What is Life Insurance?

Life Insurance pays out a tax free cash lump sum to your loved ones should you pass away.

- Provides you with peace of mind your loved ones will be financially secure should the worst happen.

- Life Insurance can align with an outstanding debt, such as a mortgage, or to a sum that would provide financial security to your loved ones in the event of you passing away.

- Opt to include Critical Illness Insurance for an additional premium to offer a payout should you suffer a serious illness such as cancer.

What Does Life Insurance Cover?

Death

Should you pass away during the policy term it pays out a lump sum to your loved ones so they can cover core financial commitments during such difficult times.

Terminal Illness

Many life insurance plans will pay out early if you are diagnosed with less than 12 months to live.

Critical Illness

Provides protection against the risk of a serious illnesses such as heart attack, cancer and stroke. Plans cover anywhere between 5-100+ illnesses, so read your policy’s terms carefully.

5 Minute Video Guide To Life Insurance In The UK

Don’t have time to read the below, but want a quick, expert overview of Life Insurance? Our very own Ben Brooks, has given us a run down of the key factors you need to consider before taking out a policy. Just press play. 👇

Do I Need Life Insurance?

Not everyone needs Life Insurance. If you don’t have any dependents or liabilities (e.g. a mortgage) that you’d want taken care of if you were to die, then Life Insurance possibly isn’t for you. Moreover, Life Insurance isn’t compulsory, not even if you have a mortgage.

However, many clients with families and mortgages look to Life Insurance to provide valuable protection to their loved ones should the worst happen.

Two of the most common uses of Life Insurance include covering the outstanding mortgage balance, allowing your loved ones to stay in the family home should you pass away. Alternatively, you may use your Life Insurance to provide financial security for your family after your death.

A combination of the two is of course also possible depending on your needs – discuss with your adviser regarding the appropriate level of Life Insurance for your circumstances.

What’s the Risk of Passing Away?

We’ve used our Life Expectancy Calculator to work out the risk of a healthy male of three different ages passing away over the next 10 years:

How Does Life Insurance Work?

Life Insurance is a protection policy designed to pay out a cash lump sum to alleviate financial difficulties your loved ones might face after your death.

This payout can be used for anything, from repaying the outstanding mortgage to generally maintaining their lifestyle.

There are a number of different options to consider with Life Insurance which will have an impact on both what the policy covers and how much it costs.

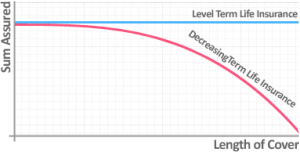

Level or Decreasing Life Assurance?

Level and Decreasing Life Insurance are the two main types of Term Life Insurance. This means the policies last for a set term, covering you if you die within that period of time, and then end.

Level Life Insurance

Level Life Insurance is the simplest of these life products.

You choose a level of cover (e.g. £100,000) and a length of cover (e.g. 25 years) and should you pass away at any point during those 25 years the policy would pay out that chosen benefit to your loved ones.

Level term life cover is most commonly used to protect an interest-only mortgage or provide a level of family protection.

With an interest-only mortgage, where you are not repaying the capital the outstanding debt remains the same over the life of the mortgage, and therefore so should the amount of life cover.

Other uses include providing a level of family protection, setting up a policy with a level of cover which would help your loved ones through the difficult times to ensure any financial pressures are removed.

Decreasing Life Insurance

Decreasing Life insurance is most commonly used to protect a repayment mortgage. The policy will be taken out for the length of the mortgage and the level of cover will decline over time in line with you repaying your mortgage and reducing this debt to zero.

Decreasing term insurance is the most cost-effective form of life insurance for repayment mortgages as the risk to insurer declines over time as the level of cover falls. As a result the monthly premiums are lower than a Level Life Insurance policy.

![Life Insurance Graph]()

What is Whole of Life Insurance?

Whole of Life Insurance is very different from the two types of Life Insurance outlined above.

This is because Whole of Life Insurance doesn’t expire after a set term – it covers you for your whole life, paying out on your eventual death, whenever that may be, providing you keep paying the premiums.

Given that a payout is assured with Whole of Life Cover, it’s sometimes known as Whole of Life Assurance. It also means that premiums are typically more expensive than for a term policy.

Payouts from a Whole of Life Insurance policy are often used to cover funerals or to meet inheritance tax bills as both are liabilities that will definitely arise on death, whenever that may be.

Single or Joint Life Insurance?

A single Life Insurance policy is written on just one life, whereas a joint policy is written on the lives of a couple.

Couples Life Insurance is typically suited to those who share joint liabilities, such as a mortgage and dependents, and would therefore need a Life Insurance payout if one half of the couple were to pass away.

However, getting Joint Life Insurance may not be the best option for all couples. This is because such policies only pay out once, usually (although not exclusively) on the death of the first policyholder.

This would then leave the surviving policyholder without any cover should they later pass away.

It would also only pay out once on the tragic event that the couple both died at the same time, despite both being named on the policy.

Should I Add Critical Illness Cover?

Most Life Insurance plans have the option of including Critical Illness Cover.

Where Life Insurance only pays out on death, a Critical Illness plan pays out the sum assured should you be diagnosed with any one of the critical illnesses as defined by the insurer’s terms.

These conditions include the likes of cancer, heart attack and stroke, which represent the top three claims on all such policies.

Given the risk of suffering a serious illness is a lot higher than that of dying, the monthly premium will increase to include critical illness cover in your policy.

However, should you suffer a serious illness there are often lifestyle changes to make, whether that be reducing working hours, stopping work completely or modifications to your home which can all have a considerably impact on your finances. This is where Critical Illness Cover can step in to help.

Many individuals opt for Critical Illness Cover for the peace of mind it offers should something serious happen.

What About Income Protection?

Income Protection is another form of sickness insurance that you can buy separately from Life Insurance.

While you can’t package it together with Life Insurance as you can Critical Illness Cover, it’s nonetheless a valuable benefit to consider.

Income Protection is designed to pay out for anything that medically prevents you from doing your job – the illness / injury doesn’t have to be critical as defined by the insurer’s terms.

It also pays out what some people may find a more manageable monthly income (a percentage of your pre-tax earnings) as opposed to the lump sum offered by Critical Illness Insurance.

Sometimes Income Protection can be seen as more comprehensive than Critical Illness Cover, although it all depends on your circumstances. Ask your adviser about which is more suited to your needs.

Do I Need to Write My Life Assurance Policy Into Trust?

Writing a Life Insurance policy into trust means at claims stage the benefit is paid from the life insurer directly into the trust to then be distributed to the nominated beneficiaries.

Writing a policy into trust is the best way to ensure your loved ones receive the payout out quickly and the lump sum gets paid to the correct beneficiaries tax free.

A trust means the payout avoids both probate and any inheritance tax so your family receive 100% of the benefit.

How Much Does Life Insurance Cost?

The cost of Life Assurance will depend on a number of different factors, with the main five being:

- How much you choose to insure your life for

- How long you want to insure your life for

- The sort of life insurance policy you choose (e.g. Level / Decreasing Term Assurance, Family Income Benefit or Whole of Life Assurance)

- Your current state of health and any pre-existing medical conditions

- Your smoker status.

In the below table, we’ve laid out the monthly cost of Life Insurance for a smoker and non-smoker of various ages.

They’re all looking to insure themselves for £250,000 of Level Life Insurance over 25 years and have no untoward medical history that would impact premiums.

The quotes shown represent the best Life Insurance quotes from across the entire UK market, as of February 20th, 2019.

Top 10 UK Life Insurance Companies

Some of the best UK life insurers include:

- Aegon

- AIG

- Aviva

- Guardian

- Legal & General

- Liverpool Victoria

- Royal London

- Scottish Widows

- Vitality

- Zurich

Of course, there a number of factors you should look at when comparing Life Insurance companies to find out which one is the best for you.

Most life insurers, like all insurers, publish their policy documents on their website, so you can see the level of cover you might be getting if you chose them.

We’ve provided a brief summary of the cover offered by the UK’s leading Term Life Insurance companies in the table below, but for more detail it always pays to check the policy wording carefully.