DIY Investor? Avoid These Top 6 Mistakes…

The vast majority of people understand that they must save for their long-term future and that one way to do this is by regularly investing spare money they have. They understand that there is a link between risk and reward and that they need to do more than just put cash under the mattress.

Trying to safeguard your financial future through investments is intuitively correct and doing something is better than doing nothing. However, when clients come to us seeking our expert help, we see some common investor mistakes that has turned a potentially good investment experience into a poor one.

- Not having any clear goals

- Not understanding risk

- Lack of diversification

- Overpaying and overtrading

- Not being tax-efficient

- Lacking discipline

1. No Goals? No Good

Unless you know exactly what you are aiming to achieve with your money, how can you measure success?

Goals should not be based on outlandishly positive investment returns nor unrealistic spending requirements. Goals should be realistic, measurable and attainable.

Having a pragmatic view on what you can afford to save, how long your money will be tied up for and realistic views on the risks you wish to expose yourself to will help shape attainable goals for your future.

Trying to chase returns through perceived market opportunities is not investing: It’s speculation.

Without a plan, investors are tempted to build portfolios from the bottom up, trying to pick that month’s hot stock or merely end up collecting funds from best buy lists based on recent past performance. There is little regard as to how the portfolio fits together and whether it is suitable for your goals.

Helping define your goals is one of the key skills of our advisers. We work closely with you to understand your present and how you want your future to look and then define your goals and how you can achieve them.

John Spink

Head of Financial Planning at Drewberry

It’s highly likely that the funding method and underlying portfolio of investments to finance your children’s university education or first home purchase in a few years’ time will be significantly different to that which aims to replace your earned income when you retire in 20 years.

2. Emotional Rollercoaster: Not Understanding Risk

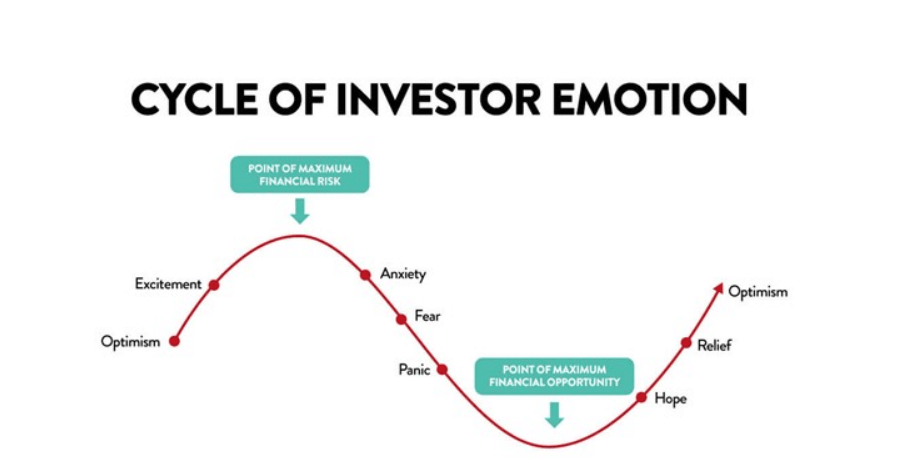

Investing is an emotional thing. Understanding how emotion impacts on investor behaviour can stop irrational, and ultimately costly, actions.

This rollercoaster of investor emotions leads to some very adverse behaviour. Essentially it makes people buy when prices are high and sell assets when prices are low. The exact opposite of what is required when trying to build wealth.

This is where we can help. We provide a dispassionate view that have your longer-term goals front and centre. We provide the emotional break required to stop poor investor behaviour.

It therefore follows that you must be happy with the level of risk you are taking. Too much risk and the highs may fuel a euphoric over confidence and the portfolio lows could invoke a panicked sell off in a mis-timed attempt to stem losses. A portfolio’s risk level therefore needs to be set at a level that does not trigger this irrational behaviour.

But your attitude to risk is only one factor that needs to be considered. Just as important is assessing how much risk you need to take and that which you can afford to take.

There is no point holding a high-octane investment that has the potential for significant growth but also significant losses if you only need a more moderate return to meet your goals.

Why expose yourself to more risk than you need to?

Equally, how would falls in any investment’s value impact your essential living requirements? Do you have the capacity to absorb the potential downside of an investment and ride out these short-term bumps to obtain the potential long-term gains expected?

Through expert analysis of your risk profile we can help build you portfolios that match your emotional and financial needs.

3. All in the Balance: Lack of Diversification

The Nobel Prize-winning thesis by Harry Markowitz considered that diversification provides higher expected returns for lower risk than can be achieved by investing in single asset classes. It provided us with what’s known as the efficient frontier — the set of optimal portfolios that offer the highest expected return for a defined level of risk.

When building a sound investment strategy, you start with an asset allocation suitable for the portfolio’s objective. The allocation should be built upon reasonable expectations for risk and returns and thereafter should use diversified investments to avoid exposure to unnecessary risks.

Both asset allocation and diversification are rooted in the idea of balance. Because all investments involve risk, investors must manage the balance between risk and potential reward through the choice of portfolio holdings.

When building a portfolio to meet a specific goal, it is critical to select a combination of types of assets that offers the best chance for meeting that objective; that is the mix of equites (shares), bonds (corporate and government debt), property, alternative investments and cash.

To illustrate, take a look at the table below. On the left is an asset allocation for a balanced investor; on the right, you can see a very different asset allocation for an adventurous investor.

Balanced Portfolio | Adventurous Portfolio | ||

|---|---|---|---|

Cash | 10% | Cash | 0% |

Fixed Interest (Bonds) | 45% | Fixed Interest (Bonds) | 0% |

Commercial Property | 10% | Commercial Property | 0% |

UK Equities | 7% | UK Equities | 0% |

Global Equities | 28% | Global Equities | 100% |

It is the mixture of assets classes in the portfolio that will determine both the expected returns and the variability of returns for the portfolio as a whole. There is a significant weight of empirical evidence that shows it is this asset class mix that is responsible for 80% or more of a diversified portfolio’s return over the long term.

Following the asset class decision there is then the need to diversify the portfolio. Holding different asset classes reduces a portfolio’s exposure to the risks common to an entire class. Diversifying within an asset class reduces exposure to risks associated with a particular country, company, business sector or segment.

Markets will often behave differently from each other and there is no way of predicting which will be the strongest or the weakest over any given period.

Owning a portfolio with exposure to many different areas ensures some participation in stronger areas while also mitigating the impact of weaker areas. The below chart shows the returns of some major market sectors. This illustrates the randomness of returns and the importance of appropriate diversification.

We have access to industry leading research that assess investments funds’ ability to provide appropriately diversified portfolios and that have the sufficient risk management in place. The fund universe is regularly monitored to ensure that we can provide best of class investment solutions to our clients.

Neil Adams

Financial Adviser at Drewberry

4. Failing to Control the Controllable – Cost & Overtrading

You cannot control which way markets will move but you can control how much you pay to participate in them.

It is logical reason that says the less you pay to hold a particular investment the more of its return you will be able to enjoy.

Holding an investment can involve a number of unavoidable costs. The cost of the product in which to hold the investment (i.e. ISA, pension investment account), the cost of trading to buy or sell a holding and the ongoing annual cost of the investment house or fund manager. In addition to this there is also the cost of financial advice for those who understand the value of paying for it.

Every pound paid for fund management fees or trading commissions is simply a pound less that is earning a potential return.

Through our advice network, Quilter, we have access to discounted platforms on which to hold your investments and we do not encourage overtrading. Overtrading is a mistake DIY investors’ often make.

There is obviously a fee to access advice, but we feel the value you will derive from it through providing you with expert advice and coaching far outweighs this outlay and is a fee worth incurring. In fact, there are a whole host of studies that quantify the financial benefits of advice.

5. Getting Tax Chills: Not Wrapping Up Well

Tax efficiency is an important part of building wealth. Using the right vehicles for different assets is a proven way to add to value.

As with other costs, tax is a charge that will compound over time. Tax efficiency is therefore critical when seeking the correct strategy to meet your goals. Wrapping up your investment in the correct tax shelter, be it an ISA, pension or other vehicle, is vital to take advantage of tax efficiency.

Tax breaks are written into law and given the complex tax environment in the UK they are many and varied. They are mainly given to support political and economic reasons. Using these to help build your personal wealth is perfectly legitimate and good practice. Tax mitigation is perfectly legal; avoidance is not.

Navigating the tax landscape, understanding opportunity and allocating wealth to the right environment at the right time is a complex endeavour. We often speak with people who have got this wrong and face tax charges which easily eliminate any intended gains.

An even more common occurrence is that of lost opportunity. Some people are either not aware of or insufficiently informed to know how to maximise the opportunities that exist for them given their circumstances. The potential for significant tax savings is therefore lost for good.

Some common examples we see of this are:

- Failure to regularly use capital allowances to crystallise gains and move them to a more tax favourable environment

- Holding investments in the wrong name and therefore losing out on being able to use a partner’s income, capital gains and dividend tax allowances now and in the future

- Not maximising annual pension and ISA allowances to gain long term relief from income, capital gains and potentially inheritance tax

- Making gifts without thought to the best method of doing this nor regard for future gifting plans resulting in potentially hefty inheritance tax charges and estate complications

We have the required expertise to tailor solutions to match your objectives and eagerly work with your other professional advisers to ensure you are taking advantage of all available opportunities.

6. Lacking Discipline

As discussed earlier in this article, investing can provoke strong emotions and we see that DIY investors often act on the immediacy of these emotions.

Common errors we see are rash departures from a previously agreed asset allocation decision, chasing winning stocks and trying to outguess the market. Such practices rarely result in a payoff.

Even if you have clearly defined your goals, set an appropriate asset allocation, diversified sufficiently and maximised cost and tax savings where you can, all this work can quickly unravel through knee-jerk reactions to economic or political events or a change in your circumstances.

Sam Barr-Worsfold

Financial Planner at Drewberry

Setting goals and implementing an investment strategy is based on a long-term view. In undertaking its execution, you should have already considered that over the long-term we will go through several market and political cycles and made assumptions and best estimates on the affordability of seeing your plans through to the end. This has been brought into sharp focus recently for many DIY investors due to the global coronavirus pandemic.

Sticking to the plan gives you the best opportunity to attain your long-term goals.

The below chart aims to illustrate the importance of discipline showing the different returns an investor would get through the global financial crisis of 2008/9 and 2011/12. This assumes an investment into the FTSE All Share index.

Had they remained 100% invested throughout these two significant downturns then a £10,000 investment in January 2003 would have been worth £23,166 in January 2013 (red line).

Had they come out of the markets when portfolio losses reached 15% and gone back in when they had recovered by 7%, the portfolio would have only reached £16,597 by 2013 (black line).

We cannot time the markets nor know when the best days to be invested will arise. No one has a crystal ball to predict future movements. Being out of the market for just a few days can have devastating effect on returns.

Using a £10,000 investment into global equities as an example the below chart shows that over the last 20 years an investor that stayed invested throughout could have a potential return of nearly three times greater than that of an investor who missed the best 25 days.

We help clients maintain a long-term perspective and a disciplined approach.

Abandoning a planned investment strategy can be costly. Many of the reasons investors do not reach their goals are behavioural: the failure to stick to the correct asset allocation, the allure of market-timing and the temptation to chase performance.

Jonathan Cooper

Senior Paraplanner at Drewberry

📞 01273060042

jonathan.cooper@drewberry.co.uk

The author of this article Jonathan Cooper (DipPFS) is Drewberry’s Senior Paraplanner. Without the hard work of Jonathan and his team, our Financial Advisers wouldn’t be able to do what they do.

Jonathan has an extensive financial services background, qualifications and knowledge of the administrative ins and outs of the industry.

In his time in the industry, he’s worked for both financial product providers and, for the last 7 years, he’s been a Senior Paraplanner, providing expert holistic wealth management technical support to advisers

- Topics

- Pensions

Our Services & Tools

We use clever technology to bring your financial future to life

- Find, organise and simplify your Pensions, ISAs and other investments.

- Plan your financial future and put a strategy in place to achieve this.

- Regularly review how you are doing to make sure you stay on track.

Contact Us

85 Queen Victoria Street

London

EC4V 4AB

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.