Inheritance Tax and the Transferable Nil-Rate Band

Inheritance tax is a tax that’s due on all of your collected taxable assets — most property, possessions, shares, cash in the bank etc. — you own at the date of your death. After you pass away, this collection of assets is known as your estate.

How Much is Inheritance Tax?

Similarly to income tax, you get an initial threshold of assets you can own before inheritance tax is payable, which is known as the nil-rate band. This stands at £325,000 in the 2019/20 tax year (and is frozen at this rate until 2021). Anything below this is normally tax-free; anything above this is generally taxable at 40%.

So imagine a single individual has an estate worth £400,000. They have an inheritance tax threshold of £325,000 so the first £325,000 of their estate is tax-free. The remainder — £75,000 — is taxable at 40% for a total tax bill of £30,000.

What is the Nil-Rate Band?

The nil-rate band is a threshold below which inheritance tax is not usually payable. You’ll fall below this inheritance tax threshold if the total value of your estate (plus possibly any non-exempt gifts you’ve made in the 7 years — and potentially up to 14 years — of your death) falls below £325,000 as a single individual. Above it, inheritance tax is due at 40%.

The nil-rate band has taken many forms over the years. Its current format dates back to the 1980s and the Inheritance Tax Act of 1986, the piece of legislation that also introduced inheritance tax.

However, it has been long-established previously under the various predecessors of inheritance tax, such as estate duty and capital transfers tax. The nil-rate band itself was not, therefore, introduced by the Inheritance Tax Act 1986.

In the 1986/87 tax year, the first year in which it was introduced, the nil-rate band was worth £71,000. The nil-rate band has tended to increase with inflation over the years but was frozen in the 2008/09 tax year during the onset of the financial crisis as a period of fiscal austerity was brought in by the then-government. It has remained at £325,000 since this point, with a potential review of this due in 2021.

What is the Transferable Nil-Rate Band?

Since October 2007, it’s been possible for spouses / civil partners to pass their nil-rate band to each other for inheritance tax purposes.

Each individual currently gets their own individual nil-rate band of £325,000. This can be transferred to a spouse on death and, providing everything is left to the spouse / civil partner, can potentially up to double the nil-rate band threshold of the second spouse to pass away to £650,000.

The transferable nil-rate band applies where the surviving spouse or civil partner died on or after October 9th 2007; however, it does not matter how long before them their spouse or civil partner died.

This said, if first death was before 1975, the full nil-rate band — if any — may not be transferable as the amount of spouse exemption was then limited until this point.

How to Pass Your Nil-Rate Band to Your Spouse

First things first –– you have to be married or in a civil partnership. Couples divorced at the date of death or couples cohabiting (which many people wrongly think equates to common law marriage) cannot benefit from this transferable nil-rate band.

A claim for the transferable nil-rate band usually has to be made within 2 years of the death of the second spouse / civil partner.

Passing your nil-rate band to your spouse is best done with a will that states your wishes. If you die without a will you are classed as dying intestate, and the laws of intestacy dictate how much a spouse can inherit and how much must be passed to other relatives.

Dying without leaving a will can complicate IHT estate planning as you don’t get to fully dictate how you want to distribute your estate.

The rules of intestacy differ depending on whether the deceased lived in England and Wales, Scotland or Northern Ireland.

In England and Wales, for instance, if the deceased doesn’t have a will and they were married with children, the spouse only inherits the first £250,000 of their deceased partner’s estate and all joint personal possessions. The remainder of the estate is split in two, with the surviving spouse being entitled to half and the other half being split equally between the children (or put into a trust for any children under 18).

Obviously this would severely curtail your ability to inheritance tax plan by leaving everything to your spouse to double their inheritance tax threshold on death.

Do I Need to Leave Everything to My Husband / Wife?

Not at all. You are perfectly entitled to distribute some of your estate to other beneficiaries as well as your spouse, but this will limit the amount of transferable nil-rate band that’s available to you as a couple.

In such a situation where you leave assets to those other than your spouse on your death, HMRC will simply assess the percentage of your nil-rate band you left to your spouse.

So if you left £162,500 to your children and £162,500 to your spouse, HMRC will then use the figure of 50% (£162,500 is 50% of the available £325,000 nil-rate band) to calculate your spouse’s larger nil-rate band based on the legislation on the day that they pass on.

If the nil-rate band goes up, in this scenario your surviving spouse would be able to leave the 50% of the nil-rate band they inherited from you based on the size of the nil-rate band when they die, not when you did.

Let’s assume the nil-rate band rose to £400,000 by the time of their death. In this case, they’d be able to leave an additional £200,000 thanks to your unused nil-rate band, more than the original £162,500 you didn’t use on your death.

Mary and Ken’s Inheritance Tax Story

Mary was a widowed very young. She was just four years into her first marriage, leaving her with two small boys, John and Ross, from her late husband.

Mary later remarried, although Mary and her new husband, Ken, had no children between them. Mary and Ken were happily married for fifty years, but sadly Mary passed away at the beginning of the 2017 tax year.

Mary, who was entitled to no gift exemptions or other allowances, leaves assets totalling £81,250 to John and Ross in her will, using one quarter of her nil-rate band allowance of £325,000.

Mary’s Use of Her Nil-Rate Band | |

|---|---|

Mary’s nil-rate band (2017) | £325,000 |

Assets left to John | £40,625 |

Assets left to Ross | £40,625 |

Total left to John and Ross | £81,250 |

Mary has used 25% of her nil-rate band through her bequest to John and Ross. She leaves the the remainder of her estate, and therefore the leftover 75% of her nil-rate band, to Ken.

Let’s imagine that Ken then lives for another 10 years before dying in 2027, when the nil-rate band has risen to £420,000.

Ken’s Enhanced Nil-Rate Band | |

|---|---|

Ken’s nil-rate band (2027) | £420,000† |

Mary’s unused nil-rate band allowance (value at Ken’s death in 2027) | £315,000 |

Ken’s total nil-rate allowance | £735,000 |

By now, the unused 75% of Mary’s allowance will be worth £315,000 (i.e. £420,000 x 75%), not the £243,750 that was notionally left unused at the time of her death.

This means that Ken now has a total IHT allowance of £735,000 (£420,000 + £315,000) that he can leave before any inheritance tax is due.

If Mary had passed Ken 100% of her nil-rate band in 2017, his total allowance would be £840,000.

Inheritance Tax Advice

If you need help getting your head around inheritance tax, don’t hesitate to get in touch. It’s a complicated business and something that can be incredibly costly if you don’t get it right, which is why it pays to seek the advice of a specialist.

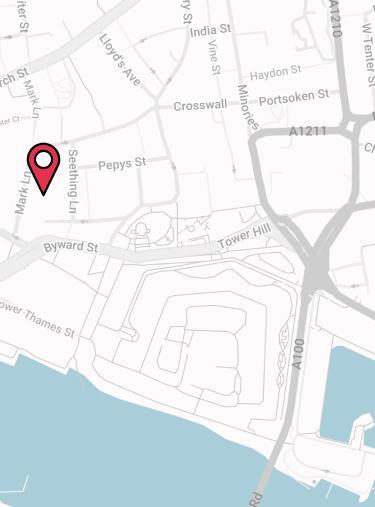

For help and specialist advice, please don’t hesitate to pop us a call on 02084327334 or email help@drewberry.co.uk.

- You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 2274 and growing independent client reviews rating us at 4.92 / 5.

- Topics

- Inheritance Tax

- Retirees

Contact Us

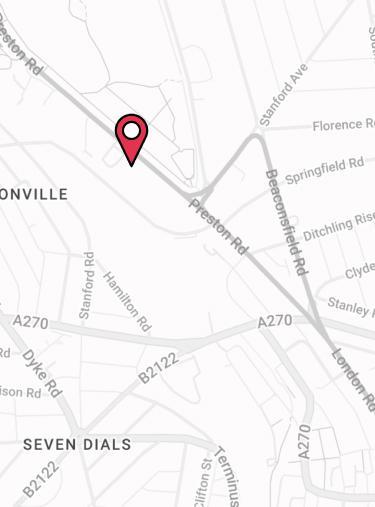

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.