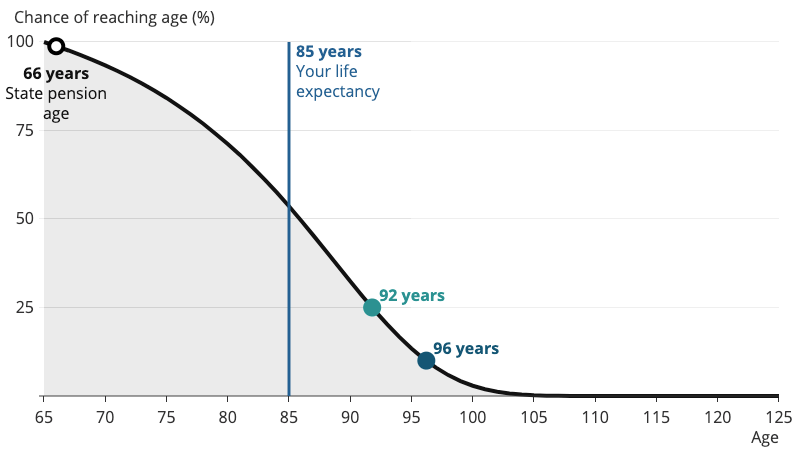

A bit morbid we know, but this tool works out the risk of you passing away based on ONS Life Expectancy Data

Retiring? How to Draw a Sustainable Pension Income…

The retirement income landscape has changed significantly over the last few decades.

Once upon a time, we all had a company final salary pension scheme. This offered some certainty with our retirement income and the only decision we had to make was whether to opt for a lump sum.

Then annuities became another option. Here, whilst we had to make some initial choices such as whether to opt for an increasing income and how much we wanted to leave to our partner if we died, it was a one-time decision. We had no need to revisit this.

We now have pension drawdown where we dip into our pension pot like a bank account.

Pension Drawdown & The Risk of Outliving Your Pension Savings

The retirement options this provides are becoming a more popular choice for retirees however if we’re not prudent there’s a real risk of running out of money in retirement!

In this article, we delve into how we can avoid that catastrophe.

What is Pension Drawdown?

Under pension drawdown you pay yourself an “income” directly from your pension pot to fund your retirement needs.

You can structure your income in a manner that suits you:

- Regular monthly figure

- Ad-hoc amounts

- Lump sum

- Smaller ad-hoc lump sums.

This flexibility can provide you with:

- Income tax efficiency

- The opportunity to continue growing your pension pot as it remains invested

- Other planning opportunities, such as providing for loved ones in the event of your death.

Many old pension contracts don’t have drawdown available, so if you plan to take your retirement income this way you may need to transfer to a modern pension. Please contact us if you’d like to check if your pensions are drawdown ready.

This is all good news and for many having this choice and control is the right way to go.

However, there is a price to pay for this. It is your responsibility to carry on managing, reviewing and administering the pension plan. You carry all the risk, investment and otherwise, to ensure the pension meets your income needs for the rest of your life, and possibly other family members’ lives as well.

But how do you know if you have enough and what can you do to ensure you do not outlive your retirement nest egg?

The Risk of Outliving Your Pension Savings

One of the key risks with pension drawdown is ensuring you don’t run out of money.

We must firstly try to ‘guestimate’ how long we need our pension pot to provide us with an income for — and to be honest, most of us are pretty bad at it.

How Long Might You Live?

Numerous studies have shown we tend to underestimate the age at which we will die. Awareness of how lifestyle choices impact our health and improving medical services and treatments mean we are, as an average, living longer.

Office of National Statistics (ONS) tables show this trend. It’s been widely reported that it’s quite reasonable to expect someone born in the year 2000 to live to 100.

This trend of increased life expectancy is currently slowing, but a breakthrough in a key medical area, cancer for instance, will raise the average to a new peak.

There is also a difference between life expectancy and likely date of death. The current life expectancy of a 65-year-old male is 85. However, there is a 1 in 4 chance of him reaching age 92 and 1 in 10 chance of living to 96 according to those same ONS figures outlined above.

Meanwhile, for a 65-year-old female there is an average life expectancy of 87, a 1 in 4 chance of reaching 94 and 1 in 10 chance of living to age 98.

We therefore need to exercise caution when considering how long we need our pension to last. It’s better to be safe than sorry!

Inflation Can Be a Pension Killer

The impact of inflation is well known. What £100 can buy you today will be significantly more than what £100 can buy you in 10 years. Underestimate the effects of inflation and you may exhaust your drawdown pension far too soon.

Whilst past rates of inflation and current government policy can provide a guide, we don’t know what the future rate of inflation will be.

Just a small increase in the rate of inflation can have a devastating effect on retirement spending power, as demonstrated below.

For example, £100 today would be the equivalent of £82 in 20 years if inflation is at 1%, but a mere £36 if inflation were at 5%. Under such a scenario, we’d have to draw much more heavily on our drawdown pension just to maintain our standard of living.

Whilst headline rates of inflation are a common measure, inflation is a rather personal thing. What each of us puts in our shopping baskets each week is likely to be very different and it changes as we move through retirement.

The below chart shows how weekly expenditure on “essential” items changes over time and also by “type” of retired household.

Don’t Underestimate the Impact of Inflation

Don’t underestimate the impact of inflation on the spending power of your drawdown pot. Also, be aware that it can vary significantly depending on the type of retirement that you want to have.

Therefore, it’s essential to factor for a meaningful rate of inflation when determining what you can afford to draw from your pension without the risk of depleting it too soon.

The current Bank of England inflation target is 2% under the consumer price index and 2.5% on the retail price index.

While this is a good place to start, your own personal inflation rate may need finessing.

We would recommend an ongoing appraisal of spending habits and a regular review of your inflation assumptions to ensure this remains meaningful to you.

Investment Returns Can Have a Huge Impact

One of the benefits of a drawdown arrangement is the opportunity for investment growth as the pot remains invested. This can of course help to offset withdrawals taken and prolong how long your pension will last.

However, the reverse is also true. Investments do and will go down as well as up. Drawing sums out of a pension pot that is experiencing negative investment returns will quickly compound with devastating effect.

This phenomenon is known as sequencing risk.

To look at this let us consider a hypothetical pension of £100,000, from which an individual draws £7,000 as income each year. If from outset investment returns are strong but get progressively weaker, after 10 years the fund will be worth £120,537.

Year | Return (%) | End of Year Value |

|---|---|---|

1 | 21 | £114,000.00 |

2 | 18 | £127,520.00 |

3 | 15 | £139,648.00 |

4 | 10 | £146,612.80 |

5 | 8 | £151,341.82 |

6 | 7 | £154,935.75 |

7 | 6 | £157,231.90 |

8 | 3 | £154,948.85 |

9 | -3 | £143,300.39 |

10 | -11 | £120,537.35 |

If we reverse the order of returns, so investment returns are weak to start with, but maintain the £7,000 annual withdrawal, then after 10 years the fund will be worth just £71,951.

|

Year |

Return (%) |

End of Year Value |

|---|---|---|

|

1 |

-11 |

£82,000.000 |

|

2 |

-3 |

£67,716.20 |

|

3 |

3 |

£64,779.17 |

|

4 |

6 |

£62,313.71 |

|

5 |

7 |

£60,298.81 |

|

6 |

8 |

£59,328.69 |

|

7 |

10 |

£157,231.90 |

|

8 |

15 |

£61,228.00 |

|

9 |

18 |

£65,249.04 |

|

10 |

21 |

£71,951.33 |

Whilst this is an oversimplified example, we can see these produce very different outcomes. It is the sequence of investment returns that greatly impacts whether a drawdown pension will be able to sustain withdrawals for life.

We cannot predict which way investments will move. Therefore your retirement plan needs to have the ability to cope with such adverse conditions. You need to ensure that you can afford to take this investment risk and that you have other resources, such as cash savings or lower risk investments, that you can draw on if markets move against you.

What is a Sustainable Rate of Withdrawal from a Drawdown Pension?

To combat some of the risks, and especially the investment risks, there have been attempts to work out exactly what a safe withdrawal rate from an investment is. Others have come up with a set of rules that provides a high level of probability that you will not outlive your retirement savings.

The Bengan Approach

This started in the US in the 1990s with research undertaken by a financial planner called William Bengen. His research pointed to a “safe withdrawal rate” of 4% of the portfolio’s initial value, with income taken increased by inflation each year, and would last for 30 years.

However, this research had many limitations and impractical applications for a UK pension drawdown strategy. To name but a few:

- It was based on US investment data alone

- The testing was based on one of the worst sequencing of investment periods of all time

- It was based on a static bond and equity investment asset allocation

- It took no account of the cost of investment or other charges.

The Guyton and Klinger Approach

Later research by Messrs Guyton and Klinger (one a US-based financial planner, the other a computer scientist) adapted the 4% safe withdrawal. They developed decision rules, such as:

- The withdrawal rule

Increase withdrawal in line with inflation in the previous years, unless the previous year’s portfolio total return was negative. - The portfolio management rule

Extract the gains from an asset class that has performed best in the previous year to provide the income, and move excess portfolio gains (beyond what is needed for the withdrawal) into a cash account to fund future withdrawals. - The capital preservation rule

If the withdrawal rate rises above 20% of the initial rate, then spending should be reduced by 10%. - The prosperity rule

Spending in the current year is raised by 10% if the current withdrawal rate has fallen by more than 20% below the initial withdrawal rate.

These rules aimed to increase the initial withdrawal rate beyond 4% and also set guardrails to ensure spending was not so high as to drastically impede the longevity of the investment nor too low as to severely impact on lifestyle spending.

The Bucket Approach

Another school of thought addressed the investment structure and introduced the concept of the bucket approach.

Under such a scenario, short-term spending is held in cash; mid-term spending allocation invested into bonds and fixed interest; and assets allocated for the longer term are invested into equities. Periodically, the short-term bucket is topped up from the mid-term bucket and that in turn is topped up by the long-term bucket.

Equity Glidepath Approach

An alternative to this is the equity glidepath route, where “buckets” are not replenished. Instead, there is a gradual move to a more heavily weighted equity allocation as cash and fixed income assets are spent first allowing equites to hopefully realise their long-term growth potential.

What Pension Withdrawal Rate is Right for Me?

Whilst there has been much research and hypothesis into what you can do to ensure you do not run out of money in your retirement, there are no hard and fast rules.

Blind implementation of any of the above strategies is no panacea.

Your retirement plans, resources, situation and objectives must be reviewed at least annually.

You must be realistic about what assets you have at your disposal and what you can afford to spend. You must understand and appreciate the risks and be prepared to alter income expectations and your lifestyle should things not go to plan.

Drawdown can offer significant freedom and flexibility, but with that comes responsibility and risk — the level of drawdown that’s right for you will involve a fine balance between these elements.

Need Help? Who Are Drewberry…

As expert financial planners we help clients manage their retirement funds. We provide ongoing advice to ensure their plans are constantly reviewed to provide the peace of mind that’s needed to enjoy retirement.

We use state of the art software that can bring your current financial reality to life and demonstrate what plans could be put into place to improve your retirement.

How Drewberry Helps Our Drawdown Clients

Typically for clients entering drawdown and at each subsequent regular review we ensure we fully discuss and explore the following key areas to ensure your retirement remains on track. This means:

- Fully reviewing your retirement needs and investment strategy to ensure it remains suitable for you.

- Assessing core and lifestyle spending and demonstrate where this can be increased or where there may be a need to temporarily reduce aspirational spending.

- Adjusting your retirement planning to take account of any unforeseen changes in your situation or circumstances, setting new goals and means to meet them.

- Looking at the annuity purchase decision. Is now the right time to increase your secure income base either by full or partial annuitisation of your drawdown pot?

- Examining how other assets and savings can be used to provide tax efficiency or to allow investments to regain ground in adverse investment conditions.

- Considering ways of releasing “income” from property via downsizing or equity release. We discuss whether this is appropriate now or whether there is a potential need for this in the future.

- Considering existing debts. Is servicing a low interest debt and preserving a larger liquid asset base to meet income needs more beneficial to debt repayment. Equally we consider the Inheritance Tax consequences of this.

We apply a holistic planning process to your retirement drawing on the wealth of expertise of our team and resources available to us, to provide you with a sustainable and enjoyable retirement.

Meet Our Clients

Needed to transfer my pension from one company to another and thanks to Sam it went through very smoothly, also like to mention Casey who kept me informed throughout the transaction they were both very helpful, would highly recommend.

- Topics

- Pensions

Our Services & Tools

We use clever technology to bring your financial future to life

- Find, organise and simplify your Pensions, ISAs and other investments.

- Plan your financial future and put a strategy in place to achieve this.

- Regularly review how you are doing to make sure you stay on track.

Contact Us

85 Queen Victoria Street

London

EC4V 4AB

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.