The Business Protection Gap: Business Owners’ Attitudes Towards Protection

Legal and General have examined the business protection gap in a recent survey. They found that under insurance has risen over the last two years and the business protection shortfall in 2013 is £1.35 trillion. The survey also investigated business owners’ attitudes to different types of business protection including key person insurance, shareholder protection and relevant life plans.

Key People

When looking at key people 61% of business owners said that the death or critical illness of this person would have the greatest impact on their business. This was above their premises being damaged by fire and the loss of a major contract. 41% of business owners said that if a key person died or became critically ill the business would cease trading within eighteen months. Despite these concerns only 43% had any life cover for a key person. This raises the question of why businesses are not protecting their key people when they protect assets such as the premises or equipment. Key person protection, also known as keyman insurance, can provide funds to cover the financial impact of losing the key person. For example they could be used to compensate for reduced sales and lost profit or to cover the recruitment and training of a new employee. The main reasons given for not having key person insurance were that the business owner hadn’t thought about it, had not got around to arranging it or were too busy to evaluate it. This highlights the role that advisers can play in explaining the benefits of business protection.

Shareholder Protection

Shareholder protectionenables business owners to purchase the shares of a deceased shareholder thereby retaining control of the business. The survey found that 60% of owners had no protection in place to cover the cost of purchasing shares should a business owner pass away. However 45% thought that the partner shareholders would buy the shares if this happened and 51% wanted their beneficiaries to receive fair compensation for their shares if they died.

Relevant life plans

The survey also asked whether business owners had heard about relevant life plans and how they provide tax efficient life cover for employees or directors. Only 37% of business owners had heard of relevant life plans and only 25% had used them. This shows that there is a real need for advisers to raise awareness of these plans as they are a cheaper way of providing life insurance to the owners and their employees.

Why aren’t business owners insured?

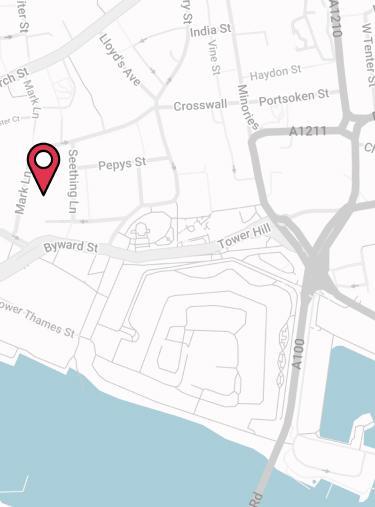

The main reasons the business owners surveyed gave were that insurance cover is too expensive or that they had not considered it. The research found that large businesses with a higher net profit had a greater concern with assessing and managing business risk than smaller businesses, yet all businesses need to be aware of the risks and consider protection. On this note, if they were going to receive advice on protection 44% of owners would prefer to be advised by an insurance broker. In light of these issues, Legal and General and unbiased.co.uk have launched a campaign to raise awareness of the importance of business protection and tackle the business protection gap. Further information about Shareholder Protection, Key Person Insurance and Relevant Life Insurance is available on the Drewberry website. Our business insurance specialists are available on 0208 432 7333 to discuss your options and provide quotes from the whole of the market.

Contact Us

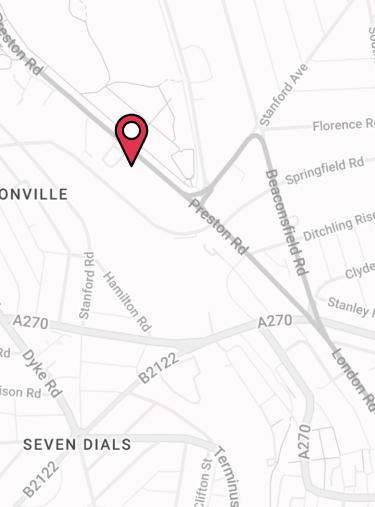

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.