How is Pension Drawdown Taxed?

The taxation of flexi-access drawdown is the most complicated part of drawing your retirement savings in this way. There’s no easy answer regarding the question of how much tax you’ll pay with pension drawdown because it depends on your circumstances.

Broadly speaking, there are four major factors affecting how your pension is taxed in income drawdown:

- How much you withdraw from your pension

- The way you choose to access your pension

- Your total income (including from sources such as the State Pension, investments, buy-to-let properties etc.)

- How much (if any) of the 25% tax-free cash lump sum you withdraw from your pension upfront.

How Do I Access My Pension Through Income Drawdown?

You have three main options for taking cash out of your pension via income drawdown, all of which will have an impact on the amount of tax you’ll pay.

- Withdraw your 25% tax-free cash and allocate the remaining 75% to drawdown

25% will be free from tax and the remainder will be taxed as income when you take it - Take just some of your tax-free lump sum

You can take a proportion of your 25% tax-free allowance, providing a sum worth three times the tax-free total is moved to drawdown to preserve the mandatory 25% / 75% split. The rest of your pension remains invested and uncrystallised, with the option to take further lump sums in the future on the same terms - Take an uncrystallised funds pension lump sum (UFPLS)

Rather than moving your pension pot to drawdown, you can withdraw cash lump sums (the first 25% of which are tax-free and the remaining 75% taxable) direct from your pot.

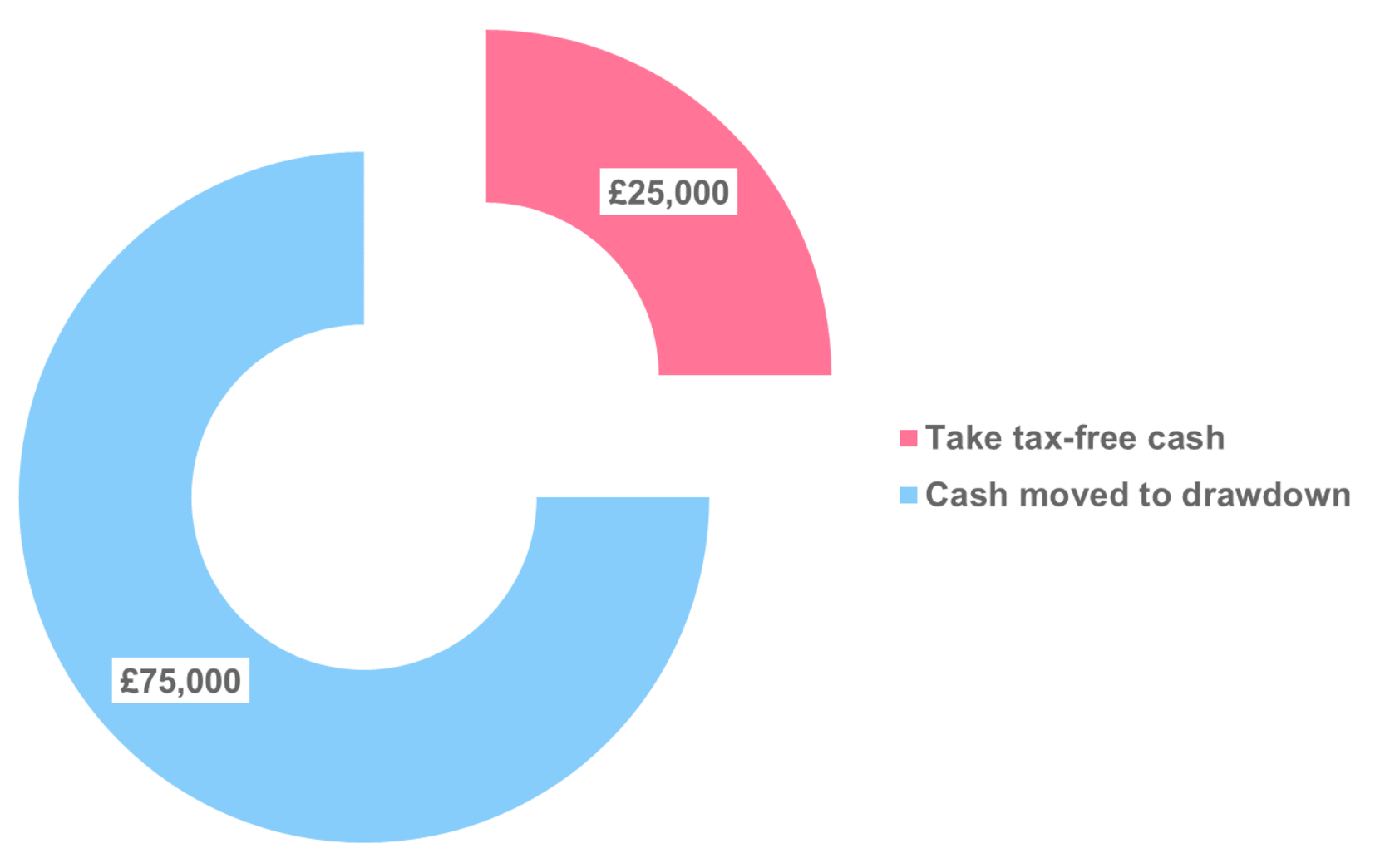

How Much Tax Will I Pay if I Move My Entire Pension into Drawdown?

If you decide to designate your whole pension to flexi-access drawdown in a single tax year, the first 25% of your pension will be available as tax-free cash, so £25,000 of a £100,000 pension pot. This is known as a pension commencement lump sum.

The remaining 75% of your pension pot, £75,000 in this instance, will be moved to a drawdown fund and taxed as income as and when you take it (assuming your total income exceeds your personal allowance in any given tax year).

Once the 75% of your pension is in flexi-access drawdown you can take cash lump sums out of your pension or invest it to provide an income. You can also use a mixture of the two.

In this instance, further withdrawals from your drawdown fund will be added to the rest of your earnings that tax year — including the State Pension — and taxed as income accordingly if it’s above the income tax personal allowance.

Tax On Pension Commencement Lump Sums: Withdrawing Your 25% Tax-Free Cash

You can take 25% tax-free from your pension and leave the rest invested to provide an income at a later date, but the remaining 75% will have to be moved into income drawdown if you don’t want to take any of it yet. You can’t just take 25% tax-free from your pot without moving the remaining 75% into drawdown.

However, once that 75% is in a compatible drawdown arrangement, you don’t have to touch it straight away — you can leave it invested and take an income from it as required.

When you need to take an income, your withdrawal will be added to your other income that tax year and, if you’ve drawn a greater amount than your income tax personal allowance, you’ll pay tax on that drawdown income.

Find > Organise > Simplify

IMPORTANT NOTICE 🧐

As of the Spring budget 2023, the UK chancellor announced the abolition of the pension lifetime allowance (LTA). This came into effect from 6 April 2023.

It’s important to note however, the Labour party has announced that if they were to be elected, the allowance may be reintroduced in the future. If this occurs, we will update our records to reflect any changes. The information on this page is based on the LTA pre 6 April 2023.

How is Phased Income Drawdown Taxed?

Phased or gradual income drawdown sees you slowly shift your pension pot into drawdown over time. Every time you withdraw cash from your pension via phased income drawdown you take just some of the 25% pension commencement lump sum you’re entitled to.

Each time you designate a chunk of cash to drawdown, the first 25% is tax-free. The cash you leave behind stays invested with your pension provider.

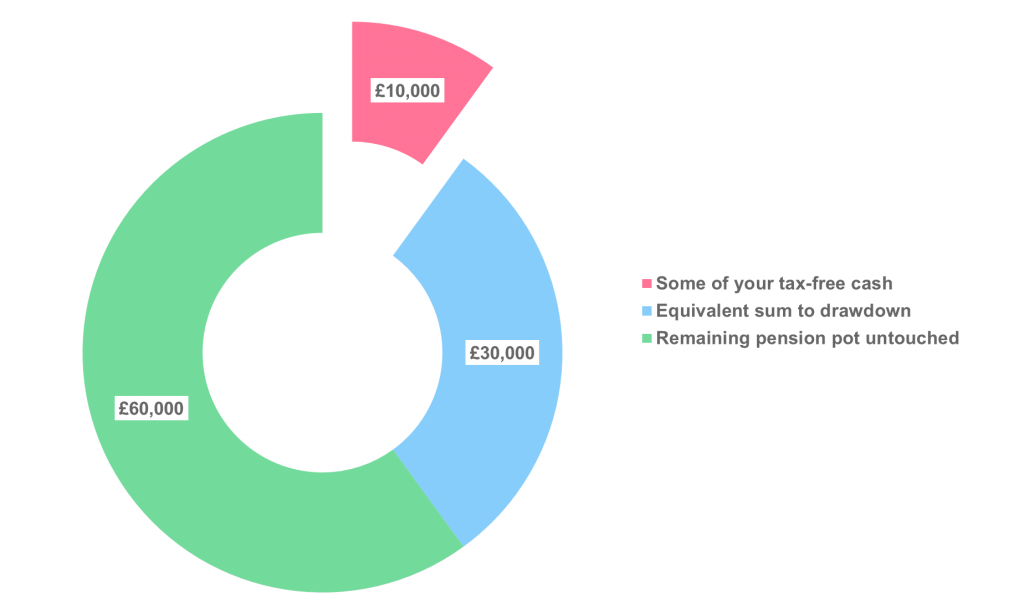

In the example below, Brenda has a total pension of £100,000. She is entitled to take up to 25% of her pension, so £25,000, tax-free.

But Brenda only needs some of that available tax-free cash today – in the example below she wants £10,000, or 10% of her total fund value.

How Gradual Income Drawdown Works

Remember that whenever you take tax-free cash from your pension, it comes with a non-negotiable taxable element along with it worth three times the tax-free cash. This element is designated to pension drawdown.

In Brenda’s case, her £10,000 tax-free cash would also need to be taken alongside £30,000 for a total designation to drawdown of £40,000.

Of this, Brenda would receive £10,000 as tax-free pension cash, 25% of the total amount (£40,000) drawn down from her whole pension pot. The £30,000 moved to pension drawdown will be added to her total income in the tax year she chooses to take it and, if she exceeds her personal allowance, she’ll be charged income tax on withdrawals from the drawdown fund.

After accessing £40,000 of her pension, Brenda has £60,000 still invested. Of this amount, 25% is available tax-free and the remainder (i.e. £45,000 plus investment growth) will be potentially taxable income when she chooses to take it.

IMPORTANT NOTICE! 🧐

For simplicity, this chart assumes no investment changes to Brenda’s pension. This is very unlikely given that a sizeable proportion of her fund will remain invested, so it’s important to consider that the value of Brenda’s retirement savings could go down as well up in line with markets.

Can I Take Small Tax-Free Lump Sums from My Pension?

Yes — you can take small tax-free lump sums from your pension with gradual income drawdown, assuming your pension arrangement permits it.

For each tax-free lump sum you take you must also allocate a non-negotiable amount to drawdown worth three times the amount you get tax-free. So if you wanted to withdraw £5,000 of tax-free cash, you’d also have to allocate £15,000 of taxable cash to your drawdown fund. Remember, that £15,000 will potentially be taxable as income when you need to take it.

In this example, £20,000 has been designated from your pension to drawdown, of which £15,000 remains invested.

Should I Move My Pension to Drawdown Gradually?

Those with the largest pension funds will typically benefit the most from gradually moving their pension pot to drawdown. This is because the tax-free cash element, when withdrawn, will form part of your estate for inheritance tax purposes.

If you have a £1 million pension pot and opt to withdraw your entire pension using income drawdown, the 25% tax-free cash element would be worth £250,000 and become part of your estate. When added to your other assets, such as your home, it’s clear to see that this could easily breach the inheritance tax nil-rate band threshold of £325,000 per individual.

Pension Drawdown and the Lifetime Allowance

Moreover, those with large pension pots might have a pension lifetime allowance issue. The lifetime allowance is currently £1 million, which is the amount you can withdraw from your pension in your lifetime before paying the lifetime allowance charge. This charge could be a hefty 55% on everything you take above your lifetime allowance.

When you move cash to drawdown, you crystallise part of your pension pot (known as a benefit crystallisation event). So if you move your whole pension to drawdown at once you crystallise the entire pot. Those with a large pension could then be hit with the lifetime allowance charge as soon as they access their pension.

Taxation of Uncrystallised Funds Pension Lump Sums

Uncrystallised funds pension lump sums (UFPLS), which are also referred to as FLUMPs, offer a very similar way of taking your pension to drawdown. However, you don’t have to designate funds as in drawdown – you simply withdraw cash straight from your pension pot.

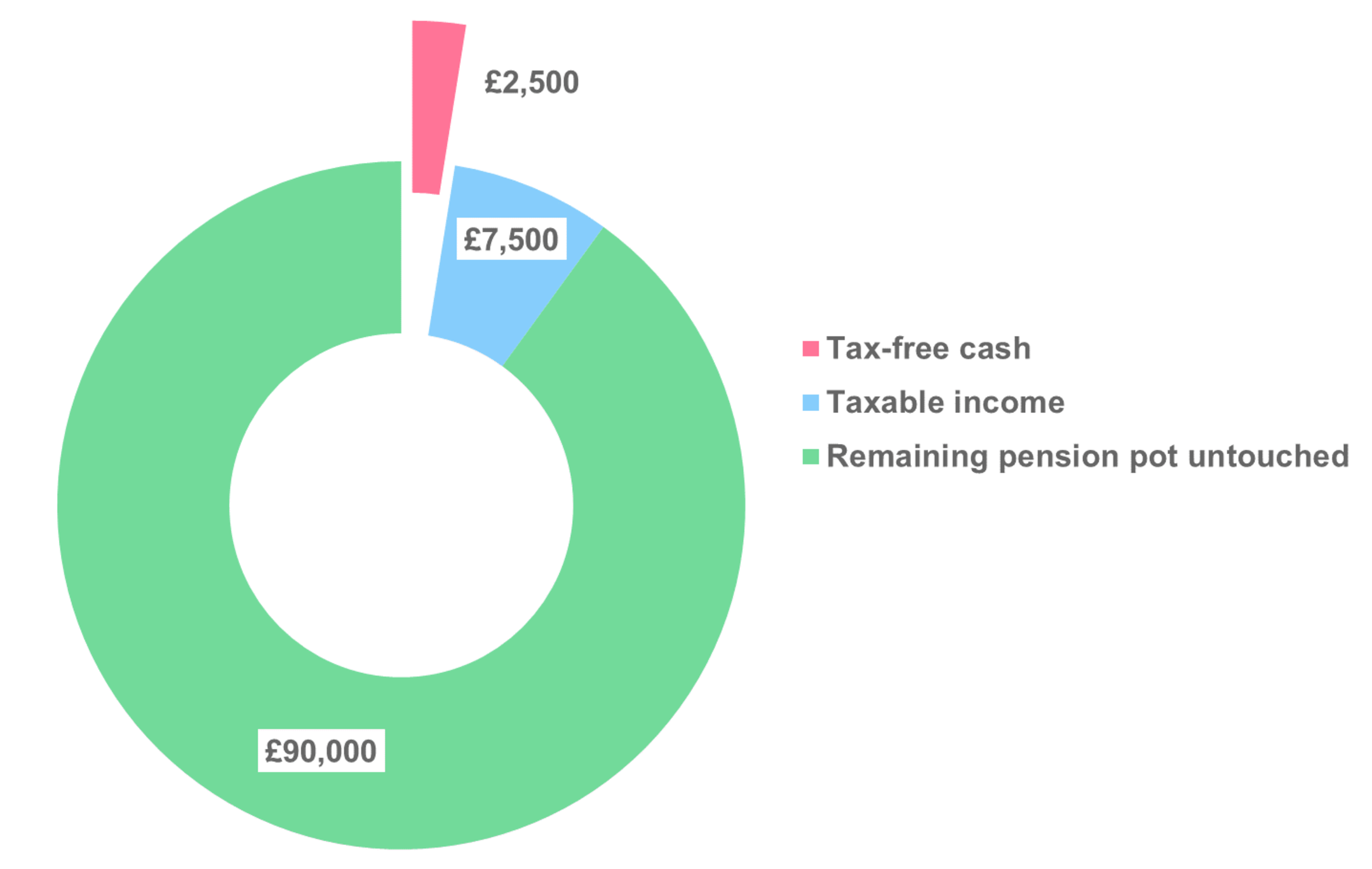

In the example below, Alan has a £100,000 pension pot. He decides to take a FLUMP worth £10,000 out of his pension pot.

25% of this sum – £2,500 – will be free from tax. The remaining £7,500 will be added to any other income Alan has that year and may therefore incur income tax depending on his other earnings.

Alan is left with £90,000 in his pension pot which he can withdraw at a later date.

IMPORTANT NOTICE! 🧐

For simplicity, this example assumes no investment changes to Alan’s pension. This is very unlikely given that a sizeable proportion of his fund will remain invested, so it’s important to consider that the value of Alan’s retirement savings could go up as well down in line with markets.

Is Tax Due on an Inherited Pension?

Following the pension freedoms introduced in April 2015, the government ditched the ‘death tax’ on pension pots. Previously, any money left to loved ones in a pension pot would be subject to a 55% charge.

This has now been abolished and most people can leave their pensions to their loved ones without having to pay inheritance tax as well. The key is that the cash must remain within a pension wrapper to be free from inheritance tax, i.e. still invested in a pension pot or designated to a drawdown fund.

If you’ve withdrawn chunks of your pension and are holding it elsewhere, such as in an ISA, this could be added to your estate for inheritance tax purposes after you’re gone.

John Spink

Head of Financial Planning at Drewberry

If you die before the age of 75, there’s also no income tax for your loved ones to pay on a defined contribution or money purchase pension you’ve left them. However, if you die after the age of 75 your beneficiaries will have to pay income tax at their highest marginal rate on any withdrawals they make from an inherited pension.

Another important consideration is that this only applies to defined contribution or money purchase pension pots. Final salary schemes will often offer a reduced survivor’s pension for your spouse and perhaps any dependent children.

However, any income from your final salary scheme paid to your loved ones after you’re gone will be added to their earnings that tax year and will be taxed as income accordingly.

Your Financial Plan: Build A Better Future

A good financial plan can help you make the right decisions when it comes to your finances. Make the right decisions today to build a more prosperous future.

Good financial planning with clear goals can increase your retirement income by as much as 53%. Old Mutual Redefining Retirement Survey

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as planning our finances. Below are just a few reasons why it makes sense to let us help.

- See your financial future

We use sophisticated financial modelling technology to visually show you your financial future. A living financial plan where you can clearly see what you can achieve depending on the decisions you make – read more - Achieve the retirement you deserve

Can afford that dream round-the-world trip? Can you help your children onto the property ladder? We’ll model your goals and build your financial plan to help you achieve them. - Our expertise saves you time and provides peace of mind

Organising your pensions, investing your assets, managing risk and making the most of your tax allowances is all taken care of as part of your financial plan. - We’ve got bargaining power on our side

This allows us to negotiate better rates for you than dealing with providers yourself. - You’ll speak to a dedicated expert from start to finish

You will speak to a named expert with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 2386 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the decisions we help you make. Doing it yourself or going direct to a provider won’t provide this protection, so you won’t benefit from these securities.

Our Services & Tools

We use clever technology to bring your financial future to life

- Find, organise and simplify your Pensions, ISAs and other investments.

- Plan your financial future and put a strategy in place to achieve this.

- Regularly review how you are doing to make sure you stay on track.

Contact Us

85 Queen Victoria Street

London

EC4V 4AB

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.