT bill if it exceeds that individual’s inheritance tax allowance. If the settlor dies within 7 years (and potentially up to 14 years), up to an additional 20% could then be charged to bring it up to the IHT charge on death.

Common Types of Trust

- Bare trusts

The simplest types of trust, these are generally set up for children who, upon reaching the age of 18, are entitled to both the assets and the income from the trust. The beneficiaries of such trusts are named at the outset and can’t be changed. Gifts into a bare trust are typically considered PETs, not CLTs, so no immediate inheritance tax is due on property settled into a bare trust. - Interest in possession trusts

Where the beneficiary is entitled to an ‘interest’ in the assets within the trust, usually the income the assets produce, but not the income-generating assets. You could set up this type of trust for a partner, giving them a right to the income from the trust but have the assets held for your children. Interest in possession trusts are often set up where an individual remarries but has children from a previous marriage. - Discretionary trusts

The trustees have absolute discretion over how the assets within the trust, and the income they produce, are used. This may be used where a grandparent sets up a trust for their grandchildren, with the trustees being the parents of the grandchildren. - Trusts for bereaved minors

A bereaved minor is a person under 18 who has lost at least one parent or stepparent. Where a trust is set up for a bereaved minor, there are no inheritance tax charges if the assets in the trust are set aside just for bereaved minor AND said bereaved minor becomes fully entitled to the assets by the age of 18. - Trusts for disabled beneficiaries

If the beneficiary of a trust qualifies for (even if they do not claim) certain benefits for disabled people, a settlor can set up a trust for disabled beneficiaries and the trust will not have to pay trust exit charges or the 10 year charge. Gifts into a trust for disabled beneficiaries are PETs, not CLTs. - Mixed trusts

Combines elements from different kinds of trusts, which may involve a beneficiary having an interest in possession (i.e., a right to the income) from half of the trust fund, with the remainder being subject to the rules of a discretionary trust.

Charges and Inheritance Tax on Trusts

Trusts aren’t usually free from inheritance tax and an array of other charges may apply depending on the type of trust you choose and your individual circumstances.

For most trusts, a gift into a trust is a chargeable lifetime transfer, which means that an immediate 20% lifetime inheritance tax charge is due on the assets if they are in excess of the individual’s available nil-rate band. If the individual dies within 7 years – and potentially up to 14 years – of making the gift, an additional 20% may be charged to bring the inheritance tax charge up to the 40% ‘death rate’.

Other charges related to tax include:

- Exit charges

These may apply when taking assets out of a trust or drawing income from the assets within the trust, or when you wind the trust up. - Income tax

With most types of trusts, either the trustees or the beneficiaries will have to pay income tax on the income they withdraw from the trust in the tax year they make the withdrawal. This will be on both dividends and income. It’s important to note that dividend income from trusts isn’t permitted as part of an individual’s annual dividend allowance, so tax is due on all dividend payments from a trust. - Capital gains tax

Capital gains tax is paid when an asset which has increased in value is taken out of or put into a trust. When assets are put into a trust, capital gains tax may have to be paid either by the person selling the asset to the trust or the person transferring the asset to the trust. When assets are taken out of a trust, the trustees usually have to pay the tax if they sell or transfer assets on behalf of the beneficiary and make a capital gain. - 10 yearly charge

This is a complicated tax charge the trustees (or their legal representative) must calculate on each 10 year anniversary on all relevant property within the trust that exceeds the inheritance tax nil-rate band. It’s charged on the net value of any relevant property in the trust on the day before that anniversary. Net value is the value after deducting any debts and reliefs such as Business or Agricultural Relief.

The 7 Year Rule

If an individual dies within 7 years of making a gift into trust, inheritance tax may be due on the assets held within the trust if it exceeds the settlor’s nil-rate band. Inheritance tax is due on a sliding scale on gifts as follows:

|

Years Between Gift and Death |

Tax Due |

|---|---|

|

Less than 3 |

40% |

|

3-4 |

32% |

|

4-5 |

24% |

|

5-6 |

16% |

|

6-7 |

8% |

|

7 years+ |

0% |

This will be in addition to the 20% lifetime rate due on trusts where gifts into it count as a chargeable lifetime transfer, pushing the tax due up to the death rate.

The 14 Year Rule

With most PETs, there will be no inheritance tax to pay providing the gift-giver lives 7 years following the date of the gift. For CLTs, there will typically be no further IHT to pay other than the 20% lifetime charge providing the individual lives for 7 years after the date the gift is settled, also.

However, matters become more complicated when these two types of gift-giving have been combined before an individual passes away.

If an individual makes a CLT more than 7 years before their death and then a PET within 7 years of the initial CLT, then the earlier CLT may also be caught up for IHT calculation purposes. This potentially means gifts made to trusts within 14 years of death could be chargeable.

Illustration:

- 2007: Jane makes a CLT to a trust of £100,000

- 2013: Jane makes a PET of £250,000 to her son, John

- 2015: Jane dies.

While it would initially appear that the CLT, made 8 years before Jane’s death, would be excluded from IHT calculations, matters are complicated by the 2013 PET (note that regardless of the CLT, the PET fails as it was made within 7 years of Jane’s death).

To calculate the nil-rate band available to offset the PET, events in the 7 years prior to the PET must be considered.

In this instance, the £100,000 CLT reduces Jane’s available nil-rate band to £225,000, less than the failed PET she made in 2013.

Jane’s IHT bill on the failed PET would therefore be calculated as such:

- Value of PET: £250,000

- Less available nil-rate band: (£225,000)

- IHT charged at 40% of £25,000: £10,000.

Inheritance tax would also be charged on any residual sums left in Jane’s estate, as all of her nil-rate band had been used by the failed PET.

Important Note

While a CLT made within 14 years of death may not create a liability at death in itself, it could nonetheless reduce the nil-rate band available to offset a subsequent PET where death follows within 7 years of the PET and 14 years of the initial CLT.

Need Inheritance Tax Advice?

Trusts are complicated business. As such, it’s highly recommended that you use an experienced, professional adviser to help you identify the most suitable trust arrangement for your needs and ensure that the trust is properly administered.

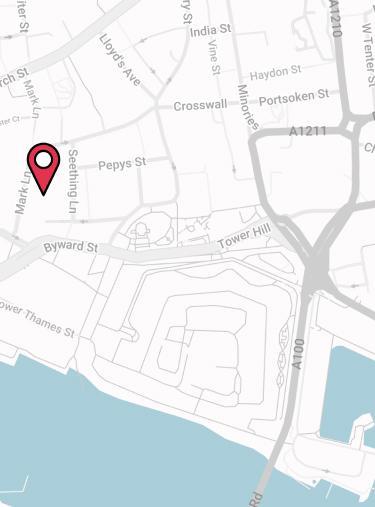

If you require specialist advice then please do not hesitate to pop us a call on 02084327334 or email help@drewberry.co.uk.

- You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 2274 and growing independent client reviews rating us at 4.92 / 5.

- Topics

- Inheritance Tax

- Retirees

Contact Us

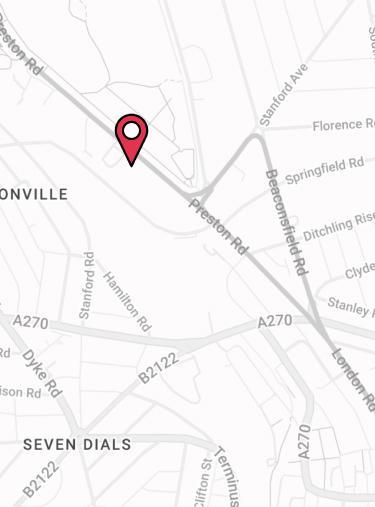

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.