Dentist Rajpreet Drills Into Income Protection

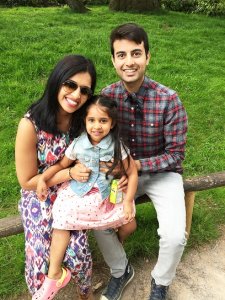

Dr Rajpreet Sidhu is a hard-working young dentist from Wolverhampton. After qualifying in 2013, he’s spent the last three years working for NHS surgeries in his home town.

Rajpreet spends his leisure time enjoying sports like football and badminton and hiking, when he gets the chance.

But he also gives his time freely to his local community and to overseas charities that he feels passionate about.

Among other things, he’s a familiar figure at his local Sikh temple where he runs evening classes in GCSE-level mathematics for students of all ages.

As he explains, “I think that’s probably why I became a dentist. I’ve always liked science and I like doing practical things but I’m also a ‘people person’.”

“I like being in a caring profession as it means I can help people; that’s probably why I moonlight as a maths teacher in my spare time too,” says Rajpreet.

Why Rajpreet Chose Dentists’ Income Protection

Although he’s still a young man, Rajpreet has known about the need for Income Protection for some time. “Income Protection is important to dentists as we’re frequently self-employed,” he says.

“I was initially introduced to the idea in university.

“Back then, an adviser from a mutual society visited the campus and presented to the senior year of the dental school.

“Like a lot of my friends, I signed up,” he says, “but the cover on offer was only minimal, so recently I decided to look around for a better option.

“An online search led me to Drewberry which did all the work for me. Their site enabled me to get Income Protection quotes and policy details from the whole market, so by the time I talked to a Drewberry adviser I already felt well informed.

“As a dentist, I’m self-employed but I also qualify for NHS sick pay benefits,” explains Rajpreet, “so I needed to find a policy with a six-month deferral period.”

“Because of the deferral period, and the fact that I’m still young, the premiums were very low. This meant that I could lock-in these low premiums with a policy that offers inflation-linked benefits for the future.”

Income Protection Provides Dentists With Peace of Mind

“I feel good about putting my new dentist Income Protection policy in place as it’s one less thing to worry about down the road,” he says.

“It means I’ll already have cover in place when I come to take out a mortgage and it also means I’ll never become a burden on my family if the worst should happen.

“Since taking out my policy with Drewberry I’ve recommended them to a number of the young dentists I work alongside and I know that one’s already taken out a new policy of his own.”

Rajpreet’s Income Protection Advice from Victoria

Rajpreet’s Drewberry adviser, Victoria Slade, recalls, “We recommended that Rajpreet take out a policy with Aviva as they’re one of the most competitive providers for dentists.”

The policy will pay out an index-linked £3,000 a month, for however long it might be needed, right up until he’s 60 years old – that’s 35 years of full cover. By this time, he’ll have built up a considerable pension pot, so if his health should fail him he’ll have something else to fall back on by this stage.

Need Income Protection Advice?

If you find yourself in a similar position to Rajpreet and are looking to set-up suitable financial protection to look after you and your loved ones then please don’t hesitate to get in touch.

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated expert from start to finish

You will speak to a named expert with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 3758 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

If it is all getting a little confusing and you need some help we are only at the other end of the phone.

Please don’t hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk.

Tom Conner

Director

- Topics

- Income Protection

Contact Us

85 Queen Victoria Street

London

EC4V 4AB

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.